Insurers Seek Growth Through Accelerated Underwriting

Courtesy of LIMRA

Many consumers view underwriting as a significant obstacle to obtaining life insurance — often believing that the process takes too long and the requirements are too invasive.

To address these challenges, companies are using automated and/or accelerated underwriting programs to improve their ability to determine medical risks by incorporating more and more data sources.

According to a recent LIMRA study, 3 out of 4 life insurance companies in the U.S. and Canada have some type of automated and/or accelerated underwriting program. One in two companies has both.

Automated underwriting uses technology/tools (including rules-based or predictive algorithms) to facilitate the review and approval of insurance applications that meet defined underwriting criteria, thus limiting human intervention.

In accelerated underwriting, some applications are eligible to have certain medical requirements waived, such as the paramedic exam or the collection of fluids.

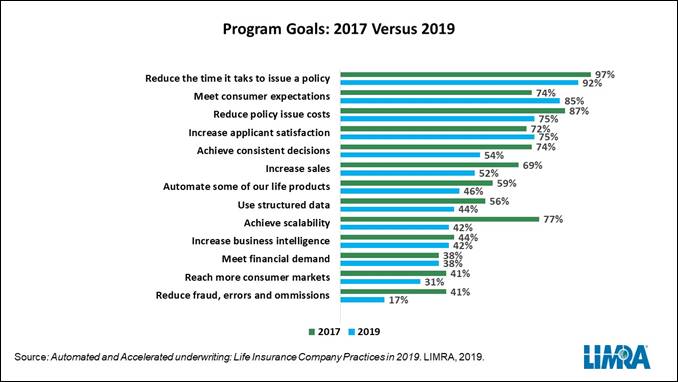

Companies’ top goal for these programs is to reduce the time it takes to issue a policy, followed by meeting consumer expectations, reducing policy issue cost and increasing applicant satisfaction (see chart).

Companies using automated and accelerated underwriting have broadened the products that can be underwritten this way. All but one of the companies with automated/accelerated underwriting programs offer term life within these programs. Most also offer whole life (82%) and universal life products (80%).

Companies are continuing to expand their use of electronic data, with prescription drug data and motor vehicle records leading the way.

The use of credit records has seen the greatest growth while none of the companies reported using wearables (such as Fitbit or Garmin) or social media to gather data.

Almost all companies (82%) believe that their automated/accelerated underwriting programs have reduced policy issue time.

Within their automated/accelerated programs, companies report that, on average, it takes three days (from receipt of an application in good order) to reach the medical questionnaire/interview—compared to eight days in their traditional underwriting programs.

To reach a final decision, it takes nine days, on average, with automated/accelerated programs versus 27 days for traditional underwriting. Therefore, overall, time to reach the medical questionnaire/interview has been reduced by more than half, and time to reach the final decision has been reduced by two-thirds.

To remain competitive and meet/exceed customer expectations, life insurance companies need to streamline their processes and differentiate themselves based on the experience they offer their customers.

One of the ways many companies are doing this is by speeding up the time it takes for an application to go through underwriting and be approved.

Arizona Tees Up Best-Interest Annuity Sales Rules

Supreme Court Will Hear Challenge To ACA Individual Mandate

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho House approves Medicaid reform bill

- Trump makes it official: The American apology tour is over

- People, News & Notes: State treasurer advocates for increase in health plan premiums

- Accounts way to empower Americans with disabilities

- State employees denounce looming cost hikes as NC health plan tackles $1.4B shortfall

More Health/Employee Benefits NewsLife Insurance News