Help clients achieve financial balance during all life stages

While each decade of life presents a new set of financial obstacles and opportunity for financial growth, what rings true for clients of all ages is that financial balance and compromise must be equally made. The wealth advisor’s role is to help clients find this balance within their finances and create a backdrop for them to make educated decisions at all stages of their life.

Here are some of the practices I’ve found work best when helping my clients navigate their finances. Collectively, these strategies can work collectively to help clients build positive habits and make consistent progress toward the life they want to live.

20s: time is their greatest asset

Many 20-year-olds who are managing their money for the first time find themselves overwhelmed by this sizable new responsibility. Between paying back student loans, developing their career, and finding a balance of saving and spending, it is easy for young adults to feel lost.

However, members of this age group commonly overlook the fact that they hold the greatest asset: time.

The sooner an individual in their 20s starts saving for retirement and investing their money, the more opportunities they will have to grow their wealth.

The first step a financial advisor should take when advising advising clients is to ask about their goals. Next, consider talking through the estimated cost of their desired lifestyle and what actionable steps are needed to secure this flexibility.

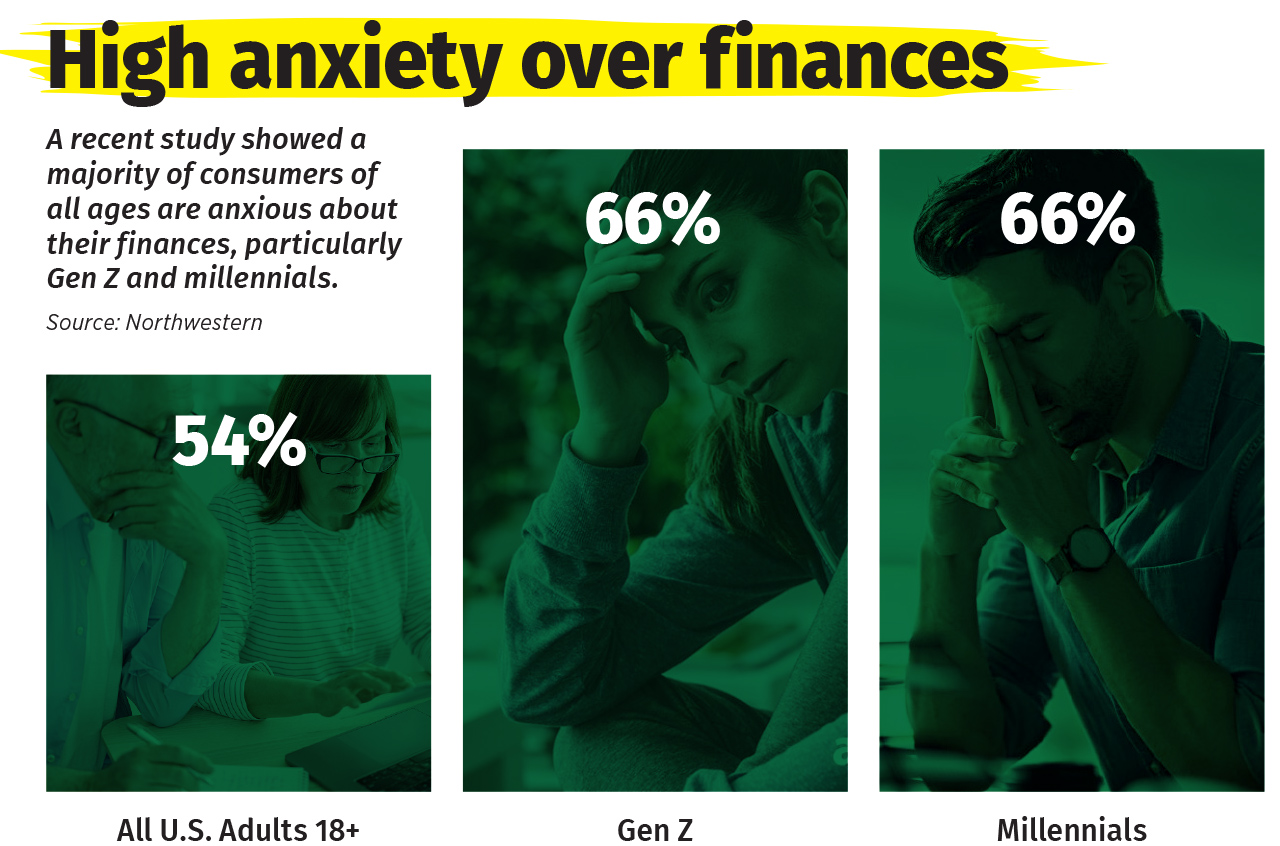

A recent Northwestern Mutual study found that 57% of people prioritize paying down debt over contributing to their savings account. Although paying down debt is important, financial advisors can encourage their clients to plan for their future strategically by taking a balanced approach to their finances.

