Consumers seek trust and results in advisor relationships

“Build a better mousetrap or show me something that I’m missing. Not just for me, but maybe for my legacy planning. Show me what’s out there.”

That’s an insightful remark we heard from an interview conducted as part of The American College Cary M. Maguire Center for Ethics in Financial Services’ research on consumer trust in financial services. This consumer, an Asian American man with an annual household income of more than $200,000 and high trust in financial services, looks at both a firm’s values and the individual advisors’ values when searching for a new firm to work with.

He shared he would not have chosen the individual advisor he started working with two years ago unless a larger firm backed him. As he put it, there are “a lot of fly-by-night firms” that are on shaky ground. For consumers such as this man, their trust is driven by the need for strong fraud and privacy protections, and these consumers are savvy at vetting firms to see whether they can grow their investments while maintaining ethical standards.

We know from academic literature that trust has been a focus of research in many disciplines for more than half a century. This has led to several frameworks that are varied and multidimensional. There is no single, universally accepted definition of trust across disciplines.

There is widespread agreement, however, that trust is essential for a range of human experiences, including business. Central to almost all definitions is a willingness to be vulnerable, as well as having confident expectations related to the ability of one party to predict how the target of trust will behave in the future.

In financial services, the conditions that make trust important — risk, vulnerability and interdependence — are at play. If the outcomes of an action were certain, there would be no need to trust financial advisors. Trust involves risk, and trust relies on interdependence between advisors and their clients. Together, risk and interdependence create vulnerability. Clients and prospects will only accept vulnerability in the presence of confident expectations about positive future behaviors of financial advisors. Given these conditions, trust can be both created and destroyed.

Establishing consumer trust: Actionable insights for advisors

We used surveys, focus groups and interviews to study trust among consumers of financial services Simply put, we’ve learned trust means confidence. When consumers trust financial advisors, they have confidence in them — in their capabilities and integrity. Although consumer beliefs about trust are complex, the good news is that financial advisors can influence trust.

It’s important for financial advisors to know that establishing trust is a function of capability and integrity. A financial advisor’s capabilities include credentials, knowledge, skills, results and performance history. Integrity is part of a financial advisor’s character and includes their motives and intent with clients and prospects. Capability and integrity are equally essential. For instance, a financial advisor could be sincere, but a client or prospect won’t trust them fully if they don’t get results. On the other side, an advisor can have great skills and a great record of getting results; but if the advisor is dishonest, clients and prospects are not going to trust that advisor either.

Of the consumers we surveyed, 83% indicated “individuals at company are up-front,” and an equal percentage indicated “individuals at company follow through” as employee behaviors that influence trust. These were among the top 10 reasons to trust a financial company.

