Expect the MYGA, indexed annuity boom into next year, Moore says

Expect a blazing fourth quarter and 2023 for multiyear guaranteed and indexed annuities and a bumpy ride for variable annuities and its hybrid offspring, structured annuities.

Those were a few observations from Sheryl Moore, CEO of Wink Inc. and Moore Market Intelligence, after third quarter results showed banner performance for FIAs and MYGAs in particular.

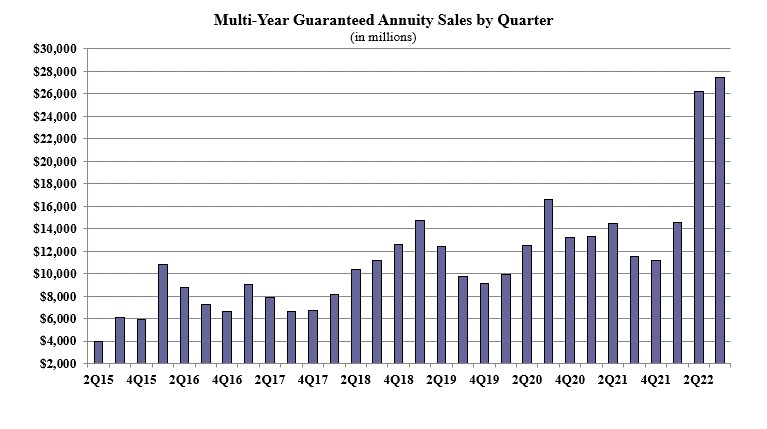

MYGAs blasted off the past few quarters with $27.4 billion in sales in the third quarter, 4.7% over the previous stellar quarter and 138% over the third quarter of last year.

Moore credited MYGAs’ success to outcompeting CDs. MYGAs lock in rates for multiple years, just like CDs but at a much higher rate. According to WINK data, the average MYGA rate is 4.34%, while the average CD for a year is 1.16% and the five-year is 1.05%.

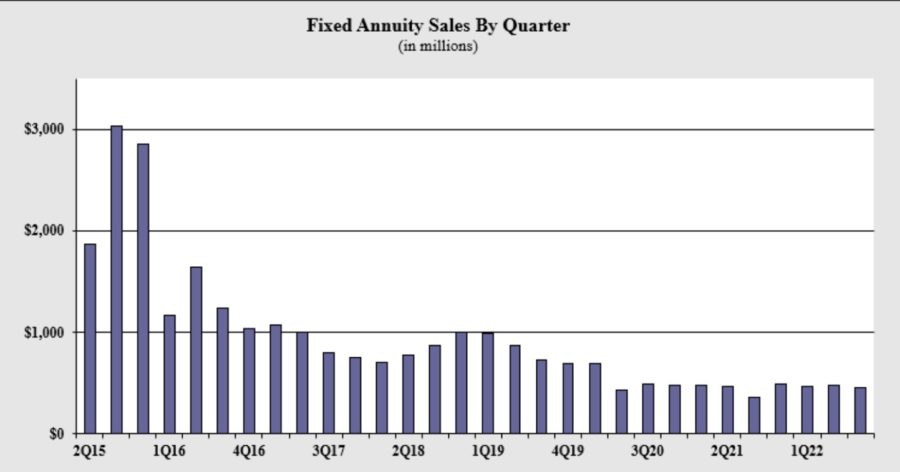

While MYGAs have skyrocketed over the past two quarters, traditional fixed annuities that guarantee only the first year’s rate have been in a slump since the beginning of 2020, even with increasing rates. Sales were $452 million in the third quarter, down 6.8% from the previous quarter but up 25% over last year’s third quarter.

The traditional annuities have had a hard go because the annuity rate tends to drop after the first year, according to Moore.

“Fixed annuities have not fared as well, because it's a ‘trust me’ sale, whereas with a MYGA, it's guaranteed,” Moore said, adding that carriers have not been able to offer attractive signing bonuses for these products since regulators have limited surrender periods and rates.

Fixed index boom

Fixed index annuities also had a booming quarter, although not as explosive as MYGAs’ performance. Still, FIAs had a record-setting quarter with $21 billion in sales, up 6.9% over the previous quarter and 20.9% over last year’s quarter.

The increase can be attributed to rates, with an average annual point-to-point cap of 8.9% on an S&P 500 index, but current annuity purchasers should expect to get 4.92% to 5.92% over the life of the contract, according to Moore.

