Commentary: Why we must join together to launch a bold new era of annuity sales growth

A recent article by Matthew Drinkwater, vice president at Secure Retirement Institute, explained that 47.2 million retired Americans receive a combined income of $1.5 trillion. Some of that income is attributable to annuities. How much? A whopping 3%.

If, like me, you care about the annuity industry, recognize the value of a principal guarantee, grasp the implications to a retiree of an income that is guaranteed for life, have seen close-up the financial security annuities provide to families, or have observed retirees’ incomes shielded from the impact of investment losses, that 3% statistic should turn your stomach. It turns mine. Never in the history of the world has anything of such consequence been so disrespected, underappreciated and underused.

I believe that an enhanced annuity market can and must be created, because:

- The annuity industry should not conduct its business in a marketplace that requires the product to be “sold.” On the contrary, annuities should be among the financial products with the greatest consumer-driven demand.

- Annuity wholesale distribution networks should not generate only the most meager penetration of the most dynamic and fastest-growing wealth management channel.

- No different than a Fidelity or a Vanguard, a fully scaled direct-to-consumer segment should generate billions in new annuity premium annually while causing no disruption of the advisor channels.

The creation of an expanded annuity market - one that benefits all annuity industry stakeholders - is achievable. I will lay out the path that can get us there. But my strategy won’t succeed unless it becomes “our” strategy. You are the indispensable individuals who make the gears of the annuity machine turn. I will explain why agents, wholesalers, field marketing organizations, insurance marketing organizations, independent broker-dealers, bank broker-dealers, credit unions and the entire annuity distribution complex must demand that carriers rally around the Constrained Investor Initiative.

For annuities to evolve into consumer-demanded products, several battles must be won. Chief among these is widespread adoption of annuities in the registered investment advisor channel. The Constrained Investor Initiative will win this battle and others because it:

- Fundamentally alters how fiduciary advisors think about and serve the largest segment of retirees, constrained investors.

- Creates “fiduciary leverage” that compels RIAs to recommend annuities.

- Cannot be argued against in any rational manner.

- Produces unambiguous benefits for consumers.

- Transforms annuities into mainline products, unleashing consumer demand.

- Opens up vast new recruiting opportunities for wholesaling organizations.

- Generates volumes of production that enrich all distribution channels.

- Is the only scalable strategy that can ignite revolutionary change within a reasonable period.

Once annuities are broadly accepted in the RIA channel, the negative, preconceived perceptions of annuities among consumer advocates, as well as members of the press, will be transformed. And a new era of consumer attitudes and demand will be ignited.

Generating Fiduciary Leverage

Recently, I wrote an article titled, “The Trial of Ken Fisher for Crimes Against Annuities.” As part of a trial that played out in my imagination, I charged Fisher with three crimes: (1) placing advertising that causes people to have an incomplete or inaccurate understanding of annuities, (2) issuing a blanket condemnation of annuities that misrepresent the features and benefits of many annuity contracts, and (3) depriving at least some of his clients the continuing income that they will need to meet essential expenses in retirement.

Fisher, as you know, is not alone among critics of annuities in the RIA community. Disdain of annuities is the majority perspective. But Fisher, who has become a widely recognized public figure, is the most vocal and high-profile critic. He famously declared on television, “I would die and go to hell before I would sell an annuity.”

I took Fisher to task for stigmatizing a trillion-dollar industry, and for “trivializing the social, cultural and financial benefits of an inordinately unique and valuable financial vehicle.” But trust me when I tell you, it’s not all Fisher’s fault. Although in my article I condemned his advertising, described how he fails to properly serves a large segment of investors and likely breaches fiduciary duty to a significant segment of retiree investors, I found him innocent of all three charges. The reason I gave for this finding is that the annuity industry is at least partially to blame for the negative perceptions that are prevalent among both the general public and investment advisors. Until a new strategy for improving the public image of annuities is launched, views like Fisher’s will be hard to dislodge.

