DC Plan Sales Expected To Be ‘Considerably Lower’ The Rest Of 2020

Courtesy of LIMRA

The coronavirus pandemic is expected to drive down defined contribution plan sales for the remainder of 2020.

Employers — many who are dealing with the potential of lower revenue and managing remote work arrangements and the uncertainty of when things will return to normal — may choose to delay or cancel plans to put their defined contribution (DC) plans out to bid. This would significantly impact DC plan sales in 2020.

In April 2020, Secure Retirement Institute and the Retirement Leadership Forum surveyed 14 companies, representing approximately 23% of all U.S. record-kept assets, to explore what recordkeepers expect to happen in the DC market as a result of COVID-19.

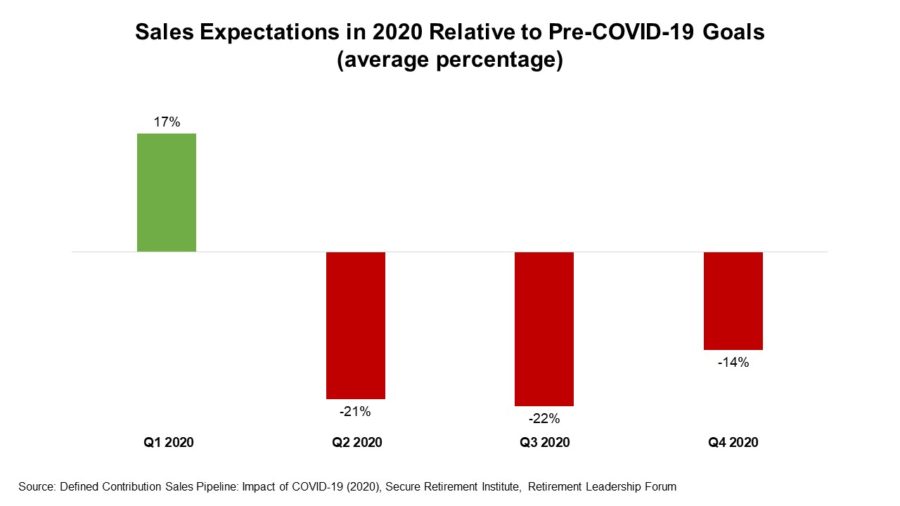

According to the DC recordkeepers surveyed, DC plan sales are predicted to be considerably lower in the second and third quarters of 2020, compared with pre-COVID-19 sales forecasts. The study reveals recordkeepers are optimistic that sales in the fourth quarter will rebound slightly but still fall below pre-COVID-19 expectations (see chart).

“This forecast aligns with what we saw during the last financial crisis more than a decade ago. According to SRI research, new plan formation declined nearly 40% between 2008 and 2010,” said Deb Dupont, SRI associate managing director. “During the same period, sales activity for existing plans (takeovers) increased slightly. If the current COVID-19 crisis results in a similar pattern, we would expect a moderate decline in sales with the new-plan/smaller-plan market to be impacted the most.”

Small-Plan Market Faces Challenges

The study found recordkeepers that focus on larger plans (i.e., $500 million or more in assets) appear to be faring somewhat better than those not focused on mid-sized and small plans. Generally, they expect their sales to be 5 to 10 percentage points closer to goal, compared with those who target smaller plans.

Researchers suggest there may be several explanations for this difference. Advisors who focus on smaller plan markets may have faced greater business disruptions, whereas the largest plans tend to be more direct- or consultant-sold for whom disruptions may have been less consequential.

In addition, the person responsible for managing the DC plan in smaller companies is more likely to be responsible for more than the retirement plan — and more likely to be occupied by the challenges of the present environment.

Also, about a third of sales in the small-plan market are newly formed plans. Given the business disruptions caused by the pandemic, most small employers without a DC plan in place aren’t likely to add one until business normalizes.

Pandemic Delays And Priorities

Survey participants report plan conversions for 23% of new plans or those under contract have been pushed out 3-4 months. However, for sales where a verbal agreement with the plan sponsor is in place, three quarters of surveyed recordkeepers report that on average, 20% have delayed or canceled signing the contract. All recordkeepers surveyed say at least some proportion of plan deals that are in the final stages were delayed or cancelled by plan sponsors.

The pandemic and its economic fallout have had an impact on plan sponsors’ priorities. Employers are placing significantly more importance around helping their workers through financial wellness programs and educational materials and capabilities, as well as higher quality call center capabilities for their participants.

With federal agencies reporting greater fraudulent activities and cybercrime during the pandemic, it is no surprise that recordkeepers report plan sponsors are interested in greater protections against fraud and increased cyber security.

“Insurance companies and recordkeepers have been keenly aware of the increased attacks on retirement plans,” Dupont said. “Last year our company launched FraudShare, a program that helps financial services companies detect and deter account takeover fraud occurring in the life insurance and retirement markets. To date, 42 companies, representing nearly a third of DC assets, participate in or are in the process of joining the program. Recordkeepers can highlight this tool to provide peace of mind to plan sponsors worried about the security of their participants’ savings.”

While short-term prospects for new DC plan business appear to be unfavorable, historical sales data suggest the downturn will be brief. This research can help recordkeepers develop the tools and offerings that have become increasingly important to plan sponsors.

COVID-19 Erases 3 Years Of Financial Gains, Prudential Study Says

Life Insurance Activity Rises Again In June, MIB Reports

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

- New York Life Investments Expands Active ETF Lineup With Launch of NYLI MacKay Muni Allocation ETF (MMMA)

- LTC riders: More education is needed, NAIFA president says

- Best’s Market Segment Report: AM Best Maintains Stable Outlook on Malaysia’s Non-Life Insurance Segment

More Life Insurance News