Health care reform: Most workers pay more for other people’s health coverage

Health care reform, otherwise known The Patient Protection and Affordable Care Act of 2010, was expanded by changes brought about by the COVID-19 pandemic. This resulted in a significant reduction in the number of Americans who are uninsured.

According to KFF, the coverage expansions put in place by health care reform served as a safety net. Health care reform extended Medicaid coverage to many more low-income individuals and provided subsidies for ACA marketplace coverage for individuals whose income falls below 400% of the federal poverty level.

The number of uninsured dropped significantly from 2010 through 2016. After 2018, the ACA’s individual mandate penalty no longer applied. However, in 2023, individual mandate penalties continue to apply in Massachusetts, New Jersey, California, Rhode Island and the District of Columbia. The number of uninsured, nonelderly individuals remains well below levels prior to the ACA’s enactment - from 46.5 million in 2010 to fewer than 26.7 million in 2016, then to 28.9 million individuals in 2019 before dropping again to 27.5 million in 2021.

This reduction was primarily the result of taxpayer subsidies for coverage - through enrollment in the marketplace exchanges, broadening out eligibility for Medicaid, coupled with baby boomers aging into eligibility for Medicare. This is why KFF reports coverage among “nonelderly” people (Medicare offers near-universal coverage for the elderly), with only 441,000, or less than 1%, of people over age 65 uninsured.