When I entered the insurance business as a rookie agent with Mutual of New York, the insurance industry managed the pension sector of the U.S. economy. But it soon ceded all of that to Wall Street. Now, the fast-growing, $5 trillion RIA channel has, at the expense of competing channels, taken on outsized prominence. In general, RIAs eschew annuities. The reasons are mostly historical, not contemporary. But they include the nature of certain complicated, expensive and relatively illiquid annuity contracts that grabbed critics’ attention. In addition, some poor annuity sales practices, high-profile class action lawsuits and certain regulatory actions did not help. Ken Fisher did not help.

As interest rates declined in recent years, annuity compensation levels also dropped. The 20-plus-year surrender charge products have been thrust out of existence. Most of today’s annuity contract designs are squarely on the consumer’s side. But in terms of consumer demand, if I snapped my fingers and tomorrow all annuities had no surrender charges and paid zero commissions, not much would change.

A Transformational Strategy Must Center On The ‘Client,’ Not The ‘Product’

Just like exchange traded funds and index funds, annuities will become mainline products once the industry changes how RIAs think about the “client.”

The longstanding efforts to change how RIAs think about the “product” haven’t worked, aren’t working and likely will never work. Over any acceptable timeframe, that focus will not deliver more than improvement at the margins. Launching a radical new sales paradigm requires shifting all emphasis toward the “client.” Once that shift in strategic focus is introduced, “product” acceptance will fall in naturally.

Fiduciary Leverage: Risk Mitigation And Shifting Demographics

I believe we are about to enter a new era in personal finance that will be characterized by a sharp focus on risk mitigation. After an unprecedented 13-year period of asset price appreciation - mostly driven by a massive expansion of credit - stock prices are falling, interest rates are rising, inflation is surging and the Fed is purging. Purging, that is, its money-expanding quantitative easing program in favor of a money-supply-shrinking pivot to quantitative tightening. This does not augur well for asset prices. Financial intermediaries, including RIAs, will be pressured to broaden their focus to embrace managing risks, especially for retirees.

Within five years, as their baby boomer husbands die, women will come to control as much as $30 trillion in wealth assets. That represents most of the money available to manage. Women are the future of wealth management. But in terms of packaging itself for a women-centric market, the clock is ticking for the annuity industry. Right now, the packaging is sub-optimal.

When annuities become mainline products, the annual compensation of virtually all annuity agents, wholesalers, FMOs and IMOs will increase. Not because commissions will be higher, but because the premium volume will be so much greater. Let me explain how “fiduciary leverage” turns annuities into popular, mainline products.

How The Constrained Investor Initiative Creates Fiduciary Leverage

Contemplate the potential of annuities to capture a trillion dollars or more in the RIA channel. Right now, industry participants including carriers, FMOs and IMOs, have zero leverage. Everyone begs for business. Imagine the emergence of a powerful form of leverage that reverses all the current distribution barriers. This “Fiduciary Leverage,” created by the Constrained Investor, invalidates RIAs’ traditional objections to annuities. In fact, it can do nothing else but invalidate them, because the RIA’s own worldview, business model, culture and regulatory scheme create the leverage which breaks down all the objections.

A crucial piece of this transformation is the introduction of a new way for RIAs to think about clients. Constrained Investor accomplishes this by introducing a three-part investor-segmentation framework. Any retiree can be placed in one of these three investor segments. They are:

- “Overfunded” investors.

- “Underfunded” investors.

- Constrained investors.

Overfunded investors are the lucky minority of clients who have more investable assets than are needed to generate the income required to fund their lifestyle.

Underfunded investors are people with low retirement savings account balances. They will rely primarily upon Social Security for their retirement income.

In between are millions of Constrained Investors, the large and lucrative market of investors whose planning priorities revolve first around risk mitigation. The majority of individuals in the U.S. who have consistently saved for retirement are Constrained Investors.

To define them, Constrained Investors are individuals who get to retirement with money, but the amount of assets they’ve accumulated is not high relative to the income they need to fund a minimally acceptable lifestyle. This does not imply that Constrained Investors have low savings balances. They have significant accumulated assets. On average, however, you can expect a Constrained Investor to have investable assets of about $1.1 million.

