If elected, could Trump actually lower auto insurance rates?

Car insurance rates have been on the rise since supply line disruptions during the COVID-19 pandemic, with costs being exacerbated in recent years by inflation, distracted driving, as well as the increased complexity and cost of parts, and other factors.

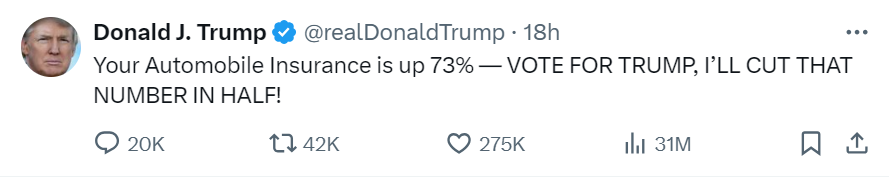

Yesterday, former president and current Republican presidential candidate Donald Trump promised some relief, posting on X that “Your Automobile Insurance is up 73% -- VOTE FOR TRUMP, I’LL CUT THAT NUMBER IN HALF.”

InsuranceNewsNet talked to Ray Lehmann, editor-in-chief and senior fellow at the International Center for Law & Economics, to find out how much impact a president and his administration could have on auto insurance costs. Premiums increased 18.6% from July 2023 to July 2024, according to Consumer Price Index, with the average cost of car insurance at $2,348, according to research from Bankrate.

“It’s interesting,” said Lehmann, “You look at the last decade going into the pandemic – about 2014 to 2017 – you were seeing average increases of about 7% a year. And then 2018 to 2021 – which includes the pandemic – was basically flat, maybe a 1% increase a year, but generally none. And then we've had several years in a row of these double-digit increases. If you normalize that over time, if we didn't have the flat period, 7% a year would actually look normal.”

Rate hikes 'more like catch-up growth'

Lehman said the recent rate jumps are ”more like catch-up growth.” During the earlier period going into the pandemic, said Lehmann, the industry was running combined ratios in the mid-nineties: 93%, 94%, 98%. (The combined ratio – also called "the combined ratio after policyholder dividends ratio" – is a measure of profitability used by insurance companies. A number below 100% means the company is making an underwriting profit. A number above 100% means the company is taking a loss, paying out more in claims than it’s taking in from premiums.)

“In the pandemic year of 2020, that dropped like a rock, because nobody was driving," said Lehmann. [Insurers] had a combined ratio of about 89%. And then we've been over 100% the last three years with 2022 being 113%.

“So, 2022 was a really extraordinarily high year for combined ratio,” said Lehman. “It went down a lot in 2023, but was still over 100%. I think it's probably like 102%. We're seeing some normalization in the cost trends, but the overall drivers of things we've known is that you have social inflation and the cost of medical care for casualty claims."

Lehmann added there has been the ongoing issue of parts being more expensive to replace. "You no longer can get some aftermarket bumper from China to stick on a car," he said. "Everything has advanced sensors and those need to be compatible with whatever car you're driving. And so those have become costly to the extent that parts didn't used to be such a significant part of the overall rate and now they're becoming a much more significant part of the overall rate."

Trends like distracted driving are playing a role as well, said Lehmann. Distracted-driving crashes accounted for 8% of all fatal crashes, 14% of injury crashes and 13% of all police-reported motor vehicle traffic crashes in 2021, according to the National Highway Traffic Safety Administration (NHTSA).

What can a president do?

So, what can a sitting president do to reduce the cost of auto insurance?

“That's sort of a secular story and that is not something you would imagine that regulation can do anything about,” said Lehmann. “The fact that people are buying more advanced cars with more safety features in general is good. It should lead over the long term to fewer crashes and fewer claims. But the claims that you have, or at least the physical damage portion of them, is certainly going up.”

Asked about the 73% figure Trump used in his social post on X, Lehmann said, “It's a little hard to even know what his claim actually is. What is he going to cut in half? 73%? … That’s a number that's hard to match to a specific year. But is he saying the increase in the future will be 36%? Or is he saying the actual rate will be cut in half?

“To know what the former president is intending to propose, you would need more details than he's given so far,” said Lehmann, adding, “But insurance is a state-regulated system. The federal government has very little to do with insurance rates and the best they could do is contribute to making the roads safer through things like the NHTSA.

Federal government can take some steps

There are some things the federal government could do, Lehmann said. “You could invest in the National Highway Traffic Safety Administration to do a much more aggressive distracted driving campaign. Inflation is an issue of monetary policy, which is the Fed. And the administration has some influence over the Fed. So, bringing down overall inflation would bring down the acceleration of claims increases. We probably have already brought down inflation, but it's possible that it could be brought down further in the future.”

“So, those are all things that the president could do, or Congress and the president working together could do. But I don't think it's reasonable to say you could promise any specific price reduction. There are things you can do to make the road safer. There are things you could do to address social inflation or what juries are coming back with as verdicts, but how that shakes out in actual rates is kind of a longer-term issue and not something that can be done immediately. Not without bankrupting the industry anyway, which doesn't serve anybody.

And, said, Lehmann, the list of the things the president, or the president and Congress, can do would only change auto insurance premiums marginally. “The thing that may, over the long term, cut rates significantly – and this is an issue that the insurance industry doesn't quite know how to deal with yet – is automated vehicles. The early data seems to suggest they are significantly safer than passenger-driven vehicles.

“The transition is maybe going to be difficult and how you insure them is not at all clear – whether it's something that would be insured by the manufacturer. Or would it maybe be a no-fault system because the driver isn't operating the vehicle? That's all still up in the air. It's maybe not tomorrow or 10 years from now, but within some of our lifetimes, we will see many more largely automated vehicles on the roads. And, hopefully, if things go as they seem to be going, they'll be a lot safer than the ones we have right now.”

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

Insurance experts see good news after Fed cuts rates by a half-point

Are consumers receptive to an in-plan, retirement-income solution?

Advisor News

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

- Implications of in-service rollovers on in-plan income adoption

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News