Execs Say Digital Transformation Will Continue As Pandemic Fades

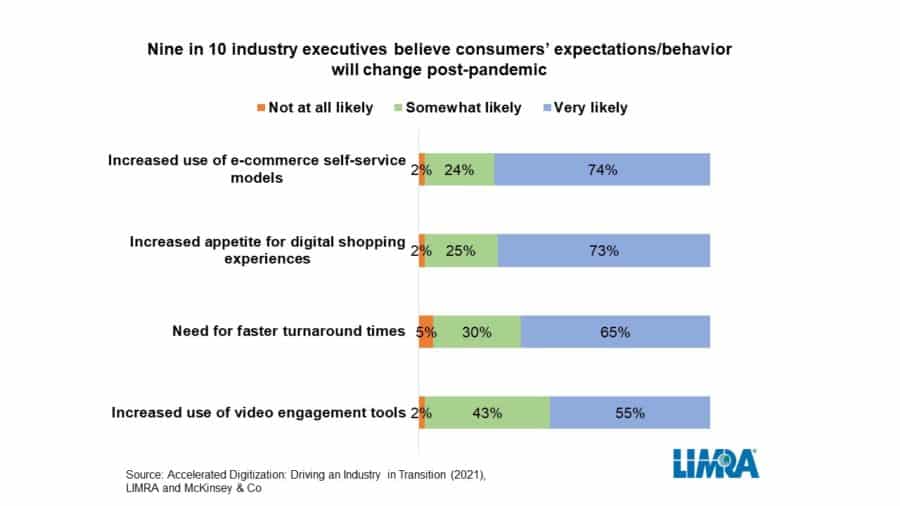

New research by LIMRA and McKinsey & Co. finds 8 in 10 insurance executives believe their companies’ efforts to adopt digital solutions accelerated due to the COVID-19 pandemic. Most (9 in 10) agree that consumer expectations will demand these efforts continue post-pandemic.

“While most companies were working on transforming their business operations through digital solutions, the pandemic fast-tracked many of these efforts,” said Kartik Sakthivel, chief information officer, LL Global, LIMRA and LOMA. “Just before the pandemic began in the United States, LL Global established an executive task force to examine the biggest challenges our members faced with regard to implementing digital transformation enterprise-wide. The effort evolved as the pandemic compelled companies to reimagine how they conducted business in a virtual environment.”

The Emerging Technologies Executive Task Force identified three areas of focus that could help modernize life insurance companies and the industry as a whole:

• Data and analytics — to gain greater insights into customers and operations, improving profitability, operations and the overall customer experience.

• Digital acceleration — improving operational efficiencies (both at the home office and for its sales force) and, by doing so, lowering costs and improving customer satisfaction.

• Platform modernization — transforming how companies organize and access their data by updating and unifying the many different data sources that exist in most companies is key in enabling insurers to take advantage of new technology solutions that other industries already use.

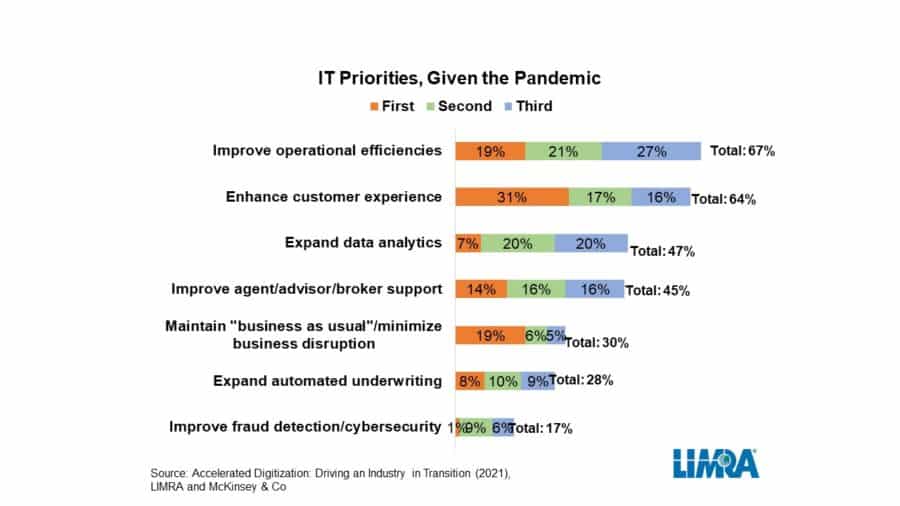

In light of COVID-19, the study finds insurers had to adapt their information technology (IT) priorities to continue to serve their customers and empower their employees. As a result, improving operational efficiencies, enhancing customer experience and expanding data analytics became the imperative for most IT departments.

“Almost overnight, an industry based on face-to-face interactions and relationships had to shift to a virtual environment,” noted Sakthivel. “The industry needed to rethink and reimagine digitization across every function of insurance. A “horizontal” look at digitization was needed, as opposed to how it has traditionally been done in a “vertical” manner.”

As the world returns to some semblance of normal, the task force identified three areas that life insurers will need to address:

1. Transformation of talent strategies: Expanding use of new technologies will require new skillsets. Whether re-training existing personnel or hiring new talent, life insurers will need to evaluate their human capital needs and deploy a long-term strategy to meet them.

2. Greater cybersecurity defenses: Older legacy systems were not designed with current, sound cybersecurity principles at their core. For life insurers, data safety is intrinsic to their business operations and reputation. At a time when cyberattacks are occurring daily across all industries, life insurers need to dedicate resources to shore up their systems to protect their businesses’ and customers’ data.

3. Continued review: As technology evolves, life insurers will need to look holistically at their enterprise and determine what the future business needs will be and how to securely and efficiently adopt the new technological tools that will position the organization for success.

In 2020, LL Global established its Emerging Technologies Executive Task Force and engaged 71 North American life insurers and industry experts to gauge how the different emerging and available technologies might provide the greatest opportunity for efficiency and/or disruption within the life insurance industry.

Seven Questions To Create A Connection With Your Clients

Kelly Rowland: Life Insurance Is A Way Of Saying ‘I’ve Got You’

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

More Life Insurance News