July Life Insurance Activity Drops After 2020 Spike, MIB Says

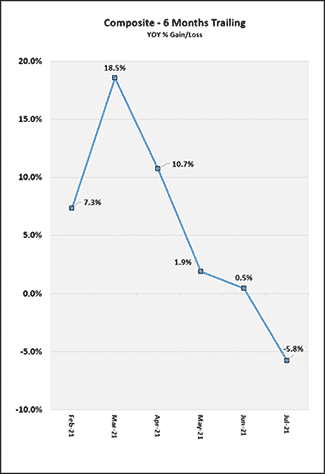

U.S. life insurance application activity declined in July 2021 compared to July 2020 with year-over-year activity down -5.8%, according to the MIB Life Index.

This decrease is largely attributable to a spike in activity that occurred in July 2020 as the industry rebounded from the impact of the COVID-19 pandemic. When comparing results to prior years, July 2021 is up +7.2% over July 2019 and up +7.8% over July 2018. Additionally, year-to-date the industry remains at growth with July 2021 up +5.3% over July 2020.

All age groups experienced YOY declines in activity in July. Those ages 0-30 dropped by -8.5%, ages 31-50 by -5.1%, ages 51-60 by -4.8%, ages 61-70 by -5.2% and age 71+ by -3.3%. These YOY comparisons are impacted by a double digit spike in activity that occurred in July 2020 for ages 0-60. When compared to 2019 activity, July 2021 was at growth for ages 0-60, in the double digits for ages 31-50, flat for ages 61-70 and declined for ages 71+. On a YTD basis, all age groups are at growth as of July 2021 compared to July 2020.

Face amounts over $1M up to and including $5M showed YOY growth in July. All other face amounts experience declines, with amounts over $5M seeing declines over 50%. This is in sharp contrast to previous months in 2021 where face amounts over $5M have been at double-digit growth YOY since February.

Ages 0-70 saw YOY declines with face amounts up to and including $1M, growth on face amounts over $1M up to and including $5M, and double digit declines of 40% or greater for face amounts over $5M. Of note, ages 61-70, saw double-digit YOY growth for face amounts over $2.5M up to and including $5M.

Activity across face amounts varied YOY for age 71+ including double digit declines for amounts over $250K up to and including $500K, double digit growth for face amounts over $1M up to and including $5M, and significant double-digit declines (-90%+) for face amounts over $5M. This decline in applications over $5M for those ages 71+ is an ongoing trend that we have observed throughout 2021; however, it is important to note that July 2020 saw a significant spike in activity for applications over $5M among those ages 71+, which affects these YOY comparisons.

July 2021 saw YOY declines in Term and Universal Life, while activity for Whole Life was relatively flat. Term Life saw declines across all age bands, including double-digit declines for ages 61-70. Universal life saw declines across all age bands with double-digit declines for ages 0-30 and 51+. Whole life saw declines for ages 0-30, flat activity for ages 31-70 and declines for ages 71+.

California Charges 2 With 36 Counts Of Felony Insurance Fraud

Former Trinity Healthshare Ministry Files For Bankruptcy

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- PLAINFIELD, VERMONT MAN SENTENCED TO 2 YEARS OF PROBATION FOR SOCIAL SECURITY DISABILITY FRAUD

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News