Despite slammed quarter, Prudential sees brighter future with annuities

Prudential Financial was slammed by losses in the third quarter, but showed growth in fixed annuities and plans to add to its growing stable of indexed variable annuities.

“Building upon FlexGuard’s tremendous success, we plan to introduce FlexGuard Life, an indexed variable universal life product, later this month,” said CEO Charles Lowrey in the company’s investor call on Wednesday. “We expect our businesses will benefit from the increased demand for retirement deaccumulation products over the next decade.”

FlexGuard had $1.08 billion in sales, bringing a total of about $12 billion since Prudential introduced its innovative indexed variable annuity suite in 2020, Lowrey said.

But that was a drop from the previous quarter’s sales of $1.45 billion, and down from $1.3 billion in the third quarter of 2021. Full surrenders and death benefits were down, however, $1.2 billion in the third quarter, a drop from $1.5 billion in the previous quarter and $2.5 billion a year ago, during the height of COVID-19 hospitalizations and deaths.

The carrier increased fixed annuity sales in what has been a boffo year for fixed deferred and fixed indexed products. Fixed sales totaled $249 million, up substantially from $67 million the previous quarter and $37 million the previous year. After figuring losses, fixed annuities had their first positive net flow, $144 million, since last year.

Sales of all annuities for insurance agents totaled $563 million, down from $607 million the previous quarter and $578 million the previous year; sales for independent marketing organizations totaled $668 million, down from $843 million the previous quarter and $762 the prior year.

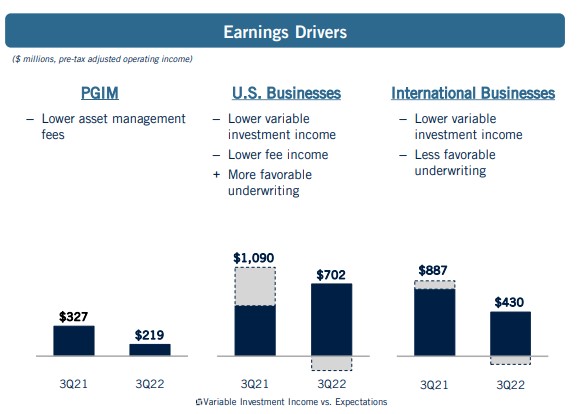

The fixed sales were a bright spot in an otherwise dismal quarter with $1.46 billion in losses, which the insurer blamed largely on higher interest rates depreciating holdings and other underperforming assets, with PGIM AUM dropping 20% in the quarter. It translated into $0.78 loss per share in the quarter and $2.41 year to date.

Those losses were primarily from a drop in asset management fees and lower variable investment income.

The insurer did not release much information on the new FlexGuard Life product, but after the call said generally that it will be a customizable indexed variable annuity. The contracts will be customizable in its death benefit amount and duration; length of guarantee against lapse (through age 120 via two optional no-lapse guarantee riders); and offer riders for chronic or terminal illness, along with new crediting strategies.

Another spot of good news for sellers is a dramatic improvement in underwriting. With the help of artificial intelligence, the carrier has cut underwriting from 22 days down to 22 seconds, Lowrey said. The insurer has also decreased the claims processing time to deliver money in six hours as opposed to 60 days. It reduced fund verification and processing on a third of new annuity sales to a few days as opposed to a few weeks. Group insurance claims processing is also now three times faster. All of which Lowrey attributed to new data systems.

Although higher interest rates have an adverse impact on some holdings, it is a positive for sales in the annuity segment, said Andy Sullivan, head of U.S. business, during the question-and-answer session.

“We get lift from interest rates on our collateral on the short end. And we're getting lift on the long term side in our portfolio as well,” Sullivan said. “Higher rates are a good thing overall for Prudential.”

Sullivan said the carrier is pleased with the long-term arc for the FlexGuard products, especially as consumer needs grow.

“We see the retirement decumulation opportunity in the country as a very good growth opportunity,” Sullivan said. “And we have all the right stuff to capture it.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Clarification: This article was updated to clarify that PGIM AUM dropped 20% in the quarter.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

AIG touts strong annuity sales, warns of CAT market problems ahead

Three ways life insurance can help with LTC needs

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- MURPHY ON TRUMP'S PLAN TO RUN VENEZUELA: NOBODY ASKED FOR THIS

- Sorensen and Miller-Meeks disagree on ACA health insurance subsidies, prepare for shutdown

- Pittsburgh Post-Gazette to publish final edition and cease operations on May 3

- After subsidies expire, skyrocketing health insurance premiums are here.

- Congress takes up health care again – and impatient voters shouldn’t hold their breath for a cure

More Health/Employee Benefits NewsLife Insurance News