DPL survey: advisors can grow revenue, improve client plans with annuities

Schneider Small Cap Value Fund is one of the worst-performing mutual funds of the past 25 years, Morningstar said recently, returning -18.9% after losing its bet on distressed energy company Chesapeake.

Still, no advisor would warn clients off of mutual funds just because Schneider struggled. While not mentioning any specific mutual fund, panelists made the general analogy of poor mutual funds to so-called bad annuity products during a webinar Tuesday sponsored by DPL Financial Partners.

There are plenty of good annuity products that make sense inside responsible, holistic financial plans, said David Blanchett, adjunct professor of wealth management at The American College of Financial Services.

"The biggest thing that I hear from advisors too often is, 'Oh, I've seen 20 annuities and they're all terrible," Blanchett said. "Well, my comment is always, if you're an investment manager, do you pick the worst funds that you can give your clients or the very best mutual funds out there?"

Longstanding prejudice to annuities

Historically, registered investment advisors have resisted annuities. Even where they fit well in a retirement plan to give a client guaranteed lifetime income, advisors demurred. Compensation was one big problem, said David Lau, founder and CEO of DPL Financial Partners.

"Annuities have represented a financial conflict of interest for RIAs pretty much forever, or until the recent advent of commission-free products that allow them to use their products in their practice without it having a negative financial impact," Lau said. "If you're an AUM advisor and you recommended annuities in the past, that was lost revenue. That's a pretty good reason to be antagonistic to the product."

In recent years, however, many insurers developed fee-based annuities in a trend that, while slow to catch on, is building momentum. And the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 and the follow-up Secure Act 2.0, signed into law in December, cleared the way for employer plans to offer annuity options.

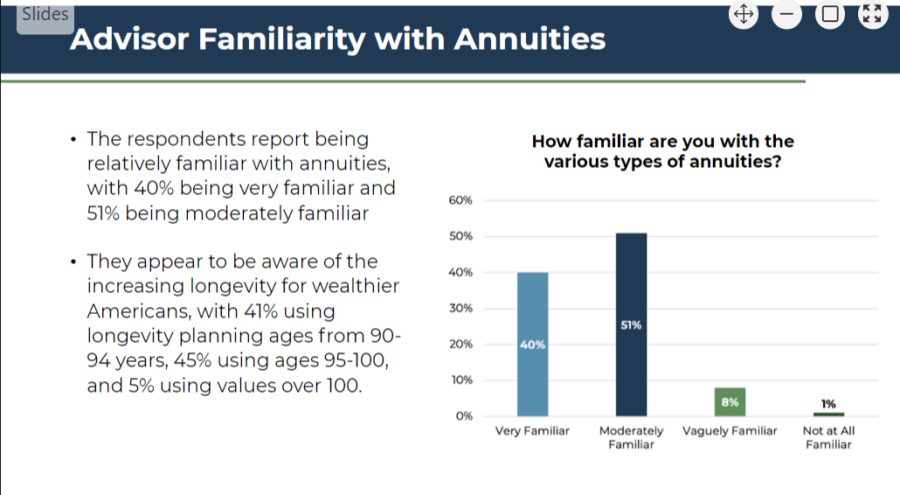

Advisor education remains a stubborn problem, Blanchett said, alluding to new DPL survey data.

"When they start to understand how they work, they see how they can help a client benefit," he said. "But too many advisors stuck, not really caring about the nuances of the products and everything else."

Boost for the firm

DPL conducted its survey in the late summer early fall months, with about 400 respondents, Lau said. Ninety one percent of respondents were independent RIAs.

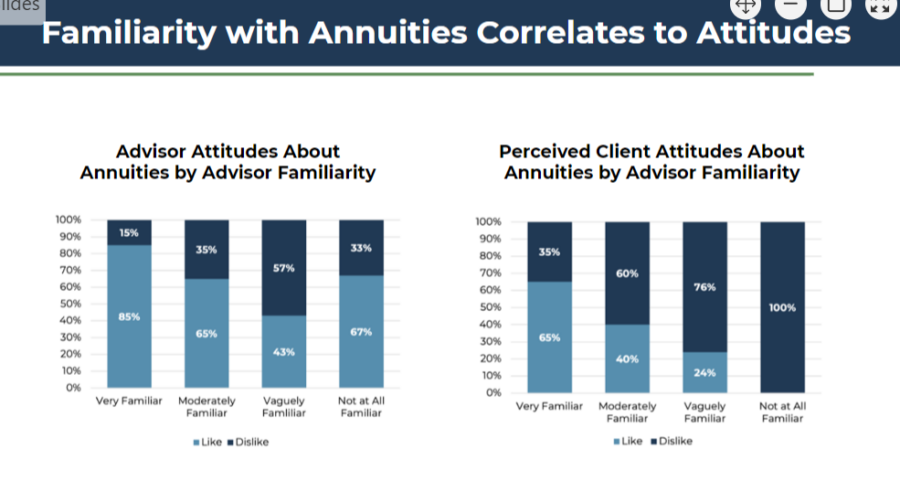

Only 6% of advisors who said they are "very familiar" with annuities never include them in a retirement plan, while 50% of advisors who said they are "not at all familiar" with annuities never include them, the survey found.

Beyond that, embracing annuities yields positive benefits for the advisory firms as well, the survey concluded. More than 60% of respondents reported an increase, either slight or significant, in the their firm revenue.

Annuity sales overall are seemingly setting new records with each passing quarter.

"I think that the fact that we're seeing a positive impact on revenue, coupled with the positive impact on client outcomes," Blanchett said, "... why are you not at least having these conversations?"

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Insurance industry finds links between fraud and insurer discrimination

Is a life insurance policy like the family minivan?

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- CATHOLIC UNIVERSITY IN ILLINOIS STILL COVERS 'ABORTION CARE' WITH CAMPUS INSURANCE

- Major health insurer overspent health insurance funds

- OPINION: Lawmakers should extend state assistance for health care costs

- House Dems roll out affordability plan, take aim at Reynolds' priorities

- Municipal healthcare costs loom as officials look to fiscal 2027 budget

More Health/Employee Benefits NewsLife Insurance News