Don’t Call Them Slackers: Why Generation X Is Really Generation $

Sure, Generation X are the overshadowed younger siblings of baby boomers – who seem to have grabbed all the fun and the money – but financial advisors would be remiss in dismissing the generation as a bunch of slackers.

That’s because they have a big pile of money that will be stacking by the trillions over the next few decades, according to Chip Roame, managing partner of Tiburon Strategic Advisors.

Boomers tend to get the most attention from advisors, Roame said in his weekly analysis presentation. Even though boomers make up 22% of American consumers, a survey of Tiburon’s CEO Summit attendees found two-thirds of the attendees said 75% of their clients were boomers. The remaining 25% said boomers made up 50% of their clientele.

Then boomers’ kids seem to be next in line for attention from financial services, skipping over Gen Xers in the middle, Roame said. The industry seems ready to jump from boomers and follow the money to millennials, but they are missing a big opportunity.

“I'm making the case for the Gen Xers,” Roame said. “I think we're ignoring them.”

The Case

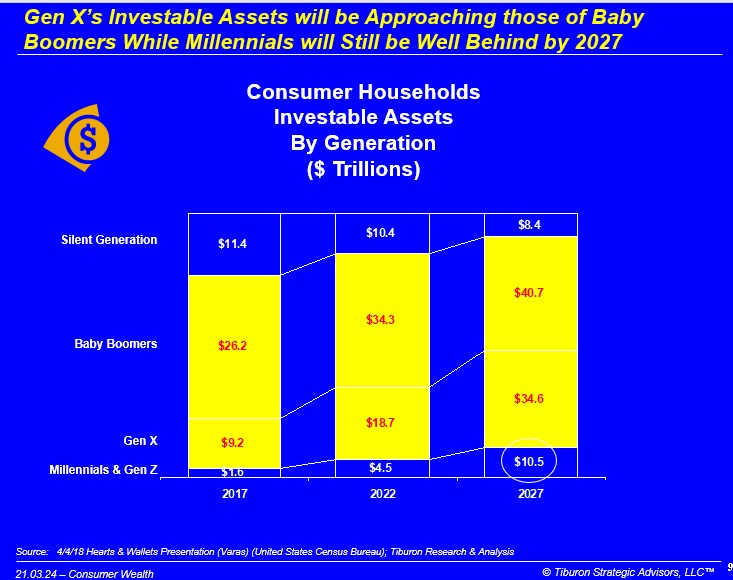

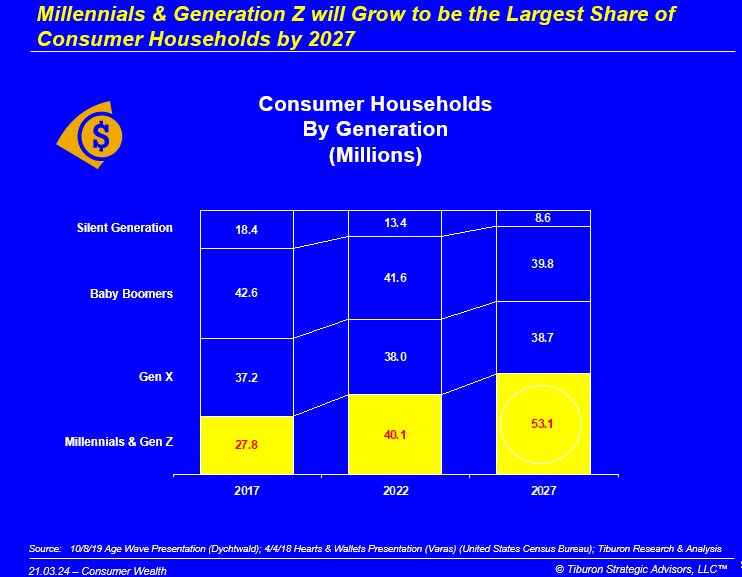

First of all, Gen X is the second largest generation, with 37.2 million households as of 2017, behind boomers at 42.7 million, Roame said. The Gen X number is expecting to hold steady for the next decade, growing to 38.7 million households by 2027, while boomers are expected to drop to 39.8 million by then.

Millennials and Generation Z are lumped together into one group, with 27.8 million households in 2017, ballooning to 53.1 million and becoming the largest group by 2027.

But the millennial/Gen Z crowd won’t be in charge of the most cash, far from it, in fact. That group had $1.6 trillion in investable assets in 2017. That’s expected to grow nearly $10.5 trillion by 2027.

That is impressive growth, but Gen X had $9.2 trillion in investable assets in 2017, projected to reach $34.6 trillion by 2027.