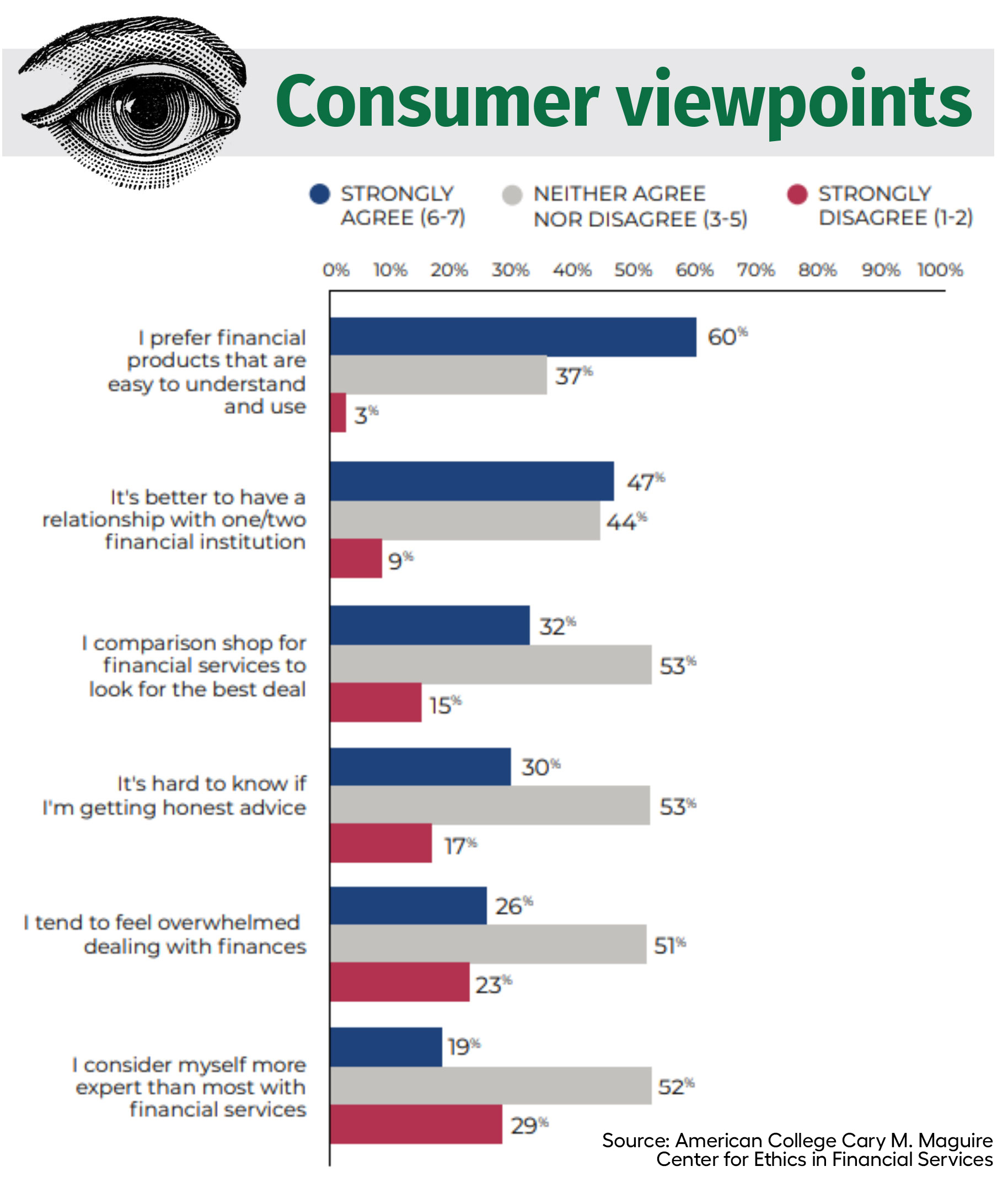

We also learned that consumers primarily seek simplicity. This finding runs counterintuitive to the general belief that consumers are seeking knowledge and skills in a financial advisor. As those in the profession are aware, it takes knowledge and skill to simplify complex ideas. Yet from the consumer’s perspective, it’s possible that complexity signals distrust while simplicity — if it’s transparent and truthful — can be an attractive characteristic.

Consumers’ preference for financial products and services that are simple and easy to use was so strong (at 60%) that it outweighed fees associated with the product or service (58%), level of risk (57%), or guarantees offered by the company (50%). This suggests financial advisors and their companies could get ahead by offering both the pros and cons of a product to a client.

Financial advisors could take time to explain difficult concepts and offer suggestions — even for products consumers don’t ask about.

Among other beliefs, we asked about perspectives on the idea “consumers trust financial professionals who build personal relationships with them.” Although 60% say it’s a reason to trust a financial company, only 17% say it’s a reason to trust the one they use. That’s an interesting discrepancy, yet it’s consistent with our general finding that company characteristics influence trust more than company employees.

When it comes to investment brokerage firms, however, consumers have a stronger view of employees influencing trust. In our survey, 40% say financial professionals who build personal relationships with them are a reason to trust their investment brokerage.

These firms lead in factors such as employees who “make an effort to know me” and “follow through on what they say they will do.” Making and keeping commitments — even small commitments — and getting to know clients as unique individuals are actions that demonstrate trustworthiness. We see them as keys to building trust.

Do credentials matter? Consumers do seek out credentials of the advisors with whom they work. Among consumers who use financial brokerages, 57% indicated “credentials of the individual” as a critical type of information for choosing a financial firm. This speaks to the importance of education in the advisory and wealth management space.

Consumers are trusting financial advisors with their hard-earned money, and they are expecting something back. Whether they refer to it as “performance,” “results” or “wealth,” consumers want more of it in the future.

Moreover, while it’s important to consumers that companies treat their employees well and that they, in turn, are treated well by financial advisors, they don’t want that treatment to be based on high fees or excess compensation.

One consumer we surveyed perhaps said it best: “I want employees who are handling my account to be treated well, to be happy and engaged. I don’t want someone who is unhappy or doesn’t believe in the product.

“I also don’t want someone who is overcompensated (e.g., with commissions or fees) for what they do and for that to be the reason they’re happy. If my investment is doing well, that person should be compensated for ensuring my investment is doing well. I don’t think there should be just standard compensation, regardless of performance.”

The financial services industry’s mechanics are powered by trust. Without it, it’s hard to run an effective business. Through our research and education on trust, we get to the heart of managing stakeholder challenges in the industry. We aspire to empower financial advisors with the latest insights, tools and strategies for building trust in their profession and elevate ethical behavior for the benefit of society.

Domarina Oshana, Ph.D., is a social scientist and research development professional. She is the research director for corporate programs for The American College Cary M. Maguire Center for Ethics in Financial Services. She may be contacted at [email protected].

Life insurance: Build and protect multigenerational wealth

COVID-19’s ongoing effect on life insurance underwriting

Advisor News

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

More Annuity NewsHealth/Employee Benefits News

- Minnesota teacher takes the fight to lower health insurance costs to the Legislature

- Predictable Benefits™ Launches White-Label ICHRA Platform For Benefit Providers To Offer ICHRA In A Matter Of Minutes, While Brokers Stay BOR

- XPOVIO® Receives Reimbursement Approval in South Korea for a Second Multiple Myeloma Indication

- Novocure Announces Optune Lua® Receives Reimbursement Approval in Japan for the Treatment of Non-Small Cell Lung Cancer

- Health insurance, inflation and federal funding cuts driving school budget increases

More Health/Employee Benefits NewsLife Insurance News

- Majority of Women Now Are the Chief Financial Officer of Their Household, Allianz Life Study Finds

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual Delivers Excellent 2025 Financial Results

- ACORE CAPITAL Named Alternative Lender of the Year ($15 Billion + AUM) by PERE Credit

- Baby on Board

More Life Insurance News