Direct mail marketing by insurance industry remains strong

Despite rising costs of paper, printing, and postage, the popularity and reliance on direct mail marketing by insurers remains strong and getting stronger. In fact, according to analysts, consumers might want to brace themselves for an onslaught of direct mail in the fourth quarter of this year.

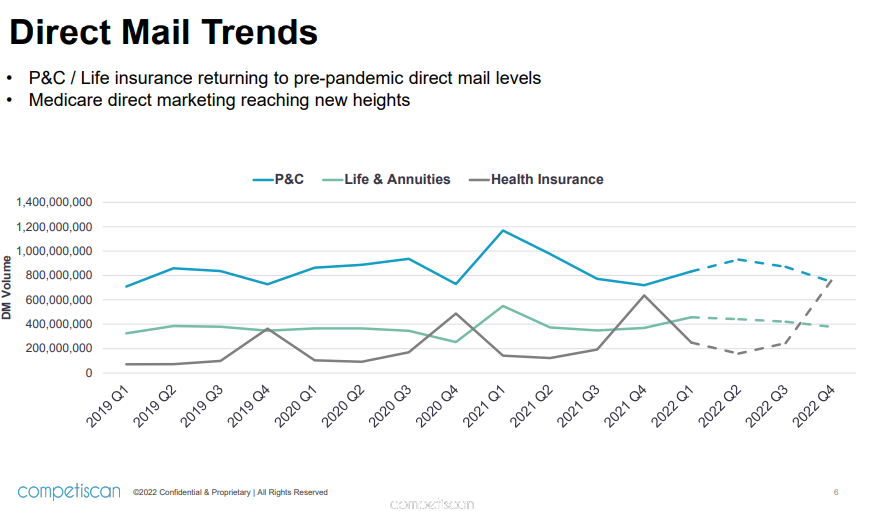

“Our prediction is that direct marketing in life, health, P&C, and Medicare insurance is not going to just maintain but is actually going to reach new heights,” said Rich Goldman, CEO & Founder of Competiscan, a competitive intelligence market research firm. “If you're planning to do some direct marketing, you might want to look at doing it now or doing some planning for Q1 next year to try and get around some of that business, because in Q4 the mailboxes are going to be stuffed.”

The pandemic, inflation, supply chain interruptions, and rising interest rates have done little to dampen insurance industry enthusiasm for direct mail marketing, Goldman told a recent Society of Insurance Research webinar. The entrance of insuretechs into direct mail marketing is also boosting volume. At the same time, reliance on e-mail or internet marketing may be waning as some insurers have not realized significant returns on investment.

“Health insurers, especially, dipped their toes in the digital marketing waters last year and they didn’t get the results they wanted,” he said. “So they've scaled back.”

Goldman also provided insight on the messaging and content of insurers in their direct mail material, noting that most have confronted the issues of the economy and rising princes head on.

“We've seen a 406% increase in mentions of inflation, interest rates, and supply chain in life insurance material,” he said. “It's up 333% for health insurers.”

Goldman predicted that property and casualty insurers will invoke or increase discounts as inflation rises.

“Consumers and the property casualty companies are lockstep in agreement that they should be looking at discounting as key,” he said. “And in fact, we've seen a 74% increase off auto insurance discount offers since the start of the pandemic.”

Consumers overwhelmed

Meanwhile consumers are being overwhelmed and highly confused by the plethora of direct mail, telemarketing, and digital advertising from third-party Medicare providers, The federal Center for Medicare and Medicaid Services was spurred into action this month after receiving more than 15,000 complaints about misleading statements in TV and direct mail material. CMS this month cracked down and issued new rules limiting third parties that conduct Medicare Advantage marketing.

“It’s not that the ads are misleading necessarily,” Goldman said. “But it's the feelings of 15,500 consumers that felt they were misled you can’t s argue with those feelings.”

As talk of recession has increased, Goldman pointed to a successful marketing campaign of The Hartford during “The Great Recession” that emphasized the company’s history, longevity, stability and strength during difficult times.

“We may or may not be heading into another recession,” he said. “But our advice is you might want to get your materials ready in case. There might be some strong headwinds, so you want to have your pictures of how you’ve been around for 150 years … and what have you. Those things resonated for The Hartford with consumers, agents, and producers.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Employers put more emphasis on benefits as Great Resignation continues

Financial wellness requires a change of mindset

Advisor News

- SEC manual shake-up: What every insurance advisor needs to know now

- Retirement moves to make before April 15

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

More Advisor NewsAnnuity News

- Variable annuity sales surge as market confidence remains high, Wink finds

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Best’s Special Report: US Life/Health Insurance Industry Sees Impairments Halved in 2024

- New York receives partial approval for Essential Plan changes

- New York receives partial approvel for Essential Plan changes

- Parents of children with disabilities urge lawmakers not to ‘lock in’ Iowa Medicaid privatization

- Delaware approves $200 copay for weight-loss drugs, new premiums for state employees

More Health/Employee Benefits NewsLife Insurance News

- Best’s Special Report: US Life/Health Insurance Industry Sees Impairments Halved in 2024

- Jackson Study Exposes Stark Disconnect Between Anticipation of Policy Change and Retirement Planning Conversations

- Thrivent plans to add 600 advisors this year

- Third Federal Named a top Financial Services Company by USA TODAY

- New Allianz Life Annuity Offers Added Flexibility in Income Benefits

More Life Insurance News