Consumer confidence drop hints at recession risk

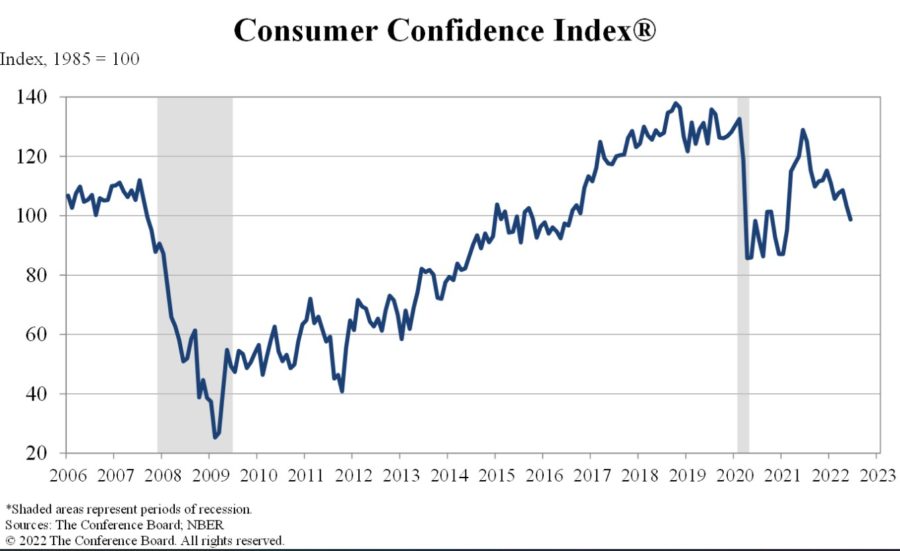

Consumer expectations have been driven down to the lowest point in nearly a decade, dragged down by fears of inflation, particularly in oil and gas prices, according to the latest Conference Board Consumer Confidence Index.

“Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by yearend,” said Lynn Franco, senior director of economic indicators at The Conference Board.

The Expectations Index, which is based on consumers’ short-term outlook for income, business and labor market conditions, decreased sharply to 66.4 in June from 73.7 in May and is at its lowest level since March 2013.

Fewer people expect business conditions to improve with only 14.7% expecting improvement, down from 16.4%. Three out of 10 consumers think business conditions will worsen, with 29.5% expecting deterioration, up from 26.4%. And although the labor market has been strong, consumers were a little more pessimistic about it, with 16.3% expecting more jobs to be available, down from 17.5%, and 22% expecting fewer jobs to be available, up from 19.5%.

Consumers were slightly less confident in current business and labor market conditions but their perception in the Present Situation Index has been relatively steady since popping back up from pandemic lows.

Confidence about consumers’ own situation fell for the second consecutive month, dropping 4.5 points to 98.7 in June, down from 103.2 in May. It’s now at the lowest point since February 2021.

The number of consumers saying business conditions were good was down slightly, 19.6%, down from 19.8%. But the number of consumers saying conditions were bad was also up slightly, 23%, up from 21.7%.

Consumers were less optimistic about their own prospects, with only 15.9% of them expecting their income will increase in the next six months, down from 17.9%, and a nearly equal percentage, 15.2% expecting their incomes will decrease, up from 14.5%.

It all adds up to a cooling of consumer intentions. Even though purchasing intentions for cars, homes and major appliances were steady, consumers were getting less excited about it as interest rates creep up.

“Intentions have cooled since the start of the year and this trend is likely to continue as the Fed aggressively raises interest rates to tame inflation,” Franco said. “Meanwhile, vacation plans softened further as rising prices took their toll. Looking ahead over the next six months, consumer spending and economic growth are likely to continue facing strong headwinds from further inflation and rate hikes.”

Already cutting expenses

Although the consumer confidence survey shows hints of softer spending, a recent poll from Provident Bank showed Americans are already cutting back.

One in 10 consumers (10.5%) have eliminated all nonessential purchases and 72% said they have made changes in personal travel habits.

“While some consumers have cut back on some non-essential spending, like dining out and unnecessary travel, others reported much more drastic changes such as skipping meals, conserving water, and eliminating meat from their diets,” according to Provident. “People are feeling an immense amount of financial pressure right now.”

Besides skimping on essentials, some respondents report some healthier trends in cutting back on spending, such as quitting smoking and walking more.

Inflation is the key culprit, especially in fuel prices, with 32% of drivers spending between $101 and $250 more per month on gas, and 13.5% spending $251 to $500. Consumers said they have reduced or eliminated unnecessary travel such as vacations and visiting family.

Grocery bills are also more painful, with more than 50% saying they spend between $101 and $500 more per month at the register.

Respondents said they are cutting back on saving, with 41% saying they are contributing less to savings. Of that group, 38% said they have less than $1,000 in a personal savings account.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Some retailers limit emergency contraception purchases

Why Health Savings Accounts may be a better retirement plan than a Roth IRA

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

- IUL sales: How to overcome ‘it’s too complicated’

More Life Insurance News