Expanding Producer Network Is Top Priority Of BGAs And IMOs

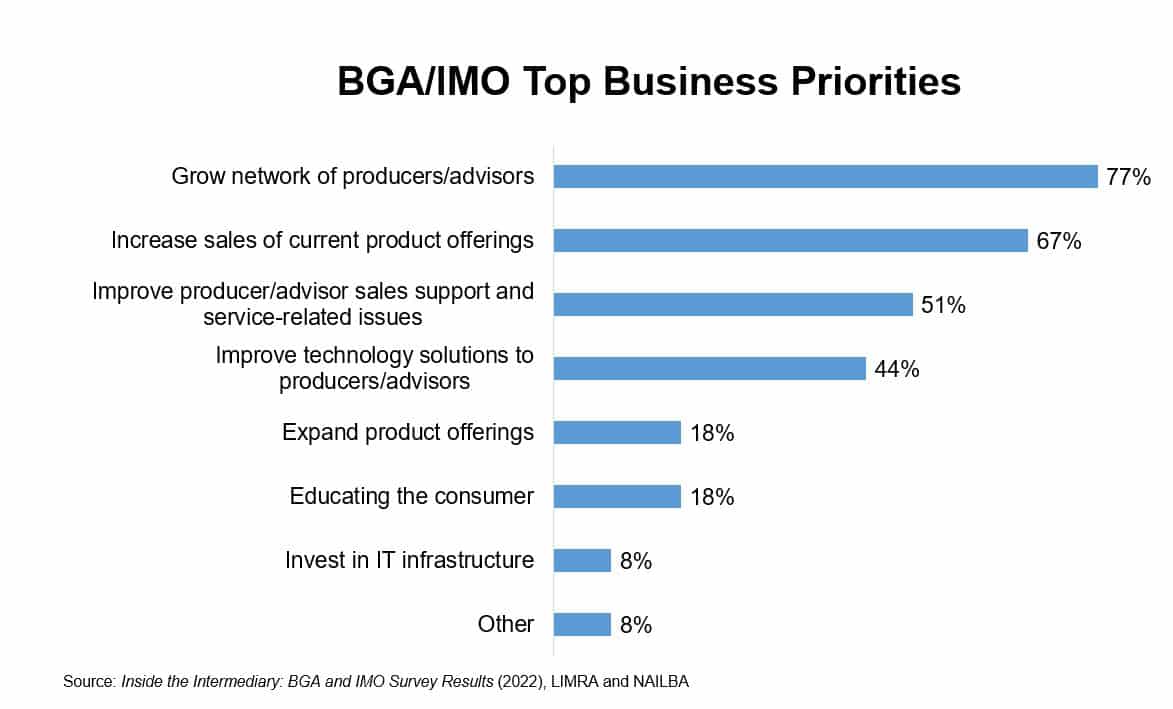

WINDSOR, Conn., Feb. 2, 2022 — More than three quarters (77%) of brokerage general agencies (BGAs) and independent marketing organizations (IMOs) surveyed say their top priority is to expand their network of producers.

The study, conducted by LIMRA and the National Association of Independent Life Brokerage Agencies (NAILBA), reveals the pandemic altered what some firms are looking for in an ideal agent or advisor, with nearly 1 in 5 firms saying they are looking for a different profile of producer.

“LIMRA research shows consumer expectations shifted during the pandemic. Clients have become accustomed to virtual meetings and digital interactions with their advisors,” said David Levenson, president and CEO, LIMRA, LOMA and LL Global. “As a result, many producer groups are looking for financial professionals who are technologically savvy and able to work comfortably with clients in a virtual environment.”

Another challenge when it comes to recruiting is attracting younger producers. Currently the average age of an independent agent is 62. To attract these individuals, it is important to know their priorities when choosing an intermediary.

“The research shows that producers under the age of 40 are looking for strong service and support, a varied portfolio of products and more favorable underwriting,” said Dan LaBert, NAILBA CEO. “Our new study finds more than 70% of intermediaries were very or moderately successful recruiting younger producers to their firms.”

As we emerge from the pandemic, intermediary firms are looking to grow their sales. Two-thirds of intermediaries say increasing sales of their current products is a top priority. Selling to consumers going forward may look a lot different post-pandemic with an increased use of video engagement tools and quicker turnaround times. This will require producers and the firms supporting them to continue or expand their use of digital tools.

“The need for intermediaries to innovate and respond to the changing market demands has never been more important,” said LaBert. “Our study shows BGAs and IMO firms are focused on improving and expanding the sales support and technological tools they provide to their agents and advisors to help them better respond to consumers’ shifting expectations.”

Even after the country emerges from the pandemic, BGAs and IMOs will continue to be the engine that drives independent distribution growth and productivity.

“As a result of the pandemic, more Americans are aware of the need for life insurance and the protection it can provide should the unexpected occur,” says Levenson. “In a relatively short period of time, BGAs and IMOs have become the largest life insurance producer channel in the United States. As such, their growth and productivity have become critically important in helping Americans get the financial guidance they need to protect the ones they love.”

The Misunderstood Cash Power Of Deferred Annuities

California Man Allegedly Set Fire To Own Car For Insurance

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

- Reports Outline End Stage Kidney Disease Study Findings from University of Utah (Medicare Advantage in the US mainland and Puerto Rico): Kidney Diseases and Conditions – End Stage Kidney Disease

- New Findings on Wilson’s Disease from Alexion Summarized (Patient Burden in the Treatment of Wilson Disease in the United States: An Analysis of Real-World Health Insurance Claims Data from the Komodo database): Nutritional and Metabolic Diseases and Conditions – Wilson’s Disease

- Legal Notices

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

More Health/Employee Benefits NewsProperty and Casualty News

- Home insurance rates rising in La Plata County amid growing wildfire risk

- Bill would increase cap on medical malpractice awards from $2.7M to $6M

- Judge must review documents in insurance dispute before releasing them

- How gamification helps insurers engage and educate younger homeowners

- Bill would increase cap on awards

Bill would increase cap on medical malpractice awards from $2.7M to $6M

More Property and Casualty News