Employers Eye Benefits As Way To Reduce Workforce Turnover

Courtesy of LIMRA

With the U.S. unemployment rate almost at a 50-year low, it is not surprising that one of the biggest challenges facing employers is recruiting and retaining good employees. According to LIMRA research, nearly 7 in 10 employers say this is one of the biggest challenges they face.

Offering employee benefits is one way employers can stay competitive in the market, attracting and retaining solid performers.

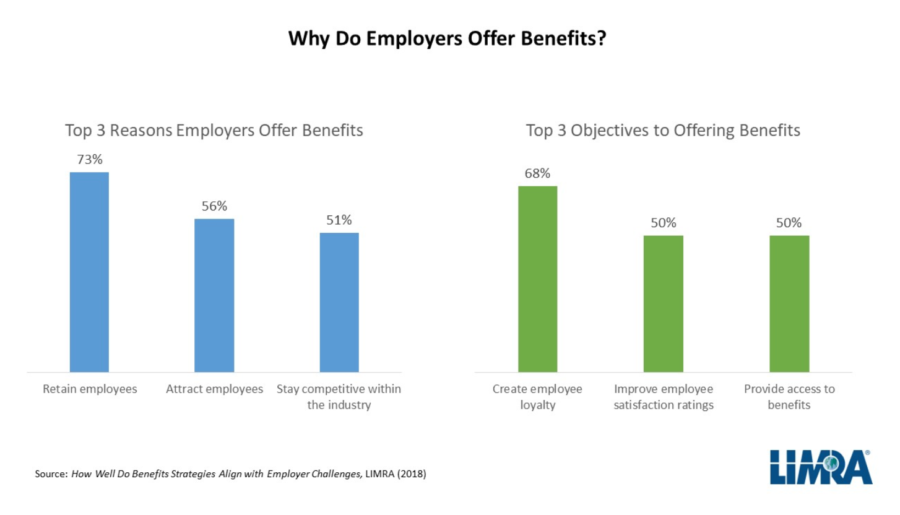

LIMRA research finds the top reason employers offer benefits is to retain employees (73%), followed by attracting new employees (56%) and staying competitive in the market (51%).

One reason that retaining employees is a significantly bigger motive than attracting new employees comes down to cost — with continued low unemployment rates employers may see more employees seeking other job opportunities.

Each time an employee leaves, a company has to spend money recruiting and training new talent. It is more efficient and economical for businesses to keep good employees rather than recruit new ones.

While the drive to boost employee loyalty and improve employee satisfaction is top of mind with employers, LIMRA research shows employers are concerned about controlling benefit costs, managing benefit enrollment and plans, and adhering to legal and regulatory requirements.

Balancing these with the desire to provide a benefits package that will best serve the employee and the company is often a difficult challenge for employers. In today’s work environment, employers recognize some of their employees are finding it difficult to afford benefits yet employers are unable to absorb the cost increases themselves. The average cost of benefits for private industry workers has risen 28% over the past 10 years.

One way an employer can better manage its benefits program is by developing a comprehensive strategic approach. Regrettably, LIMRA research finds barely 4 in 10 employers have a formal plan in place and only a quarter manage their health and retirement benefits as part of a broader total rewards compensation package.

When planning, three quarters have planning cycles of 1 year or less. This can make it more difficult for employers to holistically view all of the components of their benefits package.

When looking at the benefits programs being offered, 7 in 10 employers believe that their current program meets their employees’ needs and what is what their employees want. However, just 53% of employees say they are actually satisfied with the benefit packages offered by their employer.

In addition, LIMRA research finds few employers benchmark their benefits programs against their peers’ programs to learn how competitive they are. It is not surprising to learn that nearly 1 in 5 employees say their benefit package is not robust enough to prevent them from considering other employment options.

This shows there is still room for improvement. Employee surveys are one way to help make sure the benefits program aligns with what employees want. LIMRA research finds only 18% of employers survey their employees to find out what they want regularly and less than half (48%) do it once in a while.

This leaves 34% of employers who never solicit feedback about their benefits program from their employees. If they did, it might lead to stronger retention rates — their main objective.

NAIC Accelerated Underwriting Working Group To Take It Slow

Ohio National Lawsuits Tossed Out; Two Others Proceed

Advisor News

- Ex-employees sue Verizon over pension transfer deal with Prudential, RGA

- Gary Brecka, Cardones file dueling lawsuits in battle of social media stars

- Confidence is key to cold calling success

- Overcoming the indecision of prospects

- What issues top consumers’ list of financial goals for 2025?

More Advisor NewsAnnuity News

- Sapiens wins XCelent award for Customer Base and Support for UnderwritingPro for Life & Annuities

- SB 263 expected to bring chaos to Calif. insurance, annuity sales come Jan. 1

- Lincoln Financial hires industry veteran Tom Morelli as Vice President, Investment Distribution

- Structured settlements protect young injury victims | H. Dennis Beaver

- MetLife Inc. (NYSE: MET) Highlighted for Surprising Price Action

More Annuity NewsHealth/Employee Benefits News

- COMMENTARY: Murkowskl Questions Health Care's Direction

- Aetna drops Providence in Oregon from its health insurance network, leaving patients in limbo

- Data on COVID-19 Reported by Emmanuel Opoku-Asante and Colleagues [Effect of Covid-19 on maternal and child health services utilization in Ghana. Evidence from the National Health Insurance Scheme (NHIS)]: Coronavirus – COVID-19

- Lawsuit in Minnesota deepens pharmacy benefit manager pushback against state regulations

- Janie Slaven: TONI SAYS: Making sense of Medicare's inpatient 'under observation' hospital rule

More Health/Employee Benefits NewsLife Insurance News

- A-Cap suspends Sentinel Security Life business; gets reprieve for Atlantic Coast Life

- Hidden risk: The impact of financial markets on life insurance

- Registration Statement by Foreign Issuer (Form F-1)

- Confidence is key to cold calling success

- Exemption Application under Investment Company Act (Form 40-APP/A)

More Life Insurance News