Here is a critical distinction: In all cases, Constrained Investors share an absolute reliance upon their savings to produce a significant share of the income they need to fund their minimally acceptable lifestyle.

Fiduciary Leverage: A Constrained Investor Example Of Alice’s Retirement

Alice is a 66-year-old widow who is in excellent health. Alice knows what it’s like to live a long time in retirement. Alice’s mother lived to age 96. The notion that Alice could spend decades in retirement is always in the back of her mind. As a result, Alice craves financial security in her old age.

With a retirement nest egg of $925,000, Alice has been a disciplined saver. But she is hesitant to spend more than she needs to meet her minimum living expenses. In part, this is because Alice does not know how much she can safely spend, nor how much risk she should take.

Alice has begun collecting a Social Security income of $2,200 per month. To fund her minimally acceptable lifestyle, and to be able to “sleep at night,” Alice needs to generate a total monthly income of $5,400.

When we subtract Alice’s Social Security income from her targeted monthly income we arrive at Alice’s “income gap.”

Targeted Income – Social Security = Income Gap

$5,400 - $2,200 = $3,200

Fiduciary Leverage: The Income-To-Assets Ratio

The income-to-assets ratio offers an uncomplicated method to determine whether a prospect or client is a Constrained Investor. Just divide the annual income needed to be generated from savings by the total amount of savings available to produce income. If the resulting percentage is 3% or more, the individual is a Constrained Investor. In Alice’s case, she needs her savings to produce $3,200 X 12, or $38,400.

$38,400 ÷ $925,000 = .0415, or 4.15%

4.15% is greater than 3%. With an income-to-assets ratio of 4.15%, Alice is a Constrained Investor.

You may say, “OK, Alice is a Constrained Investor. What does it mean?” I can sum it up in one word: caution. Alice’s retirement security is at risk. Her savings will be under pressure to deliver the level of income she needs. In practice, Alice has no margin for error in terms of making investing mistakes. Her reliance upon her savings to produce income is unconditional. Risk mitigation, therefore, is the first priority in Alice’s income strategy.

Because Alice is a Constrained Investor, a number of risks can derail her retirement security. There are two especially significant risks, timing risk and longevity risk. Over the near term, timing risk is the risk I worry about most.

All retirees should understand timing risk. I do not favor the term “sequence-of-return risk” nor the manner in which it is typically explained. Because it is easier to understand, and is even surprising to many financial advisors, I prefer my “Story of 10 Retirees” to describe the income-destroying potential of timing risk.

Any prospect or client can grasp the simple concept that, in terms of the timing of retirement, one could have good luck or bad luck. As described below, this powerful story explains how a 3-month difference in the date of retirement can cost someone $1 million or more in lost retirement income.

(The Story of Ten Retirees is included in an e-brochure I wrote called, “Timing Risk: A Guide for Consumers.” I would be happy to send you a copy. Just email dm@@wealth2k.com and ask for the Timing Risk brochure).

Fiduciary Leverage: RIAs Cannot Allow Luck To Dictate A Constrained Investor’s Future

