AIG reports strong Q3 despite challenging market conditions

AIG achieved strong Q3 growth in underwriting profitability and delivered consistent capital returns to shareholders, despite challenging market conditions. The company said it continued to deliver exceptional underwriting results, maintained rigorous expense discipline, executed on its capital management plan, and made excellent progress on its strategic priorities.

AIG reported General Insurance net premiums written of $6.4 billion, a slight decrease of 1% on a reported basis, yet reflecting a 6% increase on a comparable basis. This growth was driven by the Global Commercial Lines segment, which saw a reported decrease of 2% but a 7% growth on a comparable basis, with North America Commercial Lines leading the charge with an 11% increase. AIG’s new business efforts also paid off, with $1.1 billion in new business, marking a 9% year-over-year rise in Global Commercial Lines.

Other performance highlights

- General Insurance net premiums written grew 6% on a comparable basis, with a significant 11% growth in North America Commercial Lines.

- A favorable accident year combined ratio (AYCR) of 88.3% underscores disciplined underwriting and risk management.

- AIG returned $1.8 billion to shareholders in Q3, reinforcing its commitment to shareholder value.

- The adjusted after-tax income per diluted share increased by 18% year-over-year, reflecting underlying operational strength and efficient capital management.

Next Steps:

Continue executing the “AIG Next” initiative to enhance underwriting performance and expand new business in high-growth areas.

Management Commentary:

- CEO’s Statement: Peter Zaffino emphasized AIG’s strong Q3 performance, particularly in Global Commercial Lines, and highlighted ongoing underwriting and capital management discipline. “AIG reported General Insurance net premiums written of $6.4 billion, a slight decrease of 1% on a reported basis, yet reflecting a 6% increase on a comparable basis,” he said. “This growth was largely driven by the Global Commercial Lines segment, which saw a reported decrease of 2% but a 7% growth on a comparable basis, with North America Commercial Lines leading the charge with an 11% increase. AIG’s new business efforts also paid off, with $1.1 billion in new business, marking a 9% year-over-year rise in Global Commercial Lines.”

- CFO’s Statement: Sabra Purtill, executive vice president and Chief Financial Officer, said underwriting income was 437 million dollars including 411 million of catastrophe losses. “Hurricanes Beryl and Helene were the two largest losses in the quarter,” she said. “Hurricane Milton made landfall on October 9th, and therefore its financial impact will be recognized in the fourth quarter.”

Future Outlook

AIG aims to maintain growth through disciplined underwriting, increased retention, and high-quality new business across its segments. Continued focus on risk management amid high catastrophe costs, with industry losses expected to exceed 2023’s $125 billion.

Key Drivers and Trends

- Market Conditions: High catastrophe costs, with significant market losses expected in 2024.

- Other: Strong underwriting growth in North America, supported by increased pricing and retention.

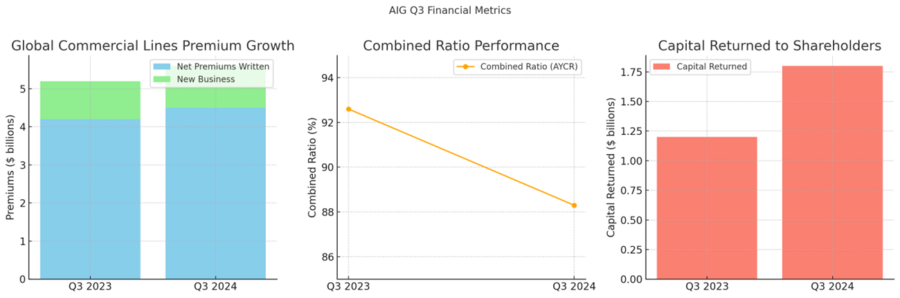

- Global Commercial Lines Premium Growth: This section shows the net premiums written and new business growth, with an increase in new business to $1.1 billion in Q3 2024.

- Combined Ratio Performance: The accident year combined ratio (AYCR) improved, showing disciplined underwriting with a ratio of 88.3% in Q3 2024, down from 92.6% in Q3 2023.

- Capital Returned to Shareholders: Shareholder returns increased to $1.8 billion in Q3 2024, reflecting AIG's strong capital management.

Segment Performance

- General Insurance :

- Pre-tax income: $1,210 billion

- Other Operations:

- Pre-tax income (loss): ($143m)

Financial Overview

- Total Revenue : Adjusted pre-tax income $1.067 billion

- Net Income (gain or loss): Net income per diluted share was $0.71 (down from $2.81 in Q3 2023, which included Corebridge results).

- Earnings Per Share (EPS): Adjusted after-tax income per diluted share was $1.23, an 18% increase.

- Share Repurchases: $1.5 billion in Q3 2024

- Dividend Declared: $254 million in Q3 2024

- Stock Price Movement: Stock is up 10.75% for the year, to $75.03.

Company Information

- Insurance Carrier Name: American International Group, Inc. (AIG)

- Quarter: Q3 2024

- Date of Earnings Call: November 4, 2024

- Specialization: AIG provides a broad range of insurance and financial services products, with a notable focus on commercial lines.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Corebridge Financial tallies strong annuity, life sales numbers in Q3

‘Everything worked’: Apollo touts a 16% increase in AUM during Q3

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

More Life Insurance News