How workplace benefits help clients win the war for talent

The American workforce has reached a generational tipping point. Millennials and Generation Z are taking over the workplace even as baby boomers remain on the job longer. The old ways of doing business no longer apply in the days of remote work and five generations in the workplace.

Workforce benefits are changing along with the workforce itself. Research shows that workers no longer are satisfied with their employers offering the traditional benefits of health, dental and vision insurance. Today’s workers are demanding benefits that address all areas of their well-being, including mental health and financial health.

When carriers take a fresh approach to benefits and brokers communicate those benefits effectively, the end result is giving employers tools to help them win the war for talent.

Wellness trends drive benefit offerings

Flexible and holistic strategies are key for employers looking to meet the needs of a diverse workforce, according to the LIMRA-EY 2023 Workforce Benefits Study. The research found the following trends regarding benefits:

1. The generational tipping point. Although older workers are working longer, millennials and Generation Z now represent the majority of the workforce. Benefits plans and programs that today are designed primarily for baby boomers and Generation X must be modernized to meet a broader range of needs and preferences and delivered in a way that younger workers can relate to.

2. New working norms. Remote and hybrid models are here to stay, and the gig economy, which younger generations prefer, will continue to grow.

3. New expectations for benefits. Workers place a higher value on benefits, and they want more options. Nontraditional offerings that would have been afterthoughts a decade ago are now central to employers’ value proposition, especially given today’s intense competition for talent.

4. Technology-driven transformation. Workers want more digitalization, especially when it comes to benefits guidance and advice.

LIMRA and EY developed the Wheel of Wellness, which is focused on five key dimensions of wellness:

1. Physical: Products and services to help employees stay healthy and physically fit (e.g., health insurance, dental insurance, gym memberships).

2. Mental: Offerings focused on mental and emotional strength and resilience (e.g., mental health benefits, employee assistance programs, meditation apps).

3. Financial: Offerings that promote economic security and resilience (e.g., life insurance, disability insurance, supplemental health insurance, retirement savings, student loan repayment).

4. Societal: Opportunities to contribute to the community (e.g., corporate volunteering programs, donation matching).

5. Professional: Resources and tools to support performance and career development (e.g., tuition assistance, training, mentoring).

Different generations in the workforce prioritize different dimensions of the Wheel of Wellness, Leary said the LIMRA-EY research showed.

“Older generations are putting more priority on physical wellness benefits — health insurance, for example,” he said. “Younger workers — Gen Z — are looking at more of a variety of benefits.”

Workers of all generations are interested in financial wellness benefits, Leary said, but interest in particular financial wellness benefits also varies by generation.

“We found that pre-retirees are more interested in retirement savings, life insurance, some of the more protection-oriented benefits. And younger workers are more interested in things such as student loan assistance or an emergency savings plan.”

As the workforce demands more benefits, brokers have a role to play by being consultants to their employer clients, Leary said.

“It’s understanding and having those conversations with employers to determine their needs, and using data and analytics to understand things such as usage patterns and participation rates as to what’s working and what’s not working. And then positioning benefits within the Wheel of Wellness to address the holistic needs of the workforce.”

From workplace to workforce

“We believe this is a workforce benefits business now, not a workplace benefits business,” he said.

The younger generations in the workforce are prioritizing their mental health as much as they are their physical health, and those who work in the benefits space must take notice, Morbelli said.

“Our research found that for Gen Z, their mental health is as important to them as their vision and dental plans, and almost as important to them as their medical plan. This was quite a stark revelation.”

With the different generations in the workforce having different needs, employers and benefits providers must tailor their offerings to serve those differing needs, Morbelli said.

“As workers age, their physical health and well-being become more important than when they were younger,” he said. “Benefits must keep up with workers as they go through different life stages.”

Benefits are crucial to the post-pandemic workforce

“There’s a real value placed today on employers that show they care about their workforce well-being,” he said. “And workers say they want to work for companies that care — we are seeing that much more today than we were before the pandemic.”

