Just 25% Of Americans View Economy Favorably: LIMRA Survey

There is a growing divergence in consumer perceptions about the economy and COVID-19 based on ideology, according to the latest results of LIMRA’s Consumer Sentiment Survey.

In March, 77% of liberals and 58% of conservatives reported a high level of concern about COVID-19. Since then, perceptions regarding the gravity of the crisis have diverged significantly. In July, 78% of consumers who identify as liberals report a high level of concern about COVID-19, whereas only 44% of consumers who identify as conservatives report this level of concern — nearly doubling the gap between the two groups.

Overall, just 25% of Americans had a favorable view of the economy in July. This is up 4 percentage points from March but down 31 percentage points from the all-time high of 56% (since LIMRA began tracking this in 2008) in January 2020.

When it comes to the economy, consumers are similarly split along political lines. Sixty-eight percent of consumers who identify as liberal continue to be highly concerned about the economy while just 44% of conservatives show this level of concern.

“Our study revealed a drastic difference in consumer perceptions about the economy and the pandemic, based on whether they are liberal or conservative,” said Alison Salka, senior vice president and head of LIMRA Research. “This political polarization exists throughout the country and suggests that businesses, policymakers and legislators will find it difficult to make decisions that will be widely accepted by all Americans.”

Personal Financial Concern Declines

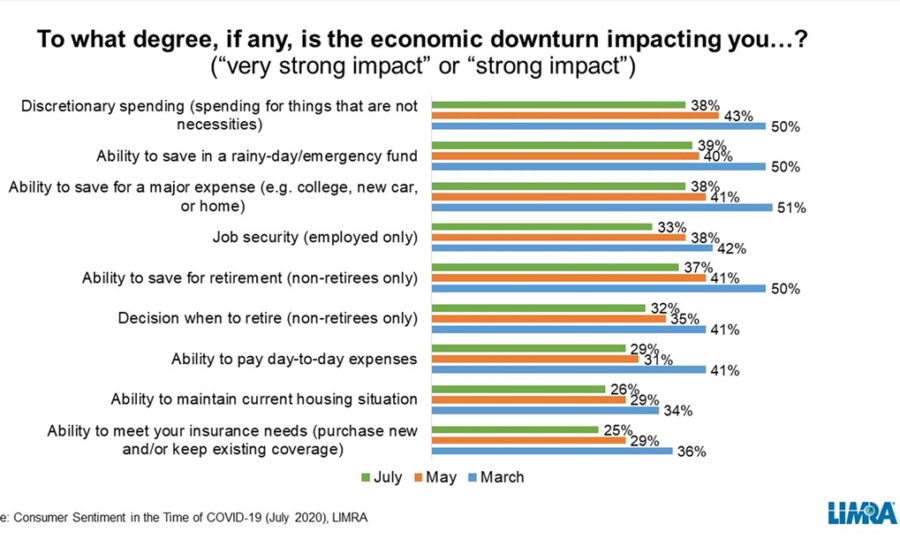

Worries about the financial impact of COVID-19 and the recession have declined since March but still remain high. Four in 10 consumers report the economic downturn has impacted their discretionary spending and their ability to save for retirement, for a major expense, or toward an emergency fund. In March, half of consumers said a recession would negatively affect these things.

The July survey finds more consumers are feeling better about their job security and their ability to pay their day-to-day expenses than they did in March. In July, just 33% of employed consumers said they were worried about their job security, compared with 42% of workers who were worried in March.

While 3 in 10 consumers said they continue to be worried about being able to pay for their day-to-day expenses in July, this is down from 41% in March.

“When much of the country shut down in March and we faced many unknowns about the severity of the pandemic’s impact, it was not surprising more people worried how the economic fallout would impact their own finances,” said Salka. “After five months, consumers have a better sense of how disruptive COVID-19 and the resulting recession will be on their personal finances so they have greater confidence in their ability to pay their bills, save for retirement and meet other financial goals.”

Awareness Of Life Insurance Grows

While consumers’ concerns about the need for household items like groceries, paper products and cleaning agents have diminished, more consumers report a heightened awareness of the need for life insurance.

In July, 58% of consumers said they are more aware of the need for adequate life insurance coverage, up from 49% in March. Current life insurance owners are more likely than non-owners to worry about having adequate coverage (64% versus 51%).

Purchasing or paying for existing coverage remains a concern for many Americans. Almost half of consumers (47%) say the recession is impacting their ability to buy or pay for insurance in general.

However, this is down from 58% in March. Concern about the ability to buy or pay for life insurance has dropped as well. In July, just 16% of consumers said the recession would make it more difficult to purchase life insurance coverage, compared with 24% in March.

One in five (19%) owners said they believed it would be more difficult to pay for their existing life insurance policies in July, down from 33% in March.

“As consumers better understand how the pandemic and the precipitous and record-breaking drop in the economy would impact them personally, we see more people becoming more confident that they will be able pay for life insurance during this recession,” noted Salka. “Our research shows that 46% of Americans don’t have life insurance coverage at all and even more don’t have adequate coverage. If there is one silver lining with regard to COVID-19, perhaps it is bringing greater attention about the important role life insurance plays in protecting families’ financial security when the unexpected occurs.”

Methodology

First initiated in early 2008 to gauge consumer opinion of the economy and the financial services industry, LIMRA’s Consumer Sentiment Survey has continued to monitor Americans' sentiment about the economy and confidence in industries. The latest results are based on responses from 2,000 Americans ages 18+, weighted to the U.S. general population. The most recent survey was fielded July 22-23.

About LIMRA

Serving the industry since 1916, LIMRA helps to advance the financial services industry by empowering nearly 700 financial services companies in 53 countries with knowledge, insights, connections, and solutions. Visit LIMRA at www.limra.com.

Queen’s ‘Bohemian Rhapsody’ Crowned Top Driving Song: Survey

Supreme Court Won’t Hear Obamacare Case Until After Election

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

- Roeland Tobin Bell

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

More Life Insurance News