Genworth Posts 1Q Loss; China Oceanwide Deal Delayed Again

Genworth Financial announced another delay in its merger with China Oceanwide, with the deal now set for late June if a financing deal can be completed.

The Genworth executive team made the announcement during a first-quarter earnings call today. Genworth announced earnings per share of $0.07 on revenue of $1.84 billion. Earnings fell well short of analysts' expectations of $0.25.

Genworth reported a first-quarter loss of $66 million, after reporting a profit in the same period a year earlier. The quarterly report comes two days after Fitch Ratings downgraded Genworth's financial strength ratings from CCC+ to CCC. The insurer has $1.1 billion in debt coming due in 2021.

"The downgrades reflect Fitch's concern regarding the impact of the economic fallout on the Genworth Life companies' already weak balance sheet fundamentals and financial performance over the next one or two years," Fitch wrote.

Genworth is expecting an infusion of $1.5 billion in capital as a standalone subsidiary of China Oceanwide under a tentative agreement announced in October 2016. The deal was expected to close in mid-2017, but has been delayed numerous times.

The deal hinges on Oceanwide completing a financing arrangement for debt funding of up to $1.8 billion through Hony Capital, said Tom McInerney, president and CEO of Genworth. There remains the possibility of an alternative financing partner, he added, but the expectation is for a deal with Hony.

Genworth remains “fully committed to the transaction," he added. "Unfortunately, COVID-19 came and given all the uncertainty it’s clearly a challenge for any deal under these circumstances."

Life Insurance Loss

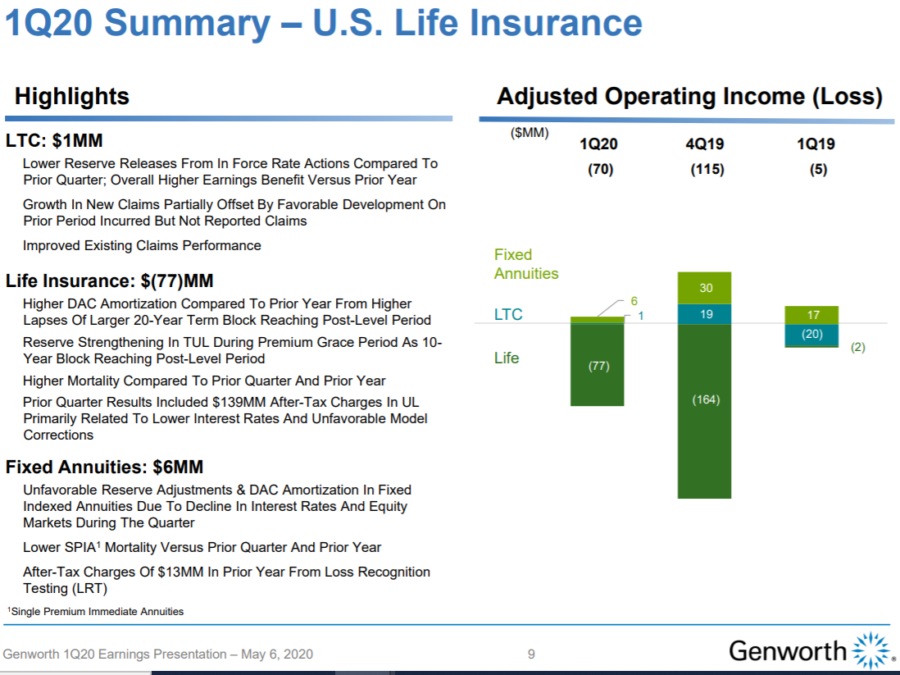

Losses on life insurance products continued in the first quarter as Genworth posted a $77 million loss. The company took a $164 million loss in the fourth quarter 2019, which included $139 million in after-tax charges for UL related to lower interest rates and unfavorable model corrections.

"Our performance in the first quarter experienced pressure due to a decline in equity markets and lower interest rates, primarily in our fixed annuity business as well as in our run-off variable annuity block of business," McInerney said.

Genworth continued to do well with its beleaguered long-term care insurance line. Thanks to aggressive rate increases at the state level, the company continues to turn a small profit on LTC products.

The insurer received 116 state approvals for rate increases in 2019, and another 32 successful increases in the first quarter.

"We have continued to make progress on our multiyear LTC rate action plan or MYRAP, which is essential to stabilizing our long-term care insurance business," McInerney said. "Year-to-date, we continue to make good progress against rate actions that is consistent with the MYRAP, with approvals on $130 million of annualized in force premiums, representing a weighted average premium increase of 35% or $45 million of annual incremental premiums going forward."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Covid-19 Biggest Catastrophe Ever: AIG Exec; 1Q Loss Posted

Prudential Posts 21% Loss From Annuity Segment In 1Q

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Report Summarizes Kinase Inhibitors Study Findings from Saga University Hospital (Simulation of Perioperative Ibrutinib Withdrawal Using a Population Pharmacokinetic Model and Sparse Clinical Concentration Data): Drugs and Therapies – Kinase Inhibitors

- Flawed Social Security death data puts life insurance benefits at risk

- EIOPA FLAGS FINANCIAL STABILITY RISKS RELATED TO PRIVATE CREDIT, A WEAKENING DOLLAR AND GLOBAL INTERCONNECTEDNESS

- Envela partnership expands agent toolkit with health screenings

- Legals for December, 12 2025

More Life Insurance News