Annuity sales up 27% through six months, LIMRA reports

Led by monster sales of fixed-indexed and income annuities, overall annuity sales hit $181.1 billion in the first half of 2023, increasing 27% and setting a new record, LIMRA reported.

While second quarter sales didn’t match the record high set in the first quarter, annuity sales jumped 10% from prior-year results to $87.1 billion.

The reasons for soaring annuity sales can be summed up in that old phrase about timing: the time is right.

“Economic conditions — particularly equity market performance and interest rates — have shifted but continue to be favorable for the annuity market,” said Todd Giesing, assistant vice president, LIMRA Annuity Research

Fixed-indexed annuity sales led the way, with sales up 34% through six months. Likewise, registered indexed-linked annuities continued selling strong.

“In the second quarter, registered indexed-linked and fixed indexed annuity sales set records as investors seek solutions that offer greater upside growth potential while maintaining some level of downside protection," Giesing said.

While income annuity sales were lower overall, the sales increase is striking. Single-premium income annuity sales of $6.8 billion nearly doubled first-half 2022 sales.

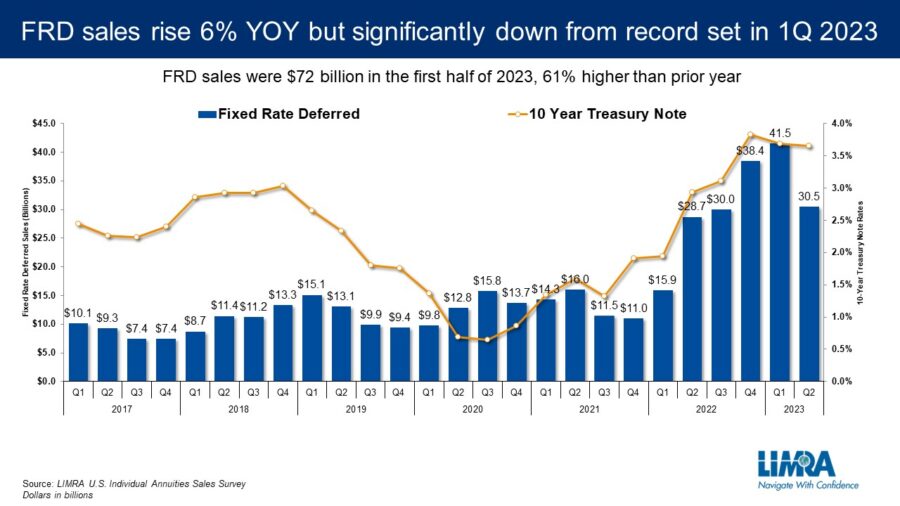

In a rare sales decline, fixed-rate deferred annuity sales declined sharply from a blockbuster first quarter.

Traditional variable annuity sales rose for the second consecutive quarter, but remain down significantly from their sales heyday a decade ago.

LIMRA expects the annuity sales market to remain hot for some time to come.

"LIMRA is forecasting a strong second half of the year and expects 2023 sales to potentially surpass the record sales set in 2022," Giesing said.

Second quarter 2023 annuity industry estimates, representing 87% of the total market.

Financial advisors say that 40% of their clients were forced to retire

Conflict-free retirement advice: Mike Francis shows how it is done

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News