ESG investments spur political divide, prompt action

Just as the demand for ESG investments increases, so does the division between those saying it is not living up to its billing and others saying the whole thing is just too woke.

The latest salvo was the $1 billion that Republican state treasurers said they will be moving out of BlackRock, $784 million of it from Louisiana, which accused the firm of shunning fossil fuel companies.

That move is part of a reaction against environmental, social and governance funds as “woke” capitalism. In 2020, BlackRock, the world’s largest asset holder with $8.5 trillion, made a commitment that “all active portfolios and advisory strategies would be fully ESG integrated in consultation with our clients – meaning that, at the portfolio level, our portfolio managers have accountability for appropriately managing exposure to ESG risks and documenting how those considerations are used in investment decisions.”

South Carolina will be pulling $200 million from BlackRock for its “leftist worldview,” state Treasurer Curtis Loftis told The Washington Examiner on Monday.

“I will not allow our financial partners to undermine my fiduciary responsibility to maximize investment returns while accepting a prudent level of risk for the benefit of our citizens,” Loftis told The Examiner. “It is imperative that we stand up to BlackRock and resist the pressure to simply fall into line with their leftist worldview.”

Meanwhile in New York City, Comptroller Brad Lander sent a letter last month to BlackRock and other asset managers that the city is reassessing its investments because he believes they are not keeping to their climate commitments.

Three of the city’s funds – the employee, teacher and board of education retirement funds – have $43 billion with the firm.

Lander’s complaint also focuses on energy investments, which he said posed a systemic risk to investors and the environment. As opposed to the Republican states, Lander accused BlackRock of backpedaling on its commitments.

“The three NYC Funds have already taken significant steps, including divesting from fossil fuel reserve owners, supporting more robust climate disclosures and voting in favor of shareholder resolutions that seek to end loans for new fossil fuel supply projects,” according to the letter.

Demand outstrips supply

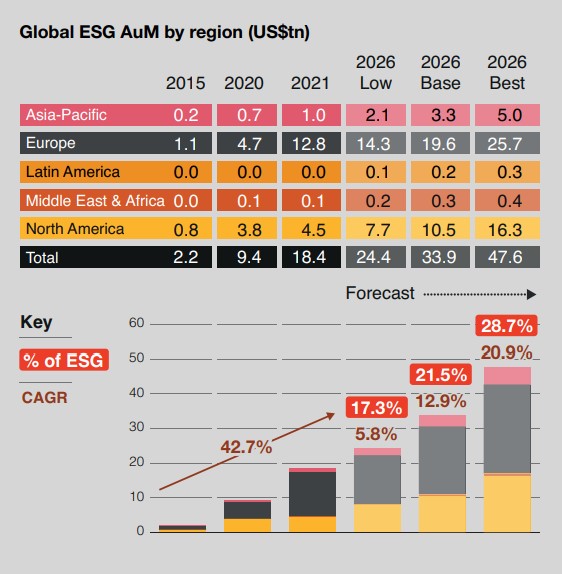

The Republican treasurers may be through with ESG, but investors can’t get enough, according to a PwC study, which said ESG-oriented ETFs are on track worldwide to accumulate $33.9 trillion in AUM by 2026, or one-fifth of all AUM. The United States is expected to double its ESG investments from $4.5 trillion in 2021 to $10.5 trillion by 2026.

Although that is a significant growth for the United States, it actually lags other regions, particularly Europe.

The increase is driven by investors rather than governments, according to PwC, which said 88% of investors believe that asset managers should be more proactive in developing new ESG products. But there is a key problem, most ESG funds are retrofitted existing, rather than new funds. Only 45% of asset managers are planning to start new funds. So, the supply is not keeping up.

“This expectation gap opens up opportunities,” according to the report. “By accelerating new product development and actively supporting green transition, early movers would sharpen innovation, boost relevance and seize market share.”

One of the stumbling blocks to developing more ESG funds is the narrowing definition of the segment. It is not enough to slap a “new and improved” label on an existing product. Regulators worldwide are taking a closer look.

“The EU is more prescriptive on ESG than the principles-based approach taken by the US Securities and Exchange Commission,” according to the report. “But on both sides of the Atlantic, the shift to a more tightly regulated ESG marketplace is decreasing the range of securities that are sufficiently ESG-friendly to choose from. However, we expect the investible universe to start expanding again as more and more businesses across different sectors embrace ESG in their strategy and operations.”

SEC scrutiny

The Securities and Exchange Commission proposed new rules in that would require registered investment advisors and business development to provide more disclosure on their ESG investment practices.

Advisors would be required to show how they use ESG factors in investment strategies in a standardized disclosure form to help investors compare funds. The system would reveal if the fund were light, medium or dark “green.” Environmental funds would be required to report greenhouse gas emissions associated with their investments.

The rules have been proposed because of a sense that some funds have not been living up to their promises.

The SEC last week extended the public comment period on the rule, along with 11 other new regulations.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

4 ways to help Hispanic Americans close the racial wealth gap

The Great Unwinding: The opportunity for brokers

Advisor News

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

More Advisor NewsAnnuity News

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

- Hexure Integrates with DTCC’s Producer Authorization, Providing Real-Time Can-Sell Check within FireLight

- LIMRA: 2024 retail annuity sales set $432B record, but how does 2025 look?

- Perspectives: Should I trust my retirement to an insurance company?

More Annuity NewsHealth/Employee Benefits News

- Tips for filing small business taxes for the first time

- Hundreds rally for expanded health coverage

- All 50 states appear to have lost access to Medicaid portals

- 500 people, many undocumented immigrants, rally in CT Capitol for expanded health coverage

- Some settlements reached in fraud lawsuit involving Sunny Hostin’s husband

More Health/Employee Benefits NewsLife Insurance News

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- AM Best Affirms Credit Ratings of Members of Aegon Ltd.’s U.S. Subsidiaries

- Annual Report of Employee Stock Purchase/Savings Plan (Form 11-K)

- Fourth Quarter 2024 Press Release

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

More Life Insurance News