Individual Health Insurance Costs Doubled For 2013-19: Heritage Foundation

The Affordable Care Act’s mandates and regulations dramatically increased the cost of individual market health insurance between 2013 and 2019 in almost all states, according to data analyzed by The Heritage Foundation.

A report released by the conservative organization today showed that the ACA more than doubled health insurance costs for individuals and families, with the national average premium increasing by 129% between 2013 and 2019.

However, the report does not look at premiums for 2020 and 2021, in which average benchmark plans on the exchange started creeping downward, the Centers for Medicare and Medicaid Services reported. The average premium for the second-lowest cost silver plan (also called the benchmark plan) dropped by 2% for the 2021 coverage year.

Three years of declining average benchmark plan premiums combined to deliver an 8% premium reduction across HealthCare.gov since the 2018 coverage year, CMS reported.

Effects Of The ACA On The Individual Market

The Heritage Foundation’s report states that, beginning in 2014, the ACA imposed a number of mandates and regulations on individual-market health insurance coverage and displaced private markets by creating new government-run health insurance exchanges to sell insurance.

Partly to offset the increased costs of its mandates, the ACA also provided income-related subsidies for plans purchased through those exchanges.

The law’s new mandates and regulations (but not its subsidies) also applied to coverage purchased outside the exchanges, although it did allow insurers to renew older policies (without all the new requirements) for a period of time. However, the design and implementation of the law ended up reducing the availability of those so-called grandfathered plans in subsequent years, as insurers discontinued them — either voluntarily or in response to directives from state insurance regulators.

The Heritage Foundation used data from the annual Medical Loss Ratio reports - which insurers are required to file with CMS - to measure the effects of Obamacare on the cost of individual market coverage.

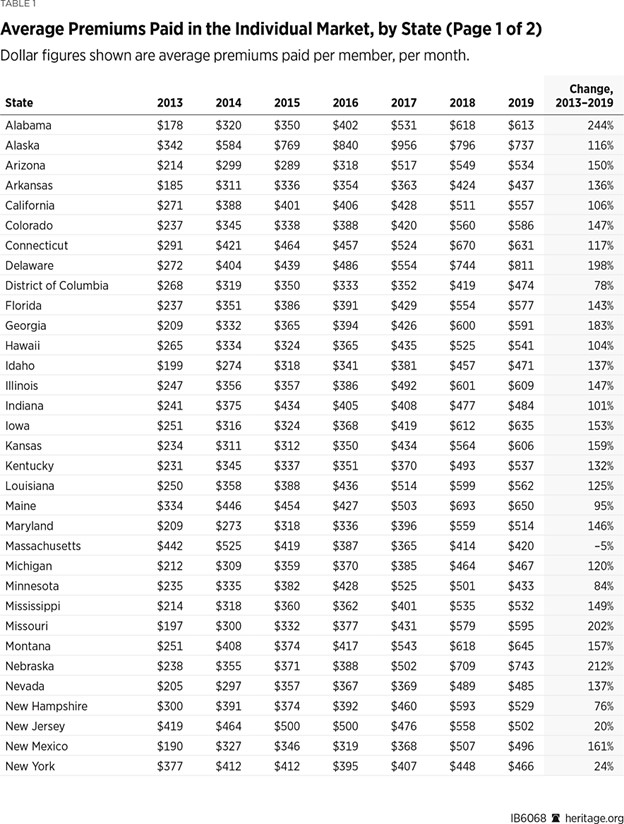

The foundation’s analysts calculated per-member per-month figures for the average cost of coverage at the state and national levels by dividing total premiums earned by the total number of member months. The resulting numbers, seen in Table 1, show the average monthly premiums that enrollees actually paid for coverage.

As 2013 was the last year of the pre-ACA market, the foundation used that as the base year, followed by each subsequent year for which MLR reports are available (through 2019).

As Table 1 shows, the national average monthly premium paid in the individual market in 2013 was $244, while by 2019 it was $558 — more than doubling from 2013 to 2019. In contrast, over the same period, the average monthly premium paid in the large-group employer market increased by only 29% — from $363 in 2013 to $468 in 2019. For comparison purposes, the foundation applied the same analysis to the MLR data for the large-group employer market.

The large-group employer market is not subject to most of the ACA’s insurance regulations. It is also more stable than the individual market, with less customer turnover and less change over time to the risk pool.

By definition, any customer exits and entrances in that market involve groups of 50 or more enrollees, and the diversity of health status among the members of each group means that groups leaving or entering that market have little effect on the composition of the overall risk pool.

Thus, changes over time in average monthly premiums paid for large-group employer insurance primarily reflect system-wide changes in the underlying cost of medical care, such as medical price inflation and the introduction of new therapies.

