Equities, volatility and the ‘Nifty 50’: A market outlook

Equity markets experienced significant volatility in the first half in 2025, highlighted by President Donald Trump’s April 2 declaration of “Liberation Day” and the sweeping imposition of blanket tariffs. That helped drive the S&P 500 Index down 7.7% within a week, although it has since recovered and is in positive territory for the year. However, other drivers of volatility remain, and investors may wonder if this volatility will lead to greater market instability.

Some suggest conditions are like those of the tech bubble of the late 1990s, an event that caused significant losses for many tech-stock investors. However, we think current conditions more closely resemble those preceding the decline of the “Nifty 50” stocks in the early 1970s, and that period offers more relevant insights into what we might expect in equity markets in the coming months.

Today’s volatility drivers: Tariffs, war, earnings

One thing is indisputable: Markets hate uncertainty. Here are some uncertainties that are feeding current volatility.

- Tariffs – Manufacturers will likely absorb part of the cost of any imposed tariffs, with consumers bearing the rest. The exact split remains uncertain. If consumers shift toward U.S.-made goods, it could strengthen the U.S. dollar and lead to deflation, potentially offsetting inflation caused by the tariffs. Conversely, if that shift does not occur, tariffs may simply result in an increase in inflation for U.S. consumers without delivering any of the potential benefits (manufacturing “re-shoring” among others).

- Conflict in the Middle East – a seemingly never-ending issue, but the events in the Iran-Israel skirmishes caused only a short-term spike in volatility (as measured by the VIX volatility index) and oil prices.

- Tax cut extensions – The tax cuts included in the 2017 Tax Cuts and Jobs Act are now permanent, removing this uncertainty, but concerns remain about potential growth in the federal budget deficit.

- Slumping earnings outlook - S&P 500 earnings expectations for 2025 are down, dropping by 37% since July 2024 (to 9.3% from 14.7%), while 2026 expectations remain steady at 13.5%. The market is uncertain about the sustainability of current market multiples if earnings do not hold up.

What is next in equities? We suggest revisiting the events of 1972.

FANGAM_NT versus the Nifty 50

Today, the FANGAM_NT stocks (Meta, Amazon, Netflix, Alphabet, Apple, Microsoft, Nvidia and Tesla) are the dominant market highfliers, as these tech companies have established products and current positive cash flows. Similarly, the Nifty 50 was a collection of some 50 stocks in the 1960s, which, like FANGAM_NT, were from large firms with good earnings growth and profitability.

However, at the end of 1972, the Nifty 50 crashed. Many of the stocks fell in value for more than two years. Most of the firms no longer exist, being taken over by other companies. The market impact was significant: The Dow Jones Industrial Average crossed the 1,000 threshold during 1972, but it did not reach that level again for another 10 years.

What caused the crash? Likely causes include the “stagflation” that began in 1971 (high inflation combined with high unemployment), along with President Richard Nixon’s August 1971 introduction of a 90-day wage and price controls order and 10% import surcharge amid the collapse of the Bretton Woods system. These events helped weaken an economy still reeling from the recession of 1969-70, and this period of economic uncertainty sapped investor confidence. The Nifty 50 took the brunt of the market downturn.

Common feature: Stretched valuations

The Nifty 50 had an average price-to-earnings ratio (by some estimates) of between 43 and 50 times at its peak. Investors characterized Nifty 50 stocks by a “buy and never sell” mentality that made for ever-increasing valuations as more money piled in. Analysts estimate that, at its apex, the five largest stocks in the Nifty 50 made up about 25% of the S&P 500. Coincidentally, the five largest stocks in FANGAM_NT are also about 28% of today’s S&P 500 (with a P/E ratio of 37).

Both the Nifty 50 and the FANGAM_NT stocks were very high quality in terms of their income and balance sheets, and solid earnings and low leverage were alluring prospects for both institutional and retail investors. However, both collections also had an average dividend yield much lower than the market. We believe that a steady and material dividend stream acts as a cushion when the markets fall, and neither stock group had or has this cushion.

