Colorado study: wildfires, hail behind steep property insurance hikes

