Gen X? Make It Gen $: Boomers Set To Funnel Big Bucks To Heirs

Generation Xers may have grown up cynical and sneering as their baby boomer siblings consumed the environment, cheap real estate and all the pre-HIV free love, but the slackers will enjoy the last smirk as they reap trillions upon trillions of dollars in generational transfer.

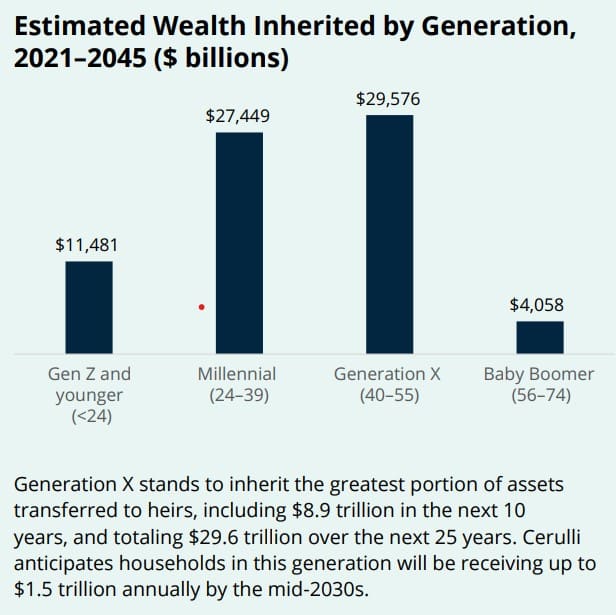

They will be the big winners with nearly $30 trillion between now and 2045, while boomers make do with their measly $4 trillion, according to Cerulli’s report “U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2021: Evolving Wealth Demographics.”

Over the next two decades, $84.4 trillion in wealth is expected to pass mostly (63%) from boomer hands, with $11.9 trillion of it going to charity.

The spigot of benjamins will open relatively slowly, with Gen Xers receiving $8.9 trillion over the next 10 years, but they will be seeing $1.5 trillion annually by the mid-2030s.

Boomer Jrs., or millennials, will be right behind their cool aunts and uncles with their own $27 trillion slice of America’s pie, according to the report. Although Millennials will be getting a relatively paltry $5 trillion over the next 10 years, they will surpass Gen Xers during the 2040s and by 2045 inherit more than $2.5 trillion annually.

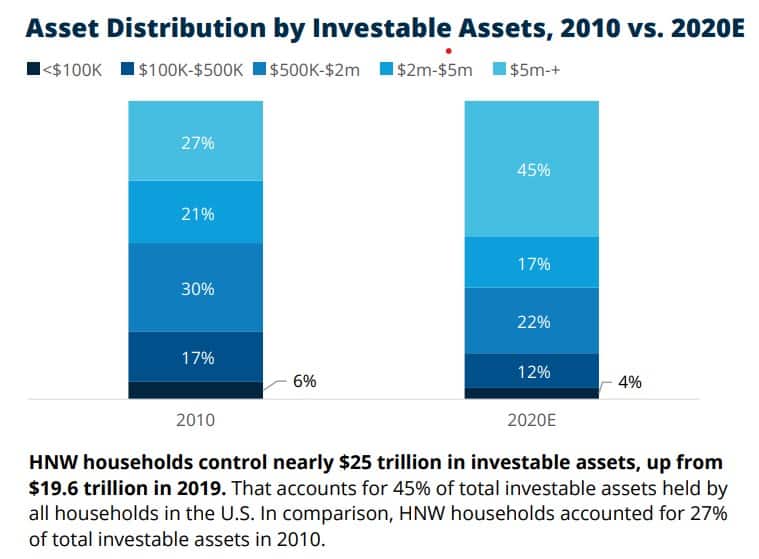

The rich will still be getting richer, with $35.8 trillion, or 42% of the transfers, to come from high-net-worth and ultra-high-net-worth households, which together make up only 1.5% of all households.

The Rich’s Riches

As of 2021, nearly 2 million high-net-worth households control nearly half of the total investable assets in the United States. The report’s authors warned advisors that they can’t expect to just wait for the money to find them.

“The need to deliver a differentiated advisory experience based on each client’s unique needs and expectations has become more important given the expanding number of wealth management options available to HNW investors,” according to the report.