Consequently, the foundation said, if the 29% increase in the cost of large-group employer coverage over this period reflects the system-wide increase in the cost of medical care, then discounting the 129% increase in the post-ACA cost of individual market insurance by 29 percentage points indicates that the ACA basically doubled the cost of individual market insurance relative to what it would have been otherwise.

Wide Variations Among States

The changes in monthly premiums for individual coverage under the ACA varied from state to state, the foundation report said.

In only one state, Massachusetts, was the average monthly premium paid in 2019 lower than it was in 2013. That is because almost all of the ACA’s new mandates and regulations, along with a similar set of income-related subsidies, were already in place in the Massachusetts individual market before the law took effect. In fact, as Table 1 shows, Massachusetts was the state with the highest average monthly premium pre-ACA ($422 in 2013).

Similarly, New Jersey, New York, and Vermont had also imposed regulations on their individual markets before the ACA; like Massachusetts, they all had high average premiums in 2013. Those states have experienced only modest increases in average premiums since the ACA’s implementation.

In contrast, states that had previously imposed fewer mandates and regulations on their markets saw higher premium increases under the ACA. In 40 states, the average monthly premium for individual market coverage more than doubled by 2019 — and it more than tripled in five of them (Alabama, Nebraska, Missouri, West Virginia and Wyoming).

The Average Premium Declined In 20 States In 2019

Between 2018 and 2019, the average individual market premium in 20 states actually declined. In half of those states, the drop was quite small (between 0.6% and 3.7%), while the remaining 10 states saw reductions of between 5% and 15%.

Part of the explanation is that, faced with large losses from Obamacare coverage, many insurers sharply increased their rates in 2017 and 2018. Some of those insurers subsequently reduced their rates in 2019 once they determined that their earlier rate hikes had overshot the mark.

Effects Of Section 1332 Waivers

Average premiums declined in all but one of the seven states that implemented Section 1332 waivers in 2018 and 2019, the foundation reported. The waivers, authorized under Section 1332 of the ACA, gave those states regulatory relief from some of the law’s mandates to enable them to better align federal subsidy dollars with enrollee need using state-based reinsurance programs that target funding to the sick with high health care costs.

The waivers granted to Alaska, Minnesota, and Oregon all took effect in 2018. Similar waivers for Maine, Maryland, New Jersey, and Wisconsin took effect in 2019.

Average premiums paid in Alaska declined by 23% (from $956 PMPM in 2017 to $737 PMPM in 2019), while average premiums paid in Minnesota declined by 18% (from $525 PMPM in 2017 to $433 PMPM in 2019). Oregon, which implemented a less aggressive reinsurance design under its waiver, did not experience a net decline in average premiums paid, but did see a somewhat slower rate of growth.

All four states that implemented their waiver programs in 2019 also experienced net declines that year in average premiums paid — with reductions of 3% in Wisconsin, 6% in Maine, 8% in Maryland, and 10% in New Jersey.

Five additional states implemented Section 1332 waiver programs in 2020, two more did so in 2021, and yet another has received approval to implement its program in 2022.

If those programs have similar premium-reducing effects, the results should be reflected in the MLR data for 2020 and subsequent years, the foundation said.

Despite the increase in premiums since 2013, the foundation said costs can fall if policymakers provide regulatory relief to allow states to redirect subsidies according to the unique needs of the citizens in their states.

The initial data from states that implemented Section 1332 waiver programs show that permitting states to apply alternative approaches enabled them to reduce premiums, expand coverage options, and do a better job of focusing available resources on helping sick patients with high health care costs.

The foundation called on Congress to expand the state flexibility and make it permanent.

Conservative groups such as The Heritage Foundation may not be fans of the ACA, but the provision in the law requiring all Americans to buy health insurance has its roots in conservative thinking.

During the Clinton administration, The Heritage Foundation and the American Enterprise Institute were among the conservative research groups favoring the idea that everyone should be required to buy health coverage. The individual mandate was seen then as a conservative alternative to creating a national health plan or forcing employers to provide coverage.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at Susan.Rupe@innfeedback.com. Follow her on Twitter @INNsusan.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Philadelphia Eagles Sue Insurer Over Pandemic Loss Claim

AIG Launches New Lifetime Income Benefit For The Power Series Of Index Annuities

Advisor News

- Should financial advisors use AI? An expert weighs in

- Inflation and interest rates: Help clients navigate this terrain

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- 2025 Proxy Statement

- More than 5 million could lose Medicaid coverage if feds impose work requirements

- Proxy Statement (Form DEFC14A)

- ‘They won’t help me’: Sickest patients face insurance denials despite policy fixes

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

More Health/Employee Benefits NewsLife Insurance News

- Sierra Financial Holdings acquires Preferred Security Life

- 2025 Proxy Statement

- How Donald Trump's tariffs hit the stocks of Maine's biggest employers

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEFC14A)

More Life Insurance News