In-plan annuities gaining steam: Where do we go from here?

Annuities are becoming more available in the defined contribution space in association with 401(k) plans. What is the future of in-plan annuities, and have they reached a tipping point? Bryan Hodgens, head of distribution research and annuity research with LIMRA, provided some insights on where in-plan annuities are going during a recent LIMRA online event.

With the passage of the SECURE Act in 2020, in-plan annuities have been gaining steam, with many innovative products entering the market.

“The idea of a guaranteed income product in a defined contribution plan is nothing new. It has been around for years,” Hodgens said. “But up until recently, plan sponsors have been a little reluctant to put annuities inside of a 401(k) plan. What has changed? How did we get to this point?”

Looking over the past few years, several factors have generated the momentum that in-plan annuities are experiencing today, he said. SECURE became the catalyst for much of the adoption of annuities by retirement sponsors, because the act provided a safe harbor for the plan sponsor in how they provide due diligence in selecting an insurer and monitoring that insurer on an ongoing basis.

Hodgens said SECURE also provided guidance on how to evaluate the inclusion of a lifetime income product into a plan and how to choose that product.

SECURE Act incentives

SECURE had other incentives to include annuities in a defined contribution plan, he said. The act provided a tax credit for small-business owners to start a retirement plan for their employees. SECURE also addressed an issue that had been a challenge previously – the portability of annuity products from one 401(k) plan to another and from a 401(k) into an individual retirement account.

Consumers also are fueling the demand for in-plan annuities, Hodgens said. “Employees don’t have the traditional pension plan they had in the past,” he said, noting that the U.S. Bureau of Labor Statistics reported only 15% of the nation’s private-sector workers have access to a defined benefit pension plan.

Hodgens said consumers already are familiar with the concept of guaranteed income in retirement, as LIMRA research showed 80% of workers surveyed said they expect Social Security to make up a major part of their future retirement income. In addition, as more Americans live longer, the issue of having income that can keep up with longevity has become a concern of retirees and pre-retirees.

“An aging population, longevity, the need for more guaranteed income but an environment in which you don’t see traditional pensions – these all are reasons why I think consumers are looking at in-plan annuities a little more,” he said.

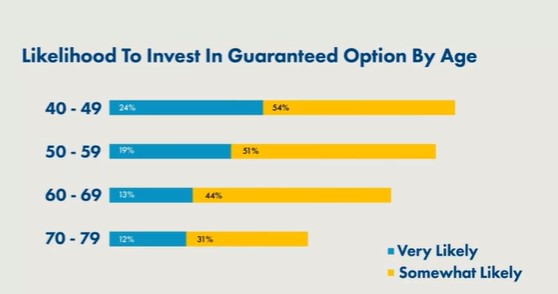

LIMRA researchers asked Americans between the ages of 40 and 80 with at least $100,000 in investable assets how likely they would be to invest in guaranteed income within their retirement plan. Hodgens said the research showed a high percentage of respondents indicated interest in selecting an in-plan annuity option if it were available.

Source: LIMRA

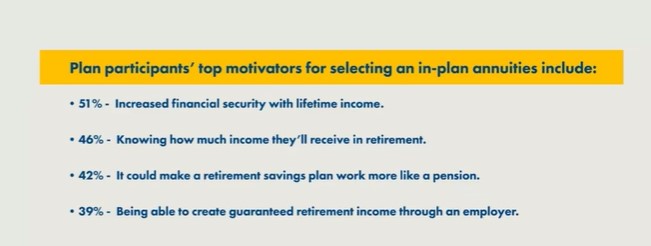

Another reason for consumer momentum toward in-plan annuities, Hodgens said, is that retirement plan participants believe that they can derisk their retirement savings by adding an annuity or having a guaranteed income solution. Other plan participants are motivated to select an in-plan annuity because they know how much income they’ll receive in retirement.

Source: LIMRA

Hodgens said that with an out-of-plan annuity option, at an age determined by the plan sponsor – usually 55 – the plan sponsor will offer the employee the option to move money they have accumulated in their plan to an annuity outside the plan.

Choices 'run the gamut'

“The choices that are that are being offered out of plan run the gamut,” he said. “Single premium immediate annuities, fixed rate, deferred, fixed indexed, variable annuities – pretty much the entire annuity menu lineup is available both out of plan and in plan.”

Technology also has been boosting interest in in-plan annuities, Hodgens said.

“Technology advancement on the portability of annuity products has been building,” he said. Record keepers also have played a part in adding annuity products to their platforms.

What do plan sponsors think about in-plan annuities? Hodgens said LIMRA conducted research into whether sponsors intend to add annuities to their retirement plans, and what types of plan sponsors are interested in annuities.

“One interesting thing is that the companies we surveyed tend to be a little younger, they were in existence 10 years or less. Some of these newer plans coming to market are being offered by companies that are offering a plan for the first time. Older companies are adding these products too but we were surprised to see a lot of newer companies bringing them in.”

LIMRA research also found that employers who offer annuities believe a guaranteed income investment option is necessary to help their workers plan for their retirement income.

Many employers who aren’t currently offering annuities are considering doing so, Hodgens said. LIMRA research found that many employers have been evaluating the annuity products available for their workplace retirement plans, with nearly 50% of them saying they will make a decision on whether to offer them in the next six to 12 months.

“So even if we’re not seeing an adoption of a new product into the plan, we’re seeing a nice pipeline of people who are about to make a decision in the near future,” he said.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on X @INNsusan.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

FACC injunction request: Freeze DOL fiduciary rule until lawsuit is heard

Study sheds light on a changing retirement landscape

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News