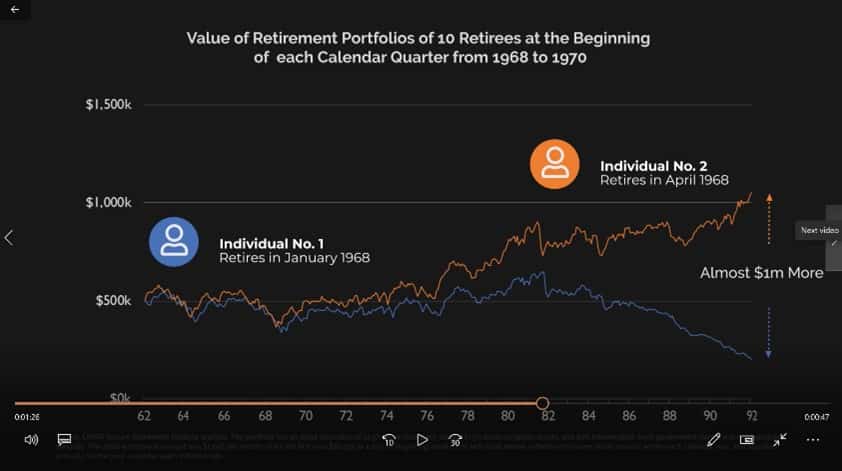

Let me explain why an RIA cannot leave Alice or any other Constrained Investor exposed to timing risk. Imagine 10 financially identical people. Each has accumulated the same amount - $500,000. Their portfolios are identical. During retirement, each individual will withdraw the same amount of money from their identical portfolios. What is different about these 10 people? Only one thing: timing.

To illustrate the devastating impact of timing risk, rather than retire all 10 people on the same day, we will separate them by one calendar quarter. This means that one person will retire about every 90 days. The sequence will look like this: The first person retires on Jan. 1, the second retires on April 1, the third retires on July 1. It continues on in this way until all 10 are retired. Next, we’ll look at what happens to the 10 individuals over a 30-year retirement. We’ll use a historical two-year period and real market values. It’s remarkable how destructive timing risk can be.

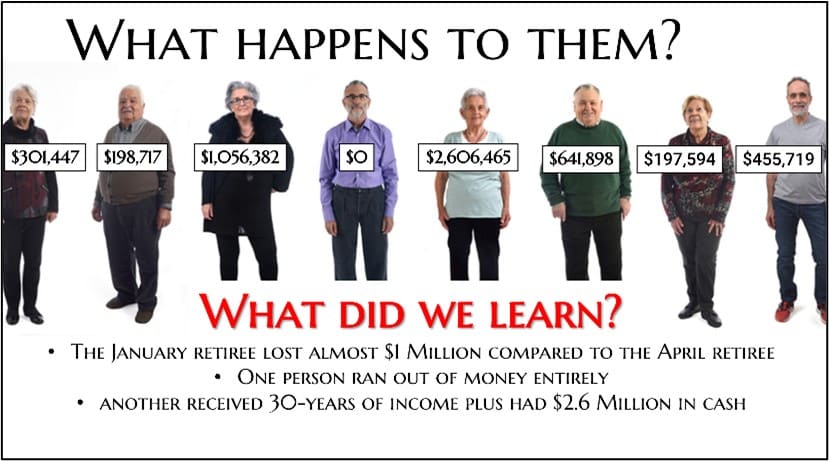

What do we learn from this story? We learn how utterly dangerous it is to let luck determine a Constrained Investor’s retirement security. Let’s focus on the first two people to retire. We’ll call them Ben and Jackie.

Ben retires first. Three months later, Jackie retires. Although their retirements are separated by only about three months, Jackie ends up with almost $1,000,000 more retirement income than poor, unlucky Ben. Ben had been thinking that he would wait until spring to retire, but he didn’t wait. A million-dollar mistake. Imagine how Ben’s retirement lifestyle could have been improved had he been lucky enough to wait.

Separated by only 3-months, Ben loses out on $1,000,000 in retirement income compared to Jackie.

But the situation of our fifth retiree, Steve, is worse than Ben’s. Steve suffered what academics describe as ”portfolio ruin.” I call it dead broke. No wealth. No income. Bad luck.

When luck dictates retirement outcomes, some people win big, and others lose out. Steve is dead broke while Margaret ends up rich.

Luck, of course, can be good or bad. One retiree, Margaret, had particularly good luck. She received 30 years’ worth of inflation-adjusted income, plus a pile of cash equal to $2.6 million.

Ben is broke. Margaret is rich. How can any fiduciary advisor – or any decent human being- leave a Constrained Investor unprotected against timing risk? The answer is the RIA can’t.

Although the RIA is bound by fiduciary duty to protect the client against timing risk, an annuity is not required to create the protection. By organizing the client’s money in a manner that income during the first 10 years of retirement is generated by assets not subject to principal risk, the advisor can easily address the problem. However, the combination of a single premium immediate annuity/multiyear guaranteed annuity-converted-to-SPIA is the most convenient and bulletproof way to manage timing risk.

