Despite $500M wildfire loss, AIG reports strong Q4, 2024 earnings

American International Group Inc. (AIG) reported strong fourth-quarter and full-year 2024 financial results, that the company said underscored its success in executing strategic priorities, improving underwriting profitability, and enhancing capital management. Despite challenges from natural catastrophes, including the California wildfires, AIG posted a net income of $898 million for the fourth quarter, a significant increase from $86 million in the prior-year quarter. Adjusted after-tax income per diluted share for the year rose to $4.95, marking a 12% increase year-over-year, or 28% on a comparable basis.

Chairman and CEO Peter Zaffino emphasized AIG’s financial strength, disciplined underwriting, and strategic initiatives, including the deconsolidation of Corebridge Financial and the launch of Syndicate 2478 at Lloyd’s. The company returned $8.1 billion to shareholders in 2024 while reducing debt by $1.6 billion, reinforcing its commitment to long-term value creation.

California Wildfires Impact

AIG acknowledged the devastation caused by the recent wildfires in California, estimating a net loss of approximately $500 million before reinstatement premiums. The company reaffirmed its commitment to supporting affected policyholders and communities while highlighting the increasing risks associated with natural disasters.

Corebridge Financial deconsolidation

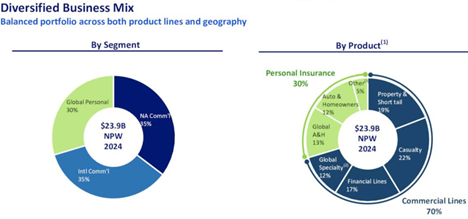

A key milestone in 2024 was the deconsolidation of Corebridge Financial, which allowed AIG to reorganize into three distinct operating segments: North America Commercial, International Commercial, and Global Personal. The deconsolidation resulted in an accounting loss but positioned AIG for a streamlined operational focus.

Reinsurance expansion with Syndicate 2478

AIG successfully launched Syndicate 2478 at Lloyd’s through a strategic partnership with Blackstone, reinforcing its reinsurance strategy. The syndicate began underwriting on January 1, 2025, playing a critical role in enhancing AIG’s risk management and capital efficiency.

Quarterly Snapshot

General Insurance net premiums written: $6.1 billion, up 6% year-over-year (7% on a comparable basis).

Combined ratio: 92.5% (88.6% accident year combined ratio, as adjusted).

Net income per diluted share: $1.43, up from $0.12 in Q4 2023.

Adjusted after-tax income per diluted share: $1.30, up 5% on a comparable basis.

Capital returned to shareholders: $2.1 billion, including $1.8 billion in share repurchases.

Management Perspective

CEO Peter Zaffino highlighted AIG’s resilience in a volatile global environment, pointing to sustained underwriting excellence, capital discipline, and strategic realignment as drivers of the company’s strong performance. He reiterated AIG’s commitment to achieving a 10%+ core operating return on equity in 2025 and maintaining disciplined capital management.

“The biggest accomplishment of the year was the deconsolidation of Corebridge Financial,” Zaffino said during an investor call on Wednesday. “The separation was a four-year journey during which we strategically positioned Corebridge for its future while creating a new capital structure for AIG.”

With the accounting deconsolidation of Corebridge, Zaffino said, AIG is now a less complex and more streamlined global business.

“We exited 2024 achieving $450 million in run rate savings,” he said. “And we expect the remaining benefits to be realized first half of 2025.”

Zaffino also noted the launch of Reinsurance Syndicate 2478 at Lloyd's through a multi-year strategic relationship with Blackstone as part of AIG's Outwards Reinsurance Program.

“The syndicate began underwriting on January 1, 2025, and now serves as a key component of AIG's reinsurance strategy,” he said.

Zaffino listed strong underwriting results, expense reduction benefits from AIG Next, and increase in net investment income, and the execution of a balanced capital management plan as the key factors in ASG’s quarterly and year-end performance.

“General Insurance delivered terrific financial performance for 2024,” he said. “For the full year, net premiums written were $23.9 billion, a 6% increase year over year.

By The Numbers

2024 Underwriting Income: $2 billion

Net Income (Q4 2024): $898 million (vs. $86 million in Q4 2023)

Net Loss (Full Year 2024): $1.4 billion, affected by Corebridge deconsolidation

Earnings Per Share (EPS):

Q4 2024: $1.43 (vs. $0.12 in Q4 2023)

Full Year 2024: -$2.17 (vs. $4.98 in 2023)

Share Repurchases: $6.6 billion in 2024, including $1.8 billion in Q4

Dividends Paid: $1.0 billion in 2024 ($244 million in Q4)

Stock Price Movement: For the year AIG shares are up 6.65%, to $74.37 per share. For most of the past year, shares have ranged between $70 and $78. Shares were down almost 2% in mid-day trading following the company’s earnings call.

P&C Picture (General Insurance)

Net Premiums Written (Q4 2024): $6.1 billion, up 6% year-over-year

Full-Year NPW (2024): $23.9 billion, up 6% on a comparable basis

Underwriting Income (Q4 2024): $454 million, down 29% due to catastrophe losses

Catastrophe Losses (Q4 2024): $325 million, with $301 million from North America Commercial

Combined Ratio: 92.5% (vs. 89.1% in Q4 2023)

Life & Annuity (Corebridge Impact)

Corebridge Divestiture Proceeds: $3.8 billion from sale of 21.6% ownership to Nippon Life

Corebridge Ownership Remaining: 22.7% as of year-end 2024

AIG enters 2025 with strong momentum, emphasizing disciplined growth, risk management, and capital efficiency while navigating an increasingly complex global insurance environment.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

DOL asks court to pause its appeal of fiduciary rule stay

Why clarity on micro-captives benefits everyone

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

More Annuity NewsHealth/Employee Benefits News

- Californians encouraged to join Covered California, enroll in health insurance by Jan. 31 deadline

- Texans are tightening their budgets to pay for health insurance after subsidies expired

- Farmers now owe a lot more for health insurance

- On the hook for uninsured, counties weighing costs

- Research from Northwestern University Feinberg School of Medicine Yields New Findings on Managed Care (Systematic Review of Managed Care Medicaid Outcomes Versus Fee-for-Service Medicaid Outcomes for Youth in Foster Care): Managed Care

More Health/Employee Benefits NewsLife Insurance News