KKR fuels up with Q4 cash off big Global Atlantic annuity sales

KKR remains a diversified, investment firm juggernaut that continued to gather momentum in the fourth quarter, fed heavily by its insurance holding, Global Atlantic.

In a deal that closed in January, KKR purchased the remaining 37% of Global Atlantic Financial Group it didn't already own for $2.7 billion.

Global Atlantic is a big seller of fixed annuities – ranking seventh with Q3 sales of more than $7 billion, according to LIMRA – and is contributing significant assets to KKR.

KKR reported net income of $1.04 billion for the October-December period, compared to $121.1 million in the year-ago quarter. Also known as Kohlberg Kravis Roberts & Co., firm executives held a conference call with Wall Street analysts this morning.

"These results are quite strong and encouraging for us," said Rob Lewin, chief financial officer. "Credit liquid strategies made up about two-thirds of the capital we raised this quarter, as our business has grown with Global Atlantic as a significant partner. GA, in particular, had record inflows in the quarter, both overall and specifically from the individual channel."

KKR reported assets under management of $552.8 billion, up 10% year over year. The firm raised $31 billion and invested $6 billion during the fourth quarter.

Valuable annuity deposits

In a November conference call following the Global Atlantic deal going public, KKR executives explained how the annuity seller fit into its aggressive growth plans. The investment firm is aiming to quadruple its market cap in the next decade.

KKR paid $4.7 billion to acquire 63% of Global Atlantic more than three years ago. Since then, Global Atlantic’s assets under management have grown significantly, up from $72 billion in 2020 to $158 billion at the end of 2023.

"Insurance is a powerful contributor to our business," said Co-CEO Scott Nuttall in November. "The earnings of Global Atlantic have proven to be highly recurring and fast growing. And GA helped scale our asset management businesses indirect private wealth distribution."

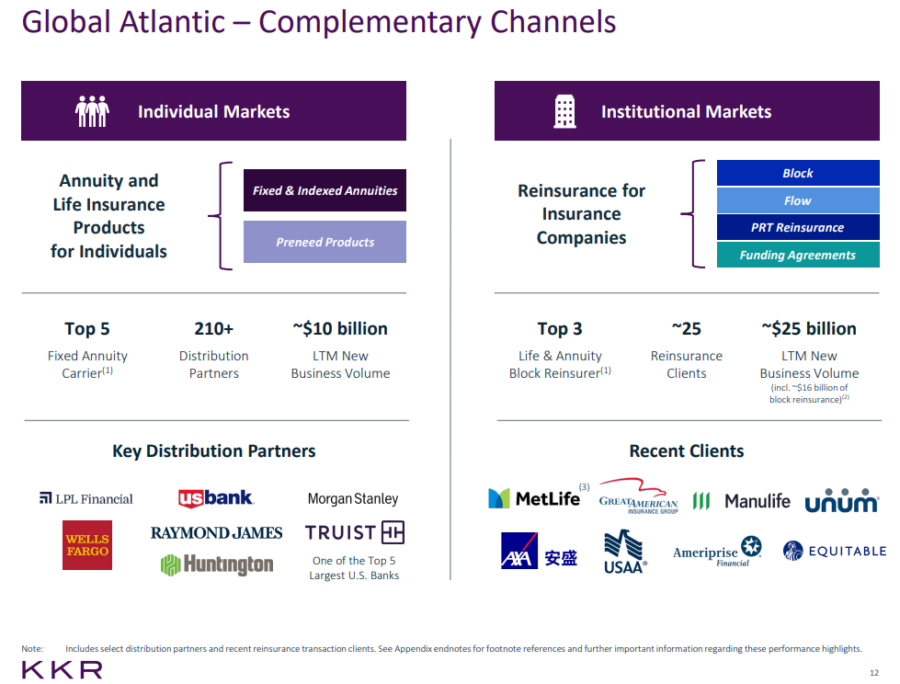

Global Atlantic is thriving with both individual and institutional investors, executives noted.

Global Atlantic is delivering a 27% compound annual growth rate in assets under management, according to a KKR Q4 presentation.

A MetLife block reinsurance transaction closed in the fourth quarter, with a pending Manulife block reinsurance transaction expected to close in the first half of 2024, KKR said. The latter deal is expected to add an estimated $10 billion to Global Atlantic AUM.

KKR fee income climbing

KKR reported record fee-related earnings of $675.4 million in Q4, up from $559.4 million in the year-ago quarter.

"Given our consistent growth in fee-paying AUM, management fees increased 14% in 2023, with line of sight of future growth from approximately $40 billion of committed capital that becomes fee paying as its invested or when it enters its investment period," Lewin explained.

KKR executives discussed the firm's plan to divide its operations into three business segments: fee-related earnings from its asset management operations, insurance earnings and balance sheet assets called “strategic holdings.”

A new profit metric called “total operating earnings” will highlight KKR's more predictable earning streams, such as base management fees, spread-related profits from its insurance operations, and dividends earned from its balance sheet investments.

"We are incredibly well positioned as a firm," Lewin said. "And we really don't think there are many companies in our industry, or others, that have the type of visibility that we have for long-term growth. We have a high level of competence that we can meaningfully grow all three of our business segments: asset management, insurance, and strategic holdings."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Rates on the move as Fed vows to slash interest rates

Senate bill would block SEC rule to regulate technology in financial services

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- National Health Insurance Service Ilsan Hospital Describes Findings in Gastric Cancer (Incidence and risk factors for symptomatic gallstone disease after gastrectomy for gastric cancer: a nationwide population-based study): Oncology – Gastric Cancer

- Reports from Stanford University School of Medicine Highlight Recent Findings in Mental Health Diseases and Conditions (PERSPECTIVE: Self-Funded Group Health Plans: A Public Mental Health Threat to Employees?): Mental Health Diseases and Conditions

- Health insurance cost increases predicted to cut millions from needed protection

- Department of Labor proposes pharmacy benefit manager fee disclosure rule

- WALKINSHAW, DUCKWORTH IMPLORE TRUMP ADMINISTRATION TO EXPAND IVF COVERAGE FOR THE MILLIONS OF HARDWORKING AMERICANS ENROLLED IN FEHB PLANS

More Health/Employee Benefits NewsLife Insurance News