For example, paying off student debt will happen over time, but it should not outweigh the importance of creating an emergency fund or participating in a company-sponsored 401(k) match.

30s: keep long-term financial goals in sight

By the time an individual reaches their 30s, they may have experienced career milestones such as salary raises and promotions, or they may have experienced significant life changes such as marriage and children. A financial advisor should approach this age group by discussing the client’s goals for the future and reevaluating their current budget.

The next step is to encourage individuals in this age group to position themselves for long-term success by increasing contributions to their 401(k)s

as their salaries grow and to rebalance their investments as needed. This is also a great time to introduce a Roth IRA to support additional savings with unique tax attributes.

Additionally, if these individuals are planning to expand their family, a financial advisor should discuss the benefits of a 529 account and how to fit this addition into their savings framework. It is essential for the advisor to encourage the client to strike a balance between maintaining their emergency savings fund, contributing to their retirement savings and starting a higher-education fund for their children.

Incorporating a multi-pronged approach of financial strategies with different tax characteristics and risk profiles allows individuals to arrive well positioned for their education and retirement funding goals with options and flexibility.

40s: retirement strategies

In an ideal world, an individual in their 40s has paid off their student loans, regularly contributes to their 529 account, has an estate plan in place and is on track for retirement.

However, a Northwestern Mutual study found that 4 in 10 people don’t think they’ll be financially ready for retirement. Additionally, that same study revealed one-third of Americans predict there is a 50% chance they’ll outlive their savings.

When advising this age group, an advisor should work closely with the client to understand what their retirement age goal is. If this is not realistic within the individual’s existing financial framework, an advisor can consult with the client on steps to better prepare for retirement. This includes advising the client on the lifestyle adjustments, if any, that must be made. Ultimately, it is up to the client to decide if they want to make changes to their current lifestyle to meet their retirement goal or retire at a later age.

Communicating with clients through a positive lens that is focused on progress planning versus perfection planning is a helpful approach to identify and build their good habits.

50s: portfolio diversification is key

Although portfolio diversification is important during any stage of life, it should be the focus when advising a client who is in their 50s. A financial advisor should discuss managing risk and ensuring there is an adequate mix of guaranteed and variable income streams. At this stage in life, a client’s portfolio should reflect a more conservative approach, and the stocks and bonds should be diversified across asset classes.

Additionally, an advisor should help their client mitigate risk by identifying any variables that can potentially derail a well-funded financial plan. The goal is for the client to establish a sufficient foundation to lean on during times of market volatility.

A financial advisor should also discuss the client’s desired approach for long-term care planning.

Although this can be a difficult conversation, creating a plan before something happens is essential to help protect the client’s savings against future unforeseen medical costs.

It’s important to recognize that no strategy on its own is enough to help an individual arrive well positioned down the line. Sustainable wealth is accumulated by optimizing various financial strategies and then using them as a road map to create a flexible future.

A well-thought-out financial plan will serve as a backbone to ensure that an individual’s finances are strong enough to withstand the unpredictability of the markets so the client can have peace of mind and enjoy the life they built for themselves.

Kurt Rupprecht is a wealth advisor and partner at Northwestern Mutual’s Private Client Group, K Street Financial, in Washington, D.C. He may be contacted at [email protected].

Help employers provide workers with benefits they actually want

Will AG 49-B be a May Day or meh day for IUL illustrations?

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

- Indiana to bid $68 billion in Medicaid contracts this summer

- NFIB NEW MEXICO CHAMPIONS SMALL BUSINESS REFORMS TO ADDRESS RISING HEALTH INSURANCE COSTS

More Health/Employee Benefits NewsLife Insurance News