“It hasn't been this way, oh gosh, I want to say since early 2000s,” she said of rate increases. “I don't project that index annuity sales are going to be going down anytime soon.”

Athene was the biggest player with 12% of the market, keeping the top position since elbowing past Allianz last year. Also notable was the absence of American Equity from the leader board. American Equity, which had been an FIA sales champ, has had a tough year, with CEO Anant Bhalla saying in the company’s third quarter earnings call that the carrier was being cautious while others were raising rates.

Moore said she didn’t understand Bhalla’s criticism of other companies’ actions because carriers all have to buy options to support their rates, and the key long-term corporate bond rate, Moody’s Baa1, has been “increasing like crazy.”

“So, I would say the response that I've seen from insurance companies is typical of what I would expect for the interest rate environment,” Moore said.

Structured annuities solid, VAs not so much

Variable annuities have slumped with the stock market. VA sales, not including structured annuities, amounted to $13.3 billion in the quarter, down more than 15.9% compared to the previous quarter, and 37.8% over the same period last year.

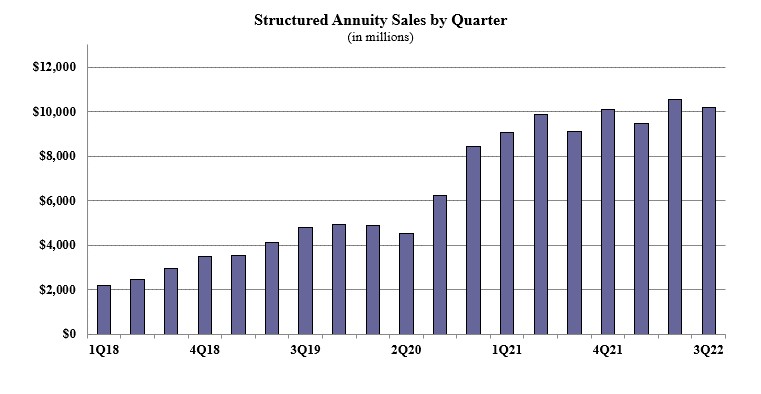

VAs have had a mighty fall over the past decade and a half when the products used to outperform all of fixed annuities. However, structured, or registered index-linked, annuities have been holding their own since bursting onto the scene several years ago.

In the first quarter of 2018, structured annuities had about $2 billion in sales. But sales grew steadily during the COVID pandemic, climbing to more than $10 billion in the third quarter. Although sales were down 3.1% compared to the previous quarter, they were up 11.8% over the third quarter of last year.

Equitable is the sales leader in the segment with 21.9% of the market and Allianz was the second highest. Moore said while Allianz has slipped from its top perch in FIA sales, the carrier has been climbing the charts in structured annuity sales.

Structured annuities’ development is similar to fixed index annuities’, which began in the mid-1990s, Moore said. A key difference is purchasers can lose money with structured products, unlike FIAs, which stops loss at 0%, excluding fees. Given that, structured products can offer a much higher cap than FIAs, averaging 21.8% of possible gain, Moore said.

Much as carriers did with FIAs, carriers are experimenting with caps, participation rates and new indices, Moore said. The distinct difference from FIAs is that structured annuities offer buffers that can limit some of the losses. These distinctions allow carriers to distinguish their product from others.

“That's kind of the one-upsmanship that I saw that drove us to have 53 different ways of calculating indexed interest,” Moore said, referring to FIA competition. “I'm starting to see that same type of behavior in the structured annuity market. And having the buffers and the floors is one way of doing that, where you can't compare your product to mine, because we absorb the first 10% of losses, and you absorb everything after 10% of loss.”

Blue skies for annuities?

Moore said she is already seeing the trendline of sales into the fourth quarter, which she said will be strong, especially with year-end promotions that carriers and distributors typically offer.

With interest rates expected to continue upward, so will go MYGAs, indexed and structured sales. The rocky equity markets might dampen structured sales, but the stock slump will place a heavy thumb on the traditional VA scale, Moore said.

“As long as that market environment continues,” Moore said, “the divide between index annuities and variable annuities is going to continue to get greater.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

LGBTQ workers less likely to be satisfied with their job, benefits and paid leave

Is limiting choice the key to stop retirement leakage?

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho House approves Medicaid reform bill

- Trump makes it official: The American apology tour is over

- People, News & Notes: State treasurer advocates for increase in health plan premiums

- Accounts way to empower Americans with disabilities

- State employees denounce looming cost hikes as NC health plan tackles $1.4B shortfall

More Health/Employee Benefits NewsLife Insurance News