Insurers See Record Returns With Riskier Bets, NAIC Reports

Insurance companies had the best return on assets in 10 years in 2020, despite last year’s volatility and persistent low interest rates, according to a National Association of Insurance Commissioners report.

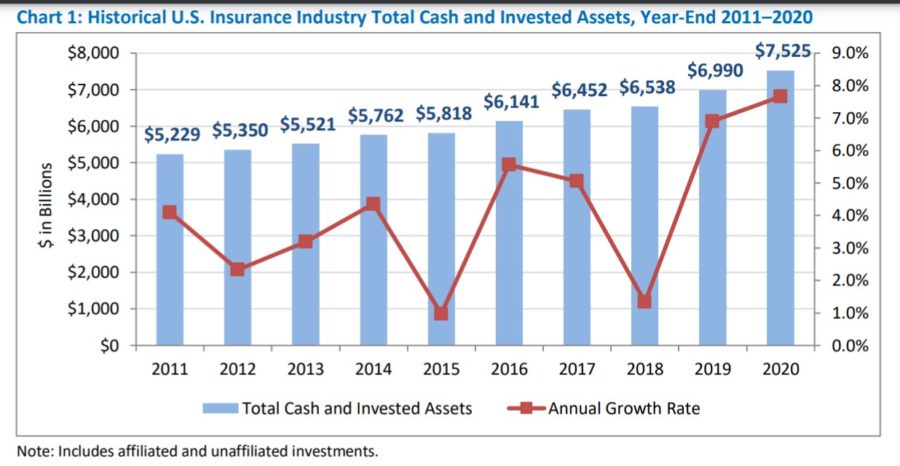

Carriers made 7.7% on their cash and invested assets in 2020 year over year, totaling $7.5 trillion, on top of a banner 7% they made in 2019, according to an NAIC special report.

But that good news also came with the observation that insurers have been picking up lower-grade investments in the pursuit of greater yields.

Carriers decreased their holdings of A-grade (NAIC 1) bonds, down to 62% from 65% of holdings. Meanwhile they increased B-grade (NAIC 2) bonds to 32%, up from 30%, along with bumping up their lower-quality (NAIC 3) bonds to 4%, up from 3%.

Many riskier bonds, such as BBB-rated bonds included in NAIC 2, were downgraded to speculative, or “fallen angel,” status in 2020 because of business disruption. Last year saw a record number of corporate bond downgrades, particularly in the wake of the oil price plunge earlier in the year.

The NAIC report authors said the increase in the lower-grade investments might be a reflection of last year’s record number of downgrades, but minimized the risk exposure.

“While there was significant concern that a large amount of fallen angel debt could result in severe market dislocation, the number of fallen angels was below the peaks of prior years, including the financial crisis,” according to the report. “In 2020, the market was able to absorb the additional high-yield debt with limited price volatility or illiquidity, due in part to central bank liquidity programs that provided support for recent fallen angel debt.”

Carries increased their cash and short-term investments 27% in 2020 in response to the uncertain operating environment resulting from the COVID-19 pandemic.

Life companies held a large majority of the assets, 65.3% of the total; followed by property and casualty, 30.5%; health, 4%; and title 0.4%.

Bonds made up 63.6% of all assets, followed by common stock at 13.2%, mortgages at 8.6%, with the remainder spread over eight categories. The report’s authors noted that carriers continue to pursue gain over liquidity in investments such as private equity and hedge funds in the prolonged low-interest rate environment.

“Although these asset classes generally offer higher yields than public corporate bonds, they are typically less liquid and have less credit and pricing transparency,” according to the report. “As such, they are subject to greater price volatility.”

One illiquid investment that carriers reduced was real estate, which continues to suffer in the commercial sector while the residential market booms.

“The pace of growth in mortgage exposure slowed in 2020 compared to YOY growth of more than 8% from 2016 to 2019,” according to the report. “Furthermore, 2020 marks the first year that the annual growth in mortgage loan exposure has not exceeded the annual growth of total cash and invested assets since the NAIC Capital Markets Bureau began tracking data in 2010.”

The authors noted the trend toward lower grade investments, but chalked up some of that to the abnormal year.

“While the U.S. insurance industry’s corporate bond investment portfolio predominantly consists of high credit quality companies, which have greater financial flexibility to withstand the negative credit effects of macroeconomic shocks,” according to the report, “credit quality deterioration was nevertheless evident in the year-end 2020 bond portfolio given the broad-based economic and credit impact of the COVID-19 pandemic.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Carson Group Strikes Blockbuster Deal With Insurance Marketing Group

Seven Questions To Create A Connection With Your Clients

Advisor News

- Wall Street CEOs warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

- Tax implications under the One Big Beautiful Bill Act

- FPA launches FPAi Authority to support members with AI education and tools

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Illinois extends enrollment deadline for health insurance plans beginning Feb. 1

- Virginia Republicans split over extending health care subsidies

- Illinois uses state-run ACA exchange to extend deadline

- Fewer Americans sign up for Affordable Care Act health insurance as costs spike

- Deerhold and Windsor Strategy Partners Launch Solution that Enhances Network Analysis for Stop-Loss Carriers and MGUs

More Health/Employee Benefits NewsLife Insurance News