Wealth begat significant wealth over the past few decades mostly through mutual and hedge funds, 54%, while 26% grew from individual securities.

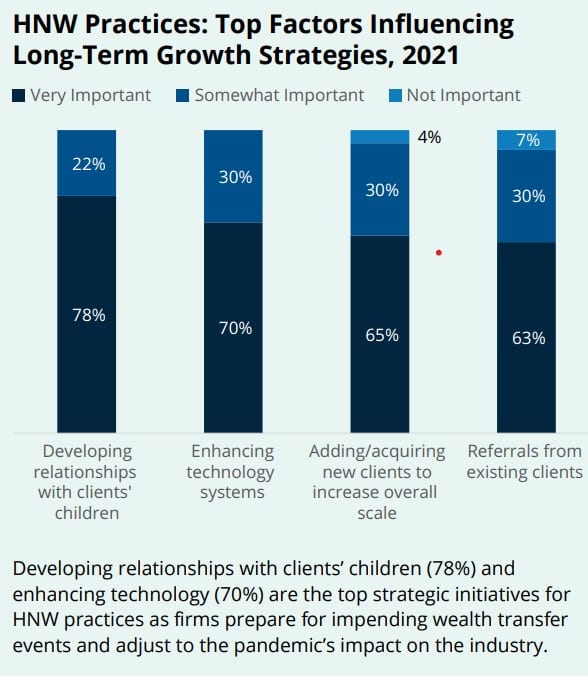

That means they will need help managing the tax impact of transitioning to retirement and assistance in planning their estates. Clients will also be used to clicking their way through their financial services because 70% of all investors use self-directed providers, with nearly the same percentage of clients with more than $1 million in investable assets using those providers.

A quarter of HNW practices are considering adding an advice platform in the next three years, according to the report. And 40% will be adding services because their clients demand them, with 27% of HNW firms planning to add services to keep up with competitors.

Keeping Up

To remain relevant to the younger generations of investors, advisors will need to pay attention not only to tech, but also to ethical investing.

Key in the tech upgrades will be improving the firms’ operational efficiency. That means tech providers will be in demand by smaller financial firms, which will need seamless integration between the many tools that advisors need to serve the next generations.

The ethical part of the equation means environmental, social and governance investing. Already, 67% of HNW practices are using ESG investing standards with more expected to use them this year.

“While the broader retail market is still very much in the early phases of leveraging ESG,” according to the report, “this has long been part of wealth managers’ conversations with HNW clients.”

As wealth passes generations, those dollars often leave the original clients’ firms. But some HNW practices are trying to keep that wealth in-house, with 34% of the firms using younger employees in conversations with clients’ children.

“Having younger team members work with HNW households’ next-generation kin creates opportunities to develop emerging talent and can improve the stability of the overall client relationship,” according to the report.

The research showed that family meetings and regular communication (81%) is the most-effective wealth transfer planning strategy by HNW practices, followed by educational support (59%), and organized succession planning (31%), according to Cerulli.

Advisors should make family events a regular part of the process, said Cerulli analyst Chayce Horton.

To improve relationships across generations, Horton recommends making family events a regular part of the advisory process. Extending interfamily relationships beyond the original clients not only keeps the next generation with the practice, it also creates a greater sense of responsibility along with greater trust in the advisors.

Not having a strategy is a plan to lose business, Horton said: “Winners of walletshare will need to be prepared for changes to their business model and open to evolving with the needs of a younger demographic.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Finseca And Forum 400 Announce Merger

How The Industry Can Bridge The Income Gender Gap

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- DEMOCRATS: Iowa’s farm income projected to plummet in 2026, ag-related layoffs expected to continue. Who is here to help?

- VERMONT SMALL BUSINESSES SUPPORT HOUSE BILL TO IMPROVE AFFORDABLE HEALTH INSURANCE OPTIONS

- ALASKA HOUSE LABOR AND COMMERCE COMMITTEE HEARS TESTIMONY FROM LOCAL BUSINESS OWNERS ON THE CONSEQUENCES OF INCREASING HEALTH CARE COSTS

- RELEASE: HILL, COSTA, DAVIDS, DAVIS, MILLER, MOORE INTRODUCE BIPARTISAN BILL TO BOOST TICKET TO WORK AWARENESS

- Health care workers warn of 'ripple effects' amid medical system issues

More Health/Employee Benefits NewsLife Insurance News