Is this beginning to sound familiar: high valuations in a select group of quality stocks with the rest of the market lagging? Government intervention with expected short-term pain in the hope of longer-term economic success? Potential stagflation on the horizon? The comparisons to today’s market environment seem compelling.

Will the market today repeat the post-Nifty 50 bear market? It’s possible, but we don’t believe it’s likely.

The ‘flying’ isn’t as high this time

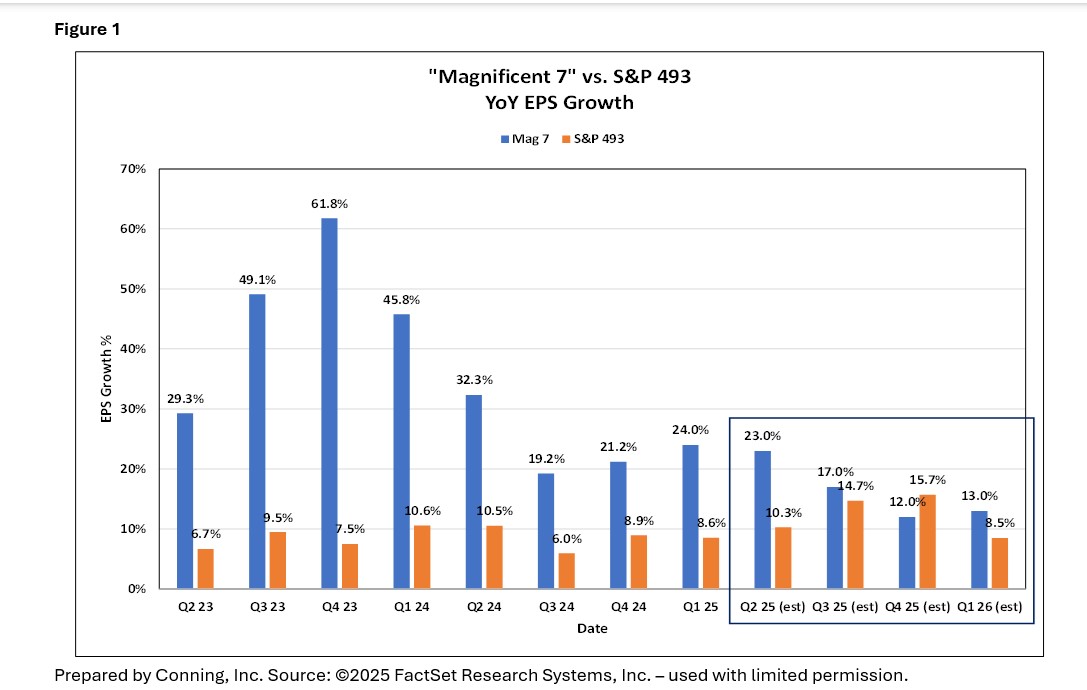

FANGAM_NT’s valuations may be high on average, but they aren’t as high as the Nifty 50’s. We can also see a difference in earnings growth. As Figure 1 illustrates, FANGAM_NT earnings over the last several years (we use the so-called “Magnificent 7” or “Mag 7” stocks, which don’t include Netflix, as a proxy) were nothing short of phenomenal. From Q2 2023 to estimated Q2 2025, they averaged earnings growth of 34%. In comparison, estimates of the Nifty 50’s annual earnings per share growth are around 22%, while the rest of the S&P 500 was growing earnings at a paltry 6% on average.

