KKR incorporates annuity company into massive investing juggernaut

Main takeaway: Three areas contributed to KKR’s massive third-quarter financial performance, executives said today.

KKR’s bottom-line numbers sparkled: Adjusted net income rose 58% to $1.24 billion, easily topping Wall Street expectations. Fee-related earnings rose 79% to a record $1 billion, driven by management fees and fees for arranged financing.

And the firm fully owns Global Atlantic Financial Group, one of the leading sellers of annuities. The successful quarter is a repeat of KKR's strong Q2 earnings report.

Chief financial officer Rob Lewin ticked off the three growth areas:

1. Infrastructure investment. "We know that the need for infrastructure investment is massive," Lewin said. "Our footprint here positions us incredibly well. Our global infra business has now scaled to $77 billion of AUM. Remember, we were just $13 billion five years ago, and all that growth has been organic."

KKR is "particularly well positioned" across digital infrastructure, Lewin explained. That ranges from mobile infrastructure, or the tower industry, to fixed line infrastructure to data center space.

"Our footprint in data centers is particularly large," Lewin said. "To give you a sense, we currently own four platforms operating across the U.S., Europe and Asia, and looking on a 100%-own basis, because we don't own 100% of all of them, the total enterprise value of those platforms and their contracted and highly visible pipeline is over $150 billion."

2. Credit markets. The credit markets that KKR participates in is a $40-plus trillion market, Lewin said.

"We are seeing the benefits of a scaled global platform with $240-plus billion of AUM," he said. "Our asset-based finance team continues to be particularly active. In total, AUM across our ABF platform exceeds $65 billion. That's up 40% versus last year. We have a real leadership position across an area that has significant market tailwinds."

3. Asia. The Far East is one of the most dynamic parts of the world, Lewin said.

"We are incredibly well positioned to generate significant scale and value for our enterprise over the next decade plus," he added. "We are particularly excited about the opportunities in Japan across multiple asset classes. Japan is a market where today we have real leadership."

Together with KJR Management, KKR has about 200 employees in Tokyo working on investment opportunities. Global Atlantic closed two reinsurance deals and KKR has $25 billion of AUM across all of its strategies in Japan, Lewin said.

'Believing' in Global Atlantic

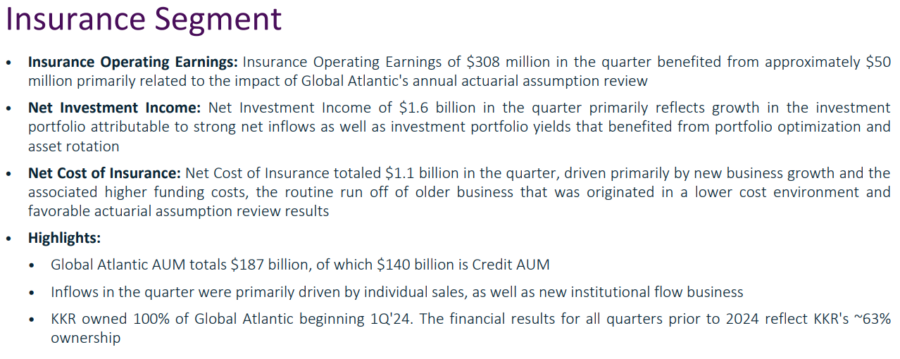

Additional takeaways: Global Atlantic continues to pour millions into the coffers of KKR. GA profit rose 46% to $307.5 million from the year-ago quarter. KKR acquired 100% ownership of the insurer during the first quarter.

GA’s book value, a company’s assets minus its liabilities, increased from $4.6 billion in Q3 2023 to $8.8 billion in the most recent quarter.

GA sold $8.2 billion worth of annuities in the second quarter, according to LIMRA, the most recent available sales data.

GA “was a solid contributor in the [third] quarter, but not all that material in the context of $420-plus million revenue,” Lewin said. “That said, we've talked about believing that the opportunity in that line of business for us is in the hundreds of millions of dollars over time, and that perspective is unchanged.”

Management commentary

“You really saw the power of our business model this quarter with our capital markets business producing record revenues of $424 million. This reflected activity across infrastructure, traditional private equity, and credit, as well as existing portfolio company opportunistic financings and third-party transactions.”

--Chief financial officer Rob Lewin

Additional notes

The election: One analyst used his question time to ask KKR executives for any thoughts on the potential economic impact of the bitterly contested presidential election, slated for Nov. 5. In particular, the harsh tariffs proposed by Republican nominee Donald Trump.

Morningstar predicts that Trump’s proposed tariff hikes could cause the U.S. gross domestic product to fall by 1.9%. A 10% uniform hike in tariffs would create a 1.4% drop in GDP while a 60% tariff on products imported from China would result in a 0.5% fall in GDP.

Lewin did not bite, calling the election outcome a factor out of the firm's control.

"I think there's going to be some pluses and minuses depending on the geography of our portfolio companies, the sectors they're in, what their cost base is made out," he said. "There's all kinds of different inputs, and so we're watching it closely. I think it's fair to say that our teams are ready to react."

Financial overview

Total revenue: $4.79 billion ($3.32 billion in Q3 2023)

Net income: $1.24 billion ($780 million in Q3 2023)

Earnings per share: 74 cents ($1.71 in Q3 2023)

Dividend declared: $0.175 per share

Stock price movement: Shares were up about 3.5% as of Thursday afternoon

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Globe Life posts another strong quarter as legal, regulatory woes mount

With lives saved, Hancock expands its longevity view of life insurance

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- PLAINFIELD, VERMONT MAN SENTENCED TO 2 YEARS OF PROBATION FOR SOCIAL SECURITY DISABILITY FRAUD

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News