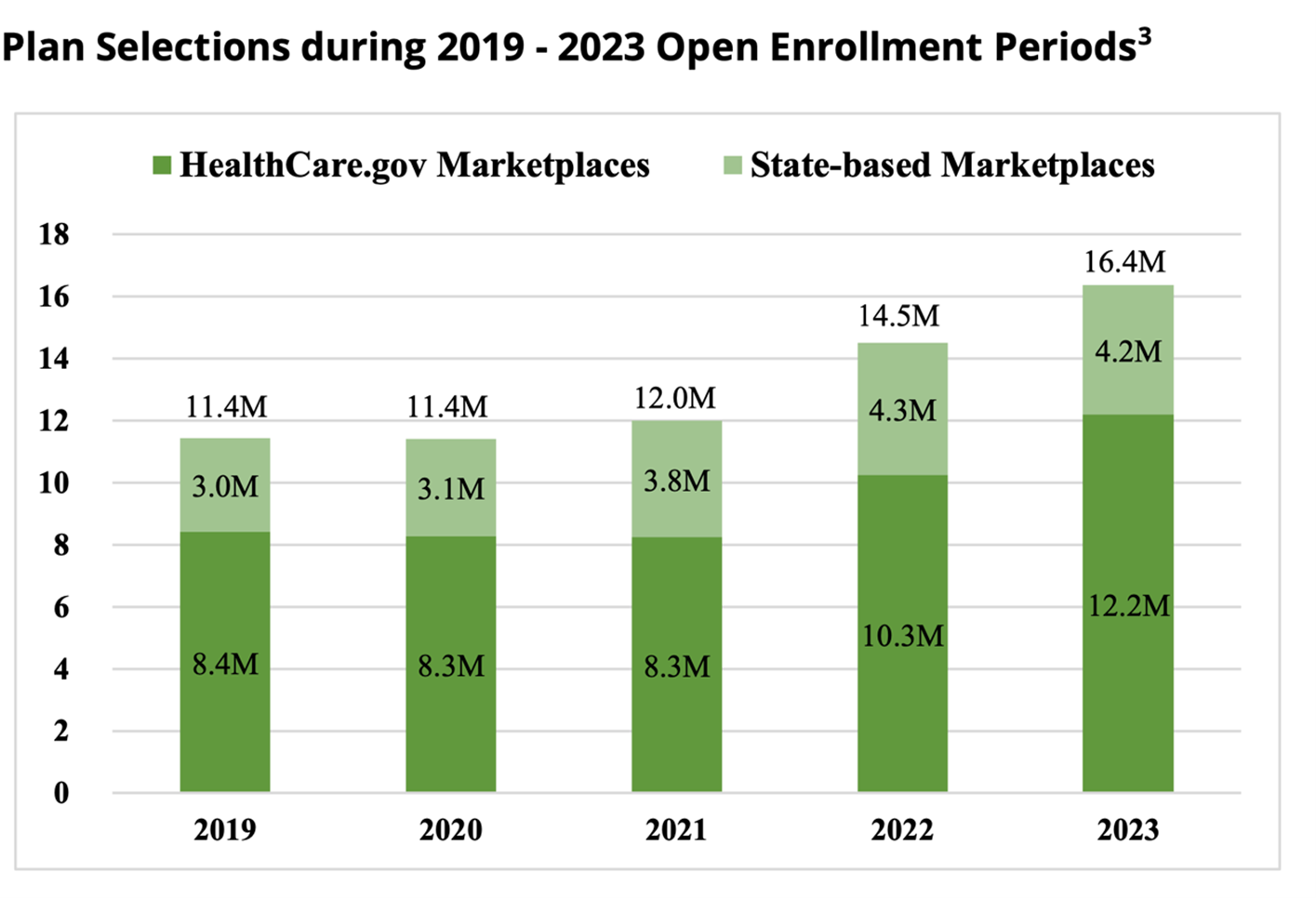

Nearly 16.4 million consumers selected or were automatically re-enrolled in health insurance coverage through HealthCare.gov and the state marketplaces during the 2023 open enrollment period. More than 1.8 million additional consumers signed up for coverage during the 2023 open enrollment period compared with the 2022 open enrollment period, a 13% increase. Nearly 4.4 million more consumers signed up compared with the 2021 OEP, a 36% increase, according to the Center for Medicare and Medicaid Services.

Most American workers would be surprised to find out that they pay more for other people’s health coverage than for their own.

Because of health care reform, most American workers will now pay more out-of-pocket for other people's coverage (in current and future taxes due to the deficits and national debt, and interest on the national debt), than they will pay out-of-pocket for their own coverage.

The Inflation Reduction Act extended COVID-19 taxpayer subsidies through 2025 for marketplace health coverage - initially approved as part of the American Rescue Plan Act.

Deficit spending on other people's health care coverage, coupled with the substantial portion of American households who do not pay income taxes (40%-50%) and the exhaustion of the Medicare Part A Hospital Insurance trust fund projected by 2026 are expected to require increases in taxes. Many expect those trends will also trigger cost shifting to employer-sponsored plans by hospitals and other providers should Medicare continue to freeze or lower allowable expenses. It means that taxpayers will see the cost of health coverage increase not only in terms of their premiums, contributions and out-of-pocket expenses, but in their taxes as well – FICA, Medicare and income taxes, today and tomorrow.

This is a unique government variant of a well-known TV commercial - paraphrased from "pay me now or pay me later" to "pay me now and pay me later."

Recent actions to restore Medicaid eligibility requirements, and the lapse of significant COVID-19 subsidies for marketplace coverage after 2025, will be more effective at reducing annual federal deficits and national debt than will the recent budget agreement approved by Congress and President Joe Biden.

Financially fragile Americans ask “What’s next?”

The COVID-19 pandemic exposed a much larger segment of Americans as being financially fragile – living paycheck to paycheck and unprepared for regular household expenses, let alone out-of-pocket medical expenses.

Now, compounded by reductions in real wages resulting from surging inflation and the potential for increased taxation, employers and employees alike are at a level of heightened concern over the potential for significant increases in the cost of medical services, drugs, supplies and devices. Both employers and employees expect increases in the cost of coverage (employer and employee contributions) and in point-of-purchase cost-sharing (deductibles, copayments, coinsurance, etc.). Americans have become anxious over “what’s next” in terms of price increases and what will add to their financial stress thanks to the soaring cost of living.

Support of a medical billing partner

Finding the right balance between a benefit package that is both adequate and affordable yet financially sustainable has never been easy for employers. This is especially challenging today given the current labor market and volatile economic conditions. To counter surging inflationary trends and to take advantage of new regulatory provisions, medical billing companies help clients and their members employ compliant and strategic solutions to manage costs, reduce spending, gain potential savings and fully optimize their plan value.

Given current and anticipated political, social and economic factors around health coverage, employer-sponsors, administrators and brokers should take strategic action and make holistic changes to ensure that their health plans incorporate the most effective strategies available to address and improve the health and wealth of their participants. These strategies include effectively designed acquisition cost-based pharmacy pricing, health savings account-capable coverage, reference-based pricing with adequate participant protections against balance billing, participant advocacy, and litigation support.

The right medical billing partner can facilitate all those strategic designs and processes – acting as an agent of change, embracing technology innovation and advocating for what is fair and just. The right partner will provide value-added services through turnkey solutions, resources, data-driven insights, administrative and compliance support, as well as guidance on navigating new and updated federal and state health care regulations.

Jack Towarnicky, member, aequum, is an ERISA/employee benefits compliance and planning attorney. In 2023, Jack was appointed to the Advisory Council on Employee Welfare and Pension Benefit Plans, also known as the ERISA Advisory Council. He may be contacted at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

How benefits brokers can reduce roadblocks to care

AI-enabled cybercrime becoming more effective, insurance experts say

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance NewsProperty and Casualty News

- Should credit shape pricing?

Virginia bills say credit shouldn't be factor in auto insurance

- Florida Bar Board seeking applicants. To make appointments in May

- Multiple family members arraigned in coordinated auto insurance fraud scheme

- Virginia lawmakers consider removing credit as factor in auto insurance

- 2026 insurance satisfaction survey: How Gen Z, Millennials, Gen X and Boomers compare

More Property and Casualty News