Indexed life sales lead the way in strong third quarter, Wink reports

Indexed life insurance continues to drive growth, despite regulation pressures and other disruptions, according to the latest Wink’s Sales & Market Report.

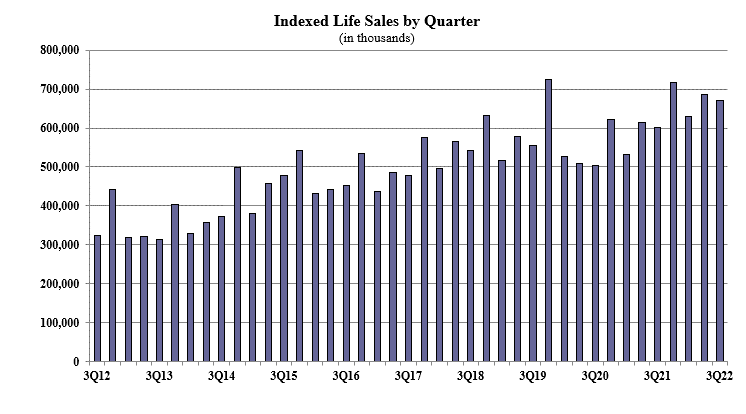

Indexed life sales for the third quarter were $670.7 million, down 2.1% when compared with the previous quarter, and up 11.3% as compared to the same period last year. Indexed life sales include both indexed universal life and indexed whole life.

“A significant indexed life company had a sizeable decline in sales this quarter,” said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “This resulted in the product line experiencing a drop in sales for the quarter, but it will be a record year for the product line.”

State insurance regulators are again looking at tightening indexed universal life illustrations, an effort that insurers say could impact the market.

Items of interest in the indexed life market included National Life Group with the No. 1 ranking in indexed life sales, with a 14.4% market share, Transamerica, Pacific Life Companies, John Hancock, and Nationwide rounded out the top five, respectively.

Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was Cash Accumulation, capturing 77.9% of sales. The average indexed life target premium for the quarter was $13,162, an increase of more than 8.0% from the prior quarter.

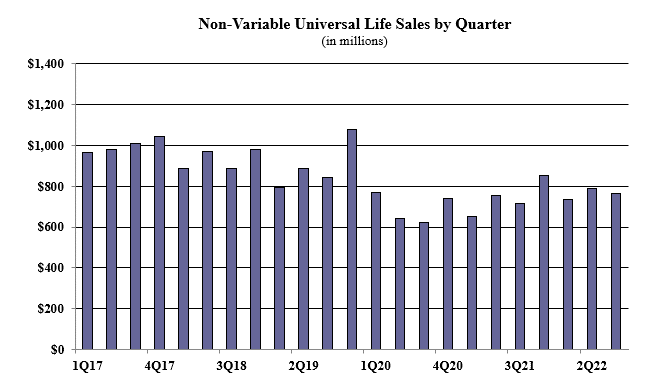

Overall, non-variable universal life sales for the third quarter were $766.8 million, down 2.9% when compared to the previous quarter and up 6.8% as compared to the same period last year. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the third quarter included National Life Group with the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 12.7%. Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined.

Fixed UL sales for the third quarter were $96 million, down 8.2% when compared to the previous quarter and down 16.6% as compared to the same period last year. Noteworthy highlights for fixed universal life included the top pricing objective of No Lapse Guarantee capturing 55.3% of sales. The average UL target premium for the quarter was $5,515, a decline of more than 7% from the prior quarter.

“Universal Life sales are the lowest they have ever been," Moore said. "It will be a record low for 2022 as well.”

Whole life third quarter sales were $1.1 billion, down 0.3% when compared with the previous quarter, and down 0.1% as compared to the same period last year. Items of interest in the whole life market included the top pricing objective of Final Expense capturing 55.7% of sales. The average premium per whole life policy for the quarter was $4,074, an increase of nearly 16% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Is limiting choice the key to stop retirement leakage?

Americans value the convenience and simplicity of telehealth

Advisor News

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

More Advisor NewsAnnuity News

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

More Annuity NewsHealth/Employee Benefits News

- Obamacare sign-ups drop, but the extent won’t be clear for months

- Lawmakers advance Reynolds' proposal for waiver

- NC Medicaid leaders seek new funding strategy as work rules loom

- Researchers to study universal health care, as Coloradans face $1 billion in medical debt

- Study Findings on Chronic Pain Are Outlined in Reports from Brody School of Medicine at East Carolina University (Associations of Source and Continuity of Private Health Insurance with Prevalence of Chronic Pain among US Adults): Musculoskeletal Diseases and Conditions – Chronic Pain

More Health/Employee Benefits NewsLife Insurance News