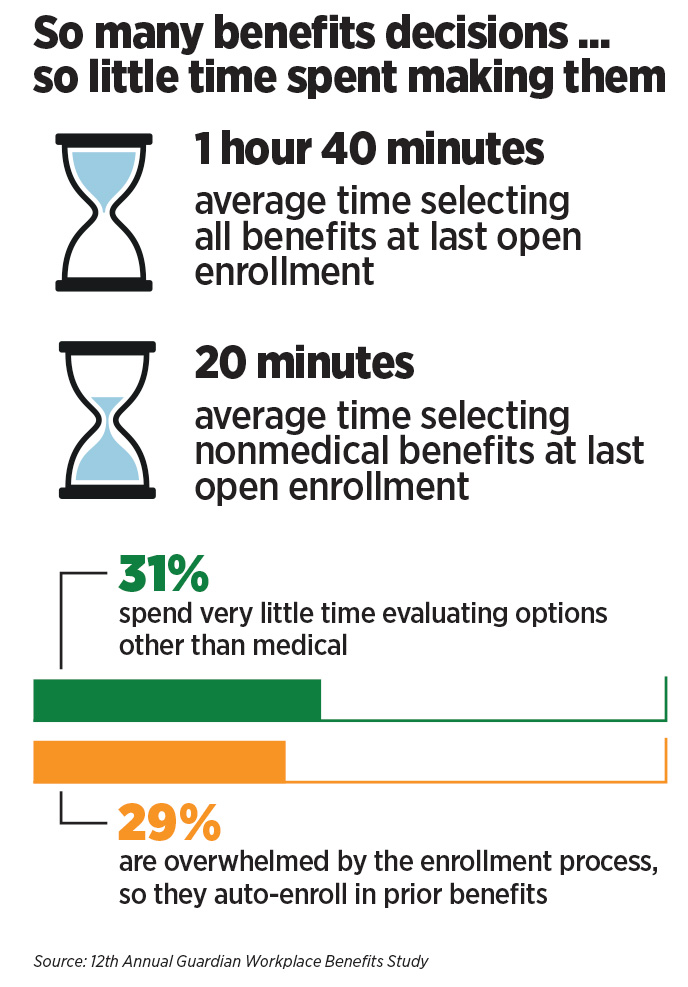

Guardian’s 12th annual Workplace Benefits Study, released in 2023, showed that 41% of working Americans said they would face financial hardship without their workplace benefits.

“I believe the pandemic, in many ways, was this tipping point in terms of how workers think about benefits. Things such as compensation, career growth, learning opportunities and advancement opportunities are still very important to workers. But we see this increased focus on corporate culture, work/life balance and diversity, equity and inclusion really accelerating since the pandemic,” Lanzoni said.

Workers are demanding their employer provide a wider array of benefits, Lanzoni said. But workers also need to understand those benefits if they are going to enroll in them and get optimum usage out of them.

“Employers want to make sure that their workers really understand the value of their benefits and are focusing on enrollment and communications strategy,” he said. “Employers recognize that if they want workers to appreciate and use these benefits, they must understand them. So we are seeing more emphasis on using a multichannel approach to communicate about benefits, to make sure you deliver information to your workforce in the ways that they prefer to receive that information so they can make the best possible choices when it comes time for open enrollment.”

Workers and their employers have seen an increased concern about mental health since the pandemic, Guardian’s research showed. Employers and carriers are responding, Lanzoni said.

Guardian partnered with Spring Health to bring personalized mental wellness benefits to employees and their families. Those benefits include in-person and virtual therapy as well as mental health assessments and mindfulness exercises.

The pandemic also contributed to workers’ growing stress and uncertainty about their finances, with Guardian’s research citing the statistic that only 28% of Americans in 2023 described their financial health as “excellent” or “very good,” down from 44% in 2022.

Lanzoni said that offering benefits is one way to boost workers’ financial well-being in addition to their physical wellness.

“Supplemental health benefits are one of the fastest-growing categories in group insurance today,” he said. “Things such as accident insurance, critical illness and hospital indemnity insurance are benefits that go a long way toward improving the financial wellness of workers and their families. There are often gaps in terms of coverage in what a medical plan will and will not cover, and that results in out-of-pocket costs. Having these benefits in place is especially beneficial to those workers who are in high-deductible health plans. So having benefits that can help cover some additional health-related expenses can go a long way toward a family’s financial wellness.”

“I think that COVID-19 and work from home were the catalysts for this,” he said. “There’s a trend toward workers looking to their employers for help with well-being and that trend isn’t losing momentum. When you think about well-being, it’s physical, it’s financial, it’s social and it’s societal. We’re seeing a much greater interest in mental health, in paid leave, in things that weren’t even talked about in the benefits space five years ago.”

Darula cited some statistics from the LIMRA-EY research that found 40% of workers are looking for a physical wellness offering, 30% want specialized mental health and financial wellness services, and 25% want caregiving benefits. That compares with about 50% of workers who said they were interested in more traditional benefits such as group life insurance.

Disability insurance, considered as a more traditional workplace benefit, also ties in to employees’ increased mental health concerns, Darula said. “One of the biggest reasons people go out on [a] disability claim is for what we call ‘mental/nervous claims.’ So, in many ways, providing mental health services is not just an opportunity to meet worker needs, but [also helps] folks feel comfortable staying in the workplace and not going out on a claim — or if they do go out on claim, they feel comfortable going back to work because they have mental health services available to them. It creates this sort of ecosystem.”