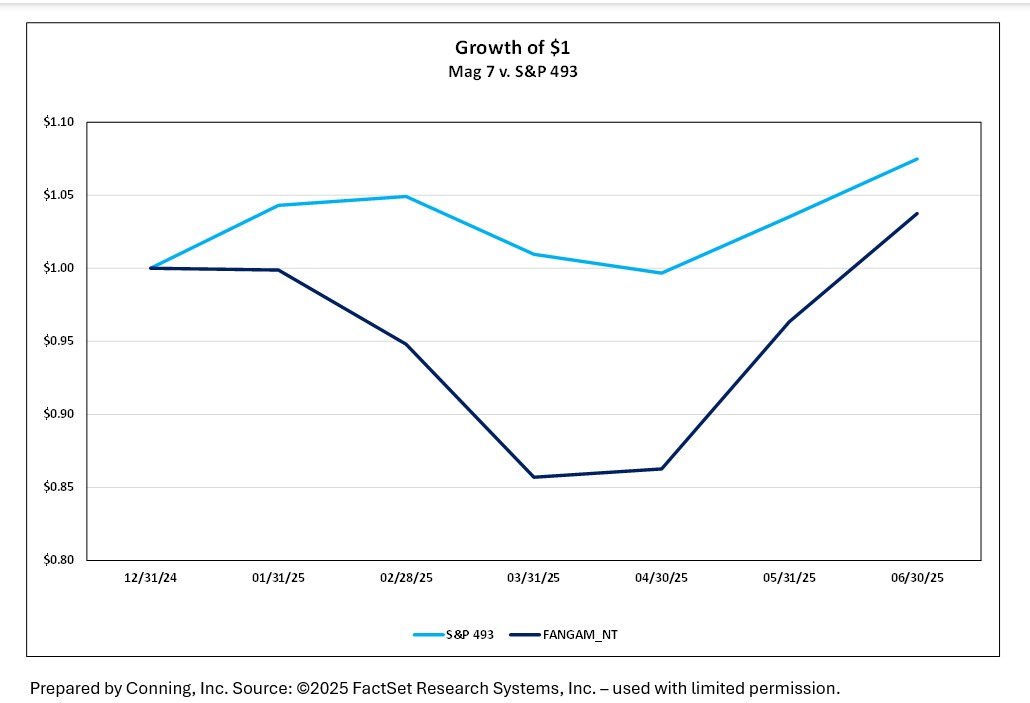

We can also see the drop in earnings expectations for the Mag 7 in conjunction with significant increases in expected earnings for the rest of the S&P 500 (including estimates of EPS growth for the next four quarters). While the Mag 7 are still expected to grow earnings at a higher rate than the S&P 493, the gap in earnings growth between the two groups is expected to shrink, implying that the P/E multiples of the groups should converge. Perhaps a correction in the Mag 7stocks could happen along with a broadening market, where the rest of the market goes down less than Mag 7 while providing competitive returns when the market turns back up. Through Q2 2025, the S&P 493 has provided solid returns with lower volatility than the Mag 7 (as seen in Figure 2), and this is likely to persist if earnings grow as expected.

Figure 2

Short-term volatility, medium-term stability, long-term growth

After an initial selloff following Liberation Day, markets seem to be shrugging off the potential impact of tariffs, although uncertainty remains. Until we have more clarity on the tariff impact on corporate earnings and economic growth, market volatility will likely continue. In the meantime, investors may view the Mag 7 as a safe haven.

Long term, we believe that tariffs should, on balance, be a good thing for U.S. markets. Lowering trade barriers that other countries put in the way of U.S. exporters should boost their prospects. Reshoring, onshoring or nearshoring would also likely be a positive driver of economic growth and employment, and tariffs may ultimately generate significant income for the Treasury (more than $125 billion through July 2025). Finally, newly permanent lower tax rates should provide more certainty and incentives for economic activity. With improved economic growth, better export prospects, higher employment and more stable and predictable supply chains, the market could rally strongly.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Donald Townswick, CFA, is managing director at Conning. Contact him at [email protected].

Judge lets $67M premium financing lawsuit against MassMutual, Penn Mutual move forward

NAIC tackles affordability, availability in disaster-prone markets

Advisor News

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

More Advisor NewsAnnuity News

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

More Annuity NewsHealth/Employee Benefits News

- Hawaii lawmakers start looking into HMSA-HPH alliance plan

- EDITORIAL: More scrutiny for HMSA-HPH health care tie-up

- US vaccine guideline changes challenge clinical practice, insurance coverage

- DIFS AND MDHHS REMIND MICHIGANDERS: HEALTH INSURANCE FOR NO COST CHILDHOOD VACCINES WILL CONTINUE FOLLOWING CDC SCHEDULE CHANGES

- Illinois Medicaid program faces looming funding crisis due to federal changes

More Health/Employee Benefits NewsLife Insurance News