KKR makes full use of Global Atlantic ownership during strong Q2

Main takeaway: KKR took full control of Global Atlantic Financial Group with the intention to exploit its revenue-generating potential.

Much of that vision took shape during the second quarter, the KKR management team said. KKR executives held a call with Wall Street analysts Wednesday to discuss Q2 results.

In a deal that closed in January, KKR purchased the remaining 37% of Global Atlantic Financial Group it didn't already own for $2.7 billion.

Global Atlantic is a big seller of fixed annuities – ranking seventh with Q1 sales of nearly $4.3 billion, according to LIMRA – and is contributing significant assets to KKR.

Global Atlantic and KKR completed multiple strategic "firsts" in the second quarter and shortly after, including: the first real estate equity multifamily investment, first investment with the infrastructure team and first capital markets transaction fee generative investment.

During the second quarter, Global Atlantic accounted for “a record volume of inflows” from annuity sales and flow reinsurance totaling over $8 billion, said Chief Financial Officer Rob Lewin, compared to less than $3 billion a year ago. Over the last four quarters, total inflows, including block activity, topped $50 billion, he added, the most at any 12-month period in Global Atlantic’s history.

KKR reported $32 billion in new investor capital during the quarter, the second most active fundraising quarter in its history. Executives credited inflows at Global Atlantic for driving capital.

KKR executives had touted Global Atlantic's potential for annuity sales growth during first-quarter earnings call.

Any additional takeaways

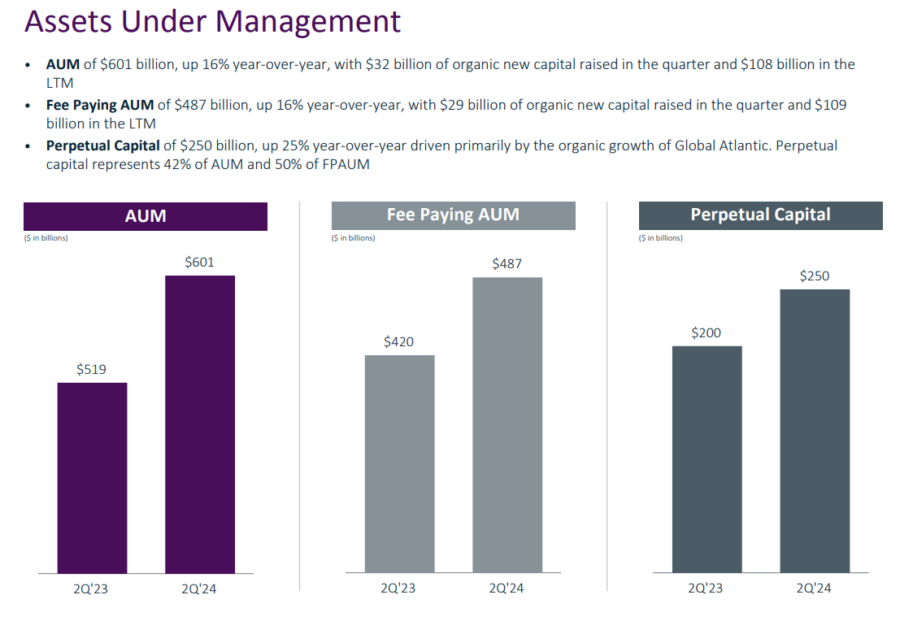

KKR reported record fee-related earnings of $755 million, up 25% increase from the year-ago quarter. Executives attributed the growth to fees generated from managing $601 billion in total assets, up 16% over Q2 2023. Fees from arranging financing for its own deals contributed as well.

The firm reported management fees of $847 million for the quarter, up 13% year-over-year, while net transaction and monitoring fees totaled $223 million.

Management Commentary

“[Global Atlantic] is growing rapidly. And as we transition the business to 100% ownership, we're seeing the combined impact of simultaneous fast growth and investing in the business for the long term. … Overall, the opportunity with GA is greater in our minds today than it was at the beginning of the year.”

– Co-CEO Scott Nuttall

Additional Notes

KKR continues to pursue mergers, acquisitions and partnerships. Most recently, KKR signed an agreement with The Penn Mutual Life Insurance Co. under which investment funds managed by KKR will acquire Janney Montgomery Scott.

Janney is a leading wealth management, investment banking and asset management firm with over $150 billion in assets under administration, and more than 900 financial advisors providing financial planning, asset allocation, retirement planning. Janney will operate as an independent, standalone company, the firm said.

The commercial real estate market plunged after the COVID-19 pandemic. But the Wall Street Journal reported this week that the “bottom is near.” KKR has no office or retail exposure of any consequence, Nuttall said.

“We have the ability to play offense in this environment,” he explained. “And we believe we will take share over the next several years and will benefit from the current and coming dislocation. The real estate investment opportunity is highly compelling. We have closed or under exclusive contract and over $10 billion of real estate equity deals since April 1 and have a full pipeline as some owners of real estate seek liquidity and sell their best assets.”

Financial Overview

Total Revenue: $4.2 billion ($3.6 billion in Q2 2023)

Adjusted net Income: $972,000 ($653,000 in Q2 2023)

Operating Income: $1 million ($772,000 in Q2 2023)

Dividend declared: 0.175 per share

Stock price movement: $123.60 at midday Wednesday, up 3%

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Will the Inflation Reduction Act make waves in other markets?

Benefits of estate planning with life insurance for seniors

Advisor News

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

More Advisor NewsAnnuity News

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News