Happiness is having benefits

MetLife recently released the results of its 21st annual U.S. Employee Benefits Trends Study, which showed three trends, Madden said.

“The first trend is that there’s a continued focus on holistic wellness,” she said. “When you think about wellness, you think about physical and mental and financial [wellness]. But what we’re seeing is that employees are focused on what’s keeping them happy. Employers can support that happiness by offering a benefits package that improves their employees’ happiness as well as their well-being.”

The MetLife study showed employees say “being happy” is the most important aspect of their work experience, and it coincides with the workforce’s transition from “The Great Resignation” to “The Big Stay,” in which employees are increasingly indicating they will stay with their companies for the long term. More than seven in 10 (73%) employees said “being happy” is the most important aspect of their work experience, while 77% said they plan to remain with their employer in a year.

The study also found it’s not enough to offer benefits that keep workers happy. Worker comprehension of those benefits plays a critical role in happiness and retention. More than three-quarters (76%) of workers who understand their benefits are happy, and 62% said understanding how to use their benefits would give them a greater sense of overall stability. Half of employees surveyed said having a better understanding of their benefits would make them more loyal to their employer.

Madden said the second trend revealed in this year’s survey is the increasing diversity of the workforce. “So it’s really important for employers and brokers to think about a broad benefits offering that’s going to fit the needs of their diverse workforce,” she said.

The third trend is employees’ desire to have their benefits communicated to them in a personalized way that they understand. Nearly half of employees surveyed by MetLife (45%) say there are elements of their benefits package they don’t fully understand.

MetLife also found that workers report feeling what they call “benefits envy.” The survey found three in 10 workers want the benefits their friends, family and colleagues have. Those benefits include long-term care insurance (43%), critical illness insurance (41%), accident insurance (38%), flexible spending accounts (37%), disability insurance (35%) and financial planning tools (34%).

Workers, employers seek holistic wellness

Nine in 10 employees say their mental and physical wellness impacts their financial well-being, and they expect their employers to play a role in their wellness. That was among the findings of Prudential’s 2022 workplace benefits study.

“We are seeing employers prioritizing their employees’ holistic wellness in the workplace. Mental health is absolutely a top concern for employers as they look to ensure their populations stay healthy and productive both at work and at home. The pandemic has certainly shifted the way employees view work/life balance and the need for additional wellness support from their employers.”

Employers also recognize the need for employee wellness, the study showed. Between 80% to 90% say wellness offerings help with productivity improvement, employee retention, burnout avoidance and stress reduction.

Specifically, for financial wellness, the top benefits for employers were lower 401(k) loans/withdrawals and better benefit usage. Physical wellness’ top benefits for employers were increased productivity and lower claim incidence. Mental wellness, specifically, also helped with reduced distraction at work.

Although 94% and 93% of employers surveyed by Prudential currently offer health and mental wellness programs, respectively, only 63% of them offer financial wellness programs. But close to 50% of the employers that currently don’t offer financial wellness programs plan to provide them in the next few years.

Voluntary benefits see a refresh

Aflac launched Aflac Choice, an enhanced hospitalization product that features more extensive protections for mental health treatment, Hawthorne said. “We’re trying to close that gap between what health insurance doesn’t cover for mental health. And so we’ve enhanced that. We are trying to show our employers who are our customers that we’re not just reimbursing for doctor’s visits, but we’re actually providing policies and services for people to get in front of that from a preventive perspective.”

Another recent Aflac offering is a wellness product where policyholders are compensated for preventive care such as an annual physical, mammogram or dental cleaning.

“You can use that to pay for parking, to pay for gas, for whatever you want to use it,” she said. “We want to encourage you to take care of yourself in a proactive way.”

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Benefits and the Bow Tie Guy — With Daryl Perry

Building success on a history of experience — With Eric Henderson

Advisor News

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- Study Results from Johns Hopkins University Broaden Understanding of Managed Care (Medicare Advantage Networks for Surgical Specialists): Managed Care

- How Personal Injury Claims Affect Future Health Insurance Coverage in Charlotte, NC

- New Dementia Data Have Been Reported by Researchers at National Health Insurance Service (Central Nervous System Medication Use Among Older Adults in Korean Long-Term Care Facilities: A Multilevel Analysis): Neurodegenerative Diseases and Conditions – Dementia

- States try 'public option' Obamacare plans to reduce coverage costs

- Novocure Announces Optune Lua® Receives Reimbursement Approval in Japan for the Treatment of Non-Small Cell Lung Cancer

More Health/Employee Benefits NewsLife Insurance News

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

- Baby on Board

More Life Insurance News