Direct mail marketing by insurance industry remains strong

Despite rising costs of paper, printing, and postage, the popularity and reliance on direct mail marketing by insurers remains strong and getting stronger. In fact, according to analysts, consumers might want to brace themselves for an onslaught of direct mail in the fourth quarter of this year.

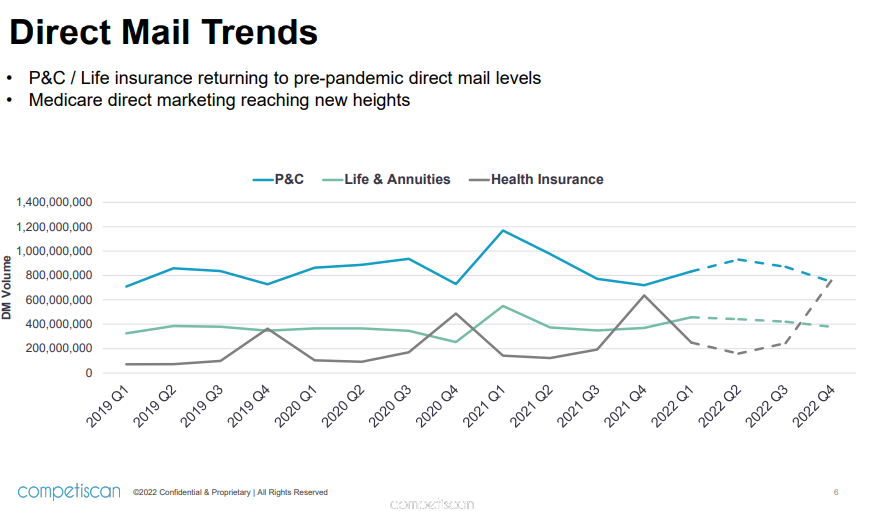

“Our prediction is that direct marketing in life, health, P&C, and Medicare insurance is not going to just maintain but is actually going to reach new heights,” said Rich Goldman, CEO & Founder of Competiscan, a competitive intelligence market research firm. “If you're planning to do some direct marketing, you might want to look at doing it now or doing some planning for Q1 next year to try and get around some of that business, because in Q4 the mailboxes are going to be stuffed.”

The pandemic, inflation, supply chain interruptions, and rising interest rates have done little to dampen insurance industry enthusiasm for direct mail marketing, Goldman told a recent Society of Insurance Research webinar. The entrance of insuretechs into direct mail marketing is also boosting volume. At the same time, reliance on e-mail or internet marketing may be waning as some insurers have not realized significant returns on investment.

“Health insurers, especially, dipped their toes in the digital marketing waters last year and they didn’t get the results they wanted,” he said. “So they've scaled back.”

Goldman also provided insight on the messaging and content of insurers in their direct mail material, noting that most have confronted the issues of the economy and rising princes head on.

“We've seen a 406% increase in mentions of inflation, interest rates, and supply chain in life insurance material,” he said. “It's up 333% for health insurers.”

Goldman predicted that property and casualty insurers will invoke or increase discounts as inflation rises.

“Consumers and the property casualty companies are lockstep in agreement that they should be looking at discounting as key,” he said. “And in fact, we've seen a 74% increase off auto insurance discount offers since the start of the pandemic.”

Consumers overwhelmed

Meanwhile consumers are being overwhelmed and highly confused by the plethora of direct mail, telemarketing, and digital advertising from third-party Medicare providers, The federal Center for Medicare and Medicaid Services was spurred into action this month after receiving more than 15,000 complaints about misleading statements in TV and direct mail material. CMS this month cracked down and issued new rules limiting third parties that conduct Medicare Advantage marketing.

“It’s not that the ads are misleading necessarily,” Goldman said. “But it's the feelings of 15,500 consumers that felt they were misled you can’t s argue with those feelings.”

As talk of recession has increased, Goldman pointed to a successful marketing campaign of The Hartford during “The Great Recession” that emphasized the company’s history, longevity, stability and strength during difficult times.

“We may or may not be heading into another recession,” he said. “But our advice is you might want to get your materials ready in case. There might be some strong headwinds, so you want to have your pictures of how you’ve been around for 150 years … and what have you. Those things resonated for The Hartford with consumers, agents, and producers.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Employers put more emphasis on benefits as Great Resignation continues

Financial wellness requires a change of mindset

Advisor News

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

More Advisor NewsAnnuity News

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

More Annuity NewsHealth/Employee Benefits News

- Health care inflation continues to eat away at retirement budgets

- Pharmacy benefit manager (PBM) reform included in government funding package

- Health insurance CEOs say they lose money in Obamacare marketplace despite subsidies

- Blood test for colorectal cancer screening now available for military in La.

- Restoring a Health Care System that Puts Patients First

More Health/Employee Benefits NewsLife Insurance News