How financial advisors can help clients improve financial stability

While a recent study credits employers for helping improve workers’ financial health this year, financial advisors also can assist clients in improving their financial stability, according to Marci Stewart, director of Client Experience at Schwab Workplace Financial Services.

“While the markets have generally performed well this year, inflation and economic conditions have continued to put pressure on workers’ finances at elevated levels,” said Lee McAdoo, managing director of Schwab Retirement Plan Services. “In the face of external economic factors, employers are supporting their employees with a combination of direct financial assistance and accompanying resources to help them manage financial stress and overall well-being.”

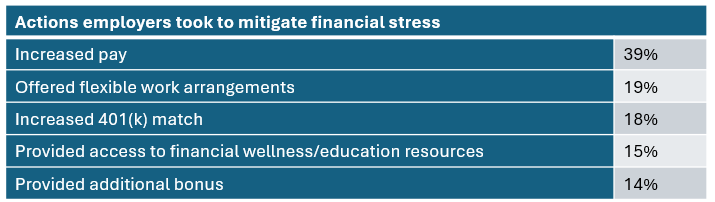

Sixty-four percent of the workers surveyed said their employers have taken action to help them manage financial stress, compared to 52% who said the same last year, according to Charles Schwab’s 2024 401(k) Participant Study. The table below shows the various actions taken by employers:

Despite those steps, many continue to feel stressed.

While more workers are feeling good about their financial health (24%) compared to last year (20%), many continue to feel stressed, according to the survey. About half of those surveyed said their financial health has not changed, and one in five said it has worsened. Gen Z (37%) and Millennials (35%) are more likely than Gen X (28%) and Boomers (21%) to say that their financial health has improved.

The potential of SECURE 2.0

As workers make use of the resources offered to help manage their financial wellness, the survey noted that nearly one in three of them (32%) would like help in understanding how new regulatory and legislative changes, like the SECURE 2.0 Act, affect their retirement plan.

SECURE 2.0 provides many changes that could help strengthen the retirement system and enhance Americans' financial readiness for retirement. The law builds on an earlier piece of legislation that increased the age when retirees must take required minimum distributions (RMDs) and allowed workplace saving plans to offer annuities, capping years of discussions that were aimed at bolstering retirement savings through employer plans and Individual Retirement Accounts (IRAs).

As employers have started to adopt SECURE 2.0 provisions, more workers have become attuned to the benefits that could help them manage their finances, the survey pointed out. The most pronounced interest of workers attempting to achieve financial stability is in the federal government’s plan to make matching contributions to workers’ retirement accounts, based on their income.

SECURE 2.0 has great potential to help participants prepare better for retirement, said Stewart, in explaining some of the key benefits of SECURE 2.0.

According to Stewart, some of the sections that 401(k) savers are the most interested in creating financial stability include:

- The “Savers Match” government matching contribution to an IRA or a 401(k) plan

- Easier 401(k) withdrawals for emergency expenses

- Employer contributions as Roth

- The ability to set up an emergency savings account at work

- The increased contribution maximum for those who are ages 60 – 63

Helping clients understand SECURE 2.0

So, what can registered investment advisors do to help their clients understand the provisions of SECURE 2.0 that would help them move closer to achieving their retirement goals?

“Our survey shows that awareness of SECURE 2.0 is up, but there may be a gap in knowledge about how the provisions can support individuals’ retirement goals,” Stewart said. “Financial advisors can have personalized discussions with their clients based on their financial needs and determine which SECURE 2.0 provisions may be offered through their clients’ workplace plans.

For example, Stewart pointed out, advisors might provide more education and guidance around the increased 401(k) catch-up contribution maximum for workers ages 60 – 63, which could help eligible participants increase their 401(k) savings levels.

The online survey of 1,000 U.S. 401(k) plan participants was conducted by Logica Research between April 17 and May 3, 2024. Survey respondents were actively employed by companies with at least 25 employees, were 401(k) plan participants and were 21-70 years old. To analyze Gen Z results against other generations, an additional 100 plan participants aged 21 to 27 completed the survey. Survey respondents include participants served by approximately 15 retirement plan providers.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Ayo Mseka has more than 30 years of experience reporting on the financial services industry. She formerly served as editor-in-chief of NAIFA’s Advisor Today magazine. Contact her at [email protected].

Long-term care: A view from the states

Long-term care needs will only increase as more Americans age

Advisor News

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Mystic resident attends State of Union to highlight healthcare cost increases

- Findings from University of Connecticut School of Medicine Provides New Data about Managed Care (Nursing Home Ratings and Characteristics Predict Hospice Use Among Decedents With Serious Illnesses): Managed Care

- Missouri, Kansas families pay nearly 10% of their income on employer-provided health insurance

- Researchers from California Polytechnic State University Report on Findings in COVID-19 (Exploring the Role of Race/Ethnicity, Metropolitan Status, and Health Insurance in Long COVID Among U.S. Adults): Coronavirus – COVID-19

- TrumpRx: Better prescription drug deals may already exist

More Health/Employee Benefits NewsLife Insurance News