Jackson National pivoting away from struggling variable annuities

Jackson National continued its necessary pivot away from the variable annuities during a dicey fourth quarter for the market leader.

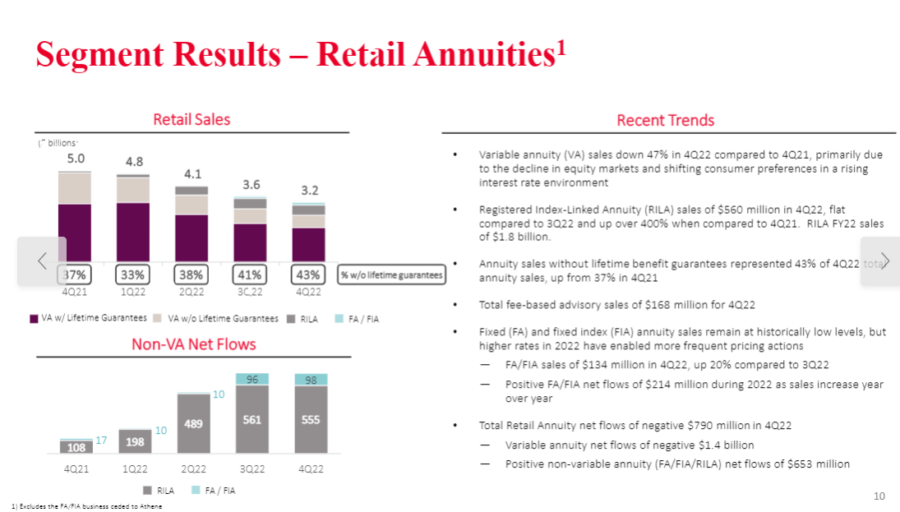

VA sales are in a steady slide amid the struggles of the equity markets. Jackson annually ranks No. 1 in VA sales, according to LIMRA sales statistics. But sales are sliding and Jackson President and CEO Laura Prieskorn presented two shifts the insurer is progressing with during a conference call today with analysts:

- Strong sales of Jackson's new registered indexed-linked annuity product. Jackson came late to the RILA in the fall 2021 with the launch of Jackson Market Link Pro and Jackson Market Link Pro Advisory. RILAs caught on with investors over the past decade due to the balance between growth and limited downside the products offer.

"Our RILA offerings continued to be a source of sales growth and distribution expansion," Prieskorn said. "We reached $1.8 billion in our first full year of RILA sales and expect these products to remain a steady source of new sales in the future."

Fourth-quarter RILA sales were $560 million, up from $108 million in the fourth quarter of 2021, Jackson reported.

- Advisor sales push. Jackson also saw promising returns on its efforts to market annuities to registered investment advisors (RIAs), Prieskorn said. Traditionally, advisors have scorned annuities in financial planning, but that sentiment is slowly evolving as regulatory barriers drop and the products gain in reputation.

"Over the past year, our distribution strategy included a focus on strengthening our presence among independent registered investment advisors," she said. "RIAs are an emerging market for Jackson in the industry and we ended 2022 with nearly 1,100 RIA firm selling agreements providing access to more than 10,000 investment advisor representatives."

Likewise, Jackson recently inked an agreement to add its annuity products to SIMON from iCapital’s insurtech platform. The partnership will increase the number of wealth management firms who have access to Jackson annuities, the insurer said.

Losses reported

Jackson reported a net income loss of $710 million in the fourth quarter, compared to $585 million in the year-ago quarter. The loss "primarily reflects a larger net hedging loss versus a year ago, driven by higher freestanding derivative losses resulting from comparatively stronger equity market returns in the current quarter," the insurer said in a news release.

For the full year, Jackson reported adjusted operating earnings of $1.4 billion, compared to $2.4 billion for 2021. The decline was "primarily due to decreased fee income from a lower average separate account balance, decreased net investment income due to lower levels of investment income on private equity and other limited partnership investments, and higher DAC amortization," the release said.

These were partially offset by lower general and administrative expenses and lower agent asset-based trail commissions in 2022 compared to 2021, the insurer added.

Rising interest rates – the Fed Funds Rate is above 4% for the first time in 15 years – is going to help Jackson, Prieskorn said. The insurer met or exceeded its "four key targets," she added:

- Full-year capital return total of $482 million, above the midpoint of the target range of $425-$525 million.

- Risk-Based Capital (RBC) ratio at Jackson National Life insurance Company of 544% as of year-end 2022 despite continued volatility in equity markets.

- Financial leverage ratio of 18.3% as of year-end 2022, below the targeted range of 20-25%.

- Cash and highly liquid securities at the holding company of approximately $675 million at the end of the year, which was significantly above Jackson’s targeted minimum liquidity buffer.

Sales numbers

Overall annuity sales were $3.2 billion in the fourth quarter and $15.7 billion for the year. Fourth-quarter sales were down 35% from the fourth quarter 2021. Variable annuity sales were down 47% compared to the fourth quarter of 2021. For the full year, annuity sales were down 19%.

"Traditional variable annuity sales per Jackson in the industry are below historical levels, reflecting the decline in equity markets and shifting product preferences and a rising interest rate environment," Prieskorn said. "Should that trend persist, we will continue to rely on our experience operating profitably throughout product cycles."

Closed life and annuity blocks reported a pretax adjusted operating loss of $32 million in the fourth quarter of 2022 compared to adjusted operating income of $21 million in the fourth quarter of 2021, Jackson reported.

The fourth quarter 2022 was "negatively impacted by lower income on private equity and other limited partnership investments, partially offset by lower death and other policy benefits resulting from the continued decrease in the size of the closed blocks," the release said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

California: One state’s rocky and expensive road to single-payer

Thomas H. Lee legacy firms see big value in insurance marketing

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

- Arizona ACA enrollment plummets by 66,000 as premium tax credits expire

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

- KFF HEALTH NEWS: RED AND BLUE STATES ALIKE WANT TO LIMIT AI IN INSURANCE. TRUMP WANTS TO LIMIT THE STATES.

More Health/Employee Benefits NewsLife Insurance News