The annuity option offers the additional advantage of 120 months of guaranteed monthly income. There are hundreds of billions of dollars in first decade’s worth of client assets that must be protected in this way. One can envision exciting product development opportunities.

Fiduciary Leverage: Alice’s Longevity Risk Must Be Managed

In terms of Alice’s life expectancy, an RIA is bound by fiduciary duty to insure her against longevity risk. This means that lifetime guaranteed income must become a component of Alice’s overall investing strategy. How would it be permissible for the advisor to do anything else? A fiduciary advisor is legally liable in the event of failure to act in the client’s best interest. The RIA must demonstrate both loyalty and competence to their client. In the case of a Constrained Investor, the RIA is obligated to serve the client’s best interests, which, by definition, entails the management of longevity risk.

Let’s say that healthy and vibrant Alice outlives her mother by six years. This means Alice will need retirement income to last until she reaches age 102. For context, the U.S. has more than 900,000 centenarians living today. Assuming Alice reaches age 102, she’ll then be one among 5 million centenarians alive at that time. It is the recommendation of lifetime guaranteed income that enables the RIA to be compliant with their fiduciary duty.

Fiduciary Leverage: The Revolutionary Transformation

Must fiduciary advisors recommend annuities? The answer is yes when the client is a Constrained Investor. Is failure to recommend an annuity a breach of an RIA’s fiduciary duty? Again, the answer is yes when the client is a Constrained Investor. If the client is “overfunded,” there is no obligation on the part of the investment advisor to recommend an annuity. This is not to say that an overfunded client may wish to purchase an annuity. That’s quite possible. I’m only drawing a distinction relative to what the RIA is obligated to do, and for whom.

Consider these four questions:

- Do you see how Constrained Investor creates a powerful leverage that compels the RIA to recommend annuities?

- Can it be successfully argued that RIAs are compliant if they ignore Constrained Investors’ timing and longevity risks?

- Is it possible for what I’ve described above to be rationally challenged?

- Finally, can you think of any approach that better advances the client’s interests?

Let me make this point again: It is the RIA’s own philosophy, business model, culture and regulatory scheme that generate fiduciary leverage. What would annuity adoption in the RIA channel look like today if Constrained Investor had been implemented, say, two years ago?

A High-Stakes Decision, And A Team Effort

I believe there is $1 trillion of premium riding on the decision to either rally around or ignore the Constrained Investor Initiative. If I am successful in bringing together a group of annuity carriers that will galvanize around it, then a bold new era of consumer acceptance and sales growth will emerge. When that happens, every participant in the industry including agent, IMO, FMO, IBD, bank broker-dealer, credit union, online product marketplace and carrier will benefit. Envision the premium volume when all of the negative perceptions, insults, smears and slurs finally are put to rest.

If you are willing to join the Constrained Investor Initiative, email me at [email protected]. I’m interested in talking with anyone who has a passion for this mission, anyone who can help organize others, and anyone who has influence with one or more annuity carriers. The creation of fiduciary leverage is game-changing. The pathway to an extraordinary new annuity marketplace is right at our feet. The only question is, will you walk it with me?

Wealth2k founder David Macchia is an entrepreneur, author and public speaker. David writes frequently on the subjects of income planning and macroeconomics. He is the author of the consumer finance book, Lucky Retiree. He may be contacted at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

David Macchia, MBA, RMA, CBBF, is founder, Wealth2k. Contact him at [email protected].

Annuity sales boom again in 2021, Morningstar, Beacon report

Recommending FIAs: Start with the client’s objective

Advisor News

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- Close to Home: U.S. health care — it's déjà vu all over again

- What’s behind Medicare Advantage product deserts

- WHITEHOUSE REINTRODUCES BILL TO REFORM PRIOR AUTHORIZATION AND DELIVER CARE TO PATIENTS FASTER

- CVS Pharmacy, Inc. Trademark Application for “CVS FLEX BENEFITS” Filed: CVS Pharmacy Inc.

- Medicaid in Mississippi

More Health/Employee Benefits NewsLife Insurance News