Surely, Gen Xers will be the kings and queens of asset mountain by 2027, right? Not exactly, boomers’ wrinkly fists will still grip most of the investable cash.

Boomers had $26.2 trillion in investable assets in 2017, which is expected to grow to $40.7 trillion by 2027. That is not the same level of percentage growth as the Gen Xer or the millennial/Gen Z piles, but it is more than $40 million.

“I'm not anti-millennial. I'm not trying to say we shouldn't focus on millennials,” Roame said. “But I do think people might be moving away too soon from the Gen Xers and the baby boomers, who I'm a little afraid people are writing off too soon.”

As a member of Gen X, Roame said his people are being overlooked.

“I've never seen a Gen X targeted campaign,” Roame said of financial services marketing. “I see boomer-targeted campaigns, I see millennial-targeted campaigns. I've never seen a Gen X-targeted campaign, and they will have the most investable assets.”

The Bucks

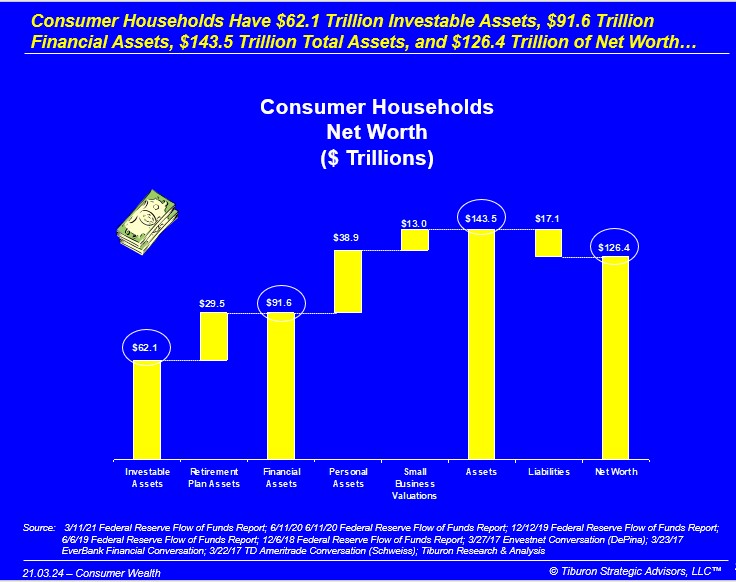

On the subject of investable assets, the opportunity is massive -- and only getting bigger. American households have $62.1 trillion in investable assets, with another $29.5 trillion in retirement funds. Those categories do not count personal assets, such as real estate.

American households control $143.5 trillion in assets overall, with investable assets making up the largest segment. Those assets will grow and shift between categories over the next few decades.

As boomers wander into their senior years, those dollars will fall into the investable asset pile, Roame said.

“You're going to see baby boomers start liquidating,” Roame said. “Boomers have money in 401(k) plans, they have money in their homes, boomers that their own small businesses. And as they start selling those things, or downsizing their houses or rolling over the 401(k) plan, that'll be the liquidation of some $80 trillion or $90 trillion over the coming coming decades.”

The Forgotten Mass Market

Roame also made the case for mass affluent households. Surveys of consumers and attendees at the Tiburon CEO Summit show that the high-net-worth segment is well-served, even though advisors and brokers indicate that they think that wealthy group is underserved.

But in the meantime, Roame said, it is widely understood that the mass affluent and poor markets are woefully underserved. And that is a disservice to those consumers and the industry itself.

“There are 33 million mass affluent households that by and large, the industry does not want to service because it cannot afford to,” Roame said. “At the same time, these are the folks who need the most help. This is an enormous opportunity for a company that can figure out the service model to profitably serve them. This is a ginormous mass affluent market of baby boomers, of Gen X, and someday of millennials.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Insurers And Stranded Suez Ship Owner Could Face Millions In Claims

Athene Launches AccuMax FIA

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsHealth/Employee Benefits News

- CommunityCare names Josiah Sutton new president and CEO

- Strengthening Roots, Shaping the Future: Josiah Sutton Appointed CEO of CommunityCare

- Artificial intelligence was hot topic at Kentucky Chamber’s inaugural Healthcare Innovation Summit

- Cancer coverage for firefighters clears Senate

- New lawsuit challenges Connecticut Medicaid eligibility rules

More Health/Employee Benefits NewsLife Insurance News

- Michal Wilson "Mike" Perrine

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance NewsProperty and Casualty News

- Jim Beam column:Auto insurance is top issue

- Savvy Senior: How seniors can save on auto insurance

- 2024 Annual Report

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

- Louisiana homeowners are still facing an insurance crisis. Will the Legislature respond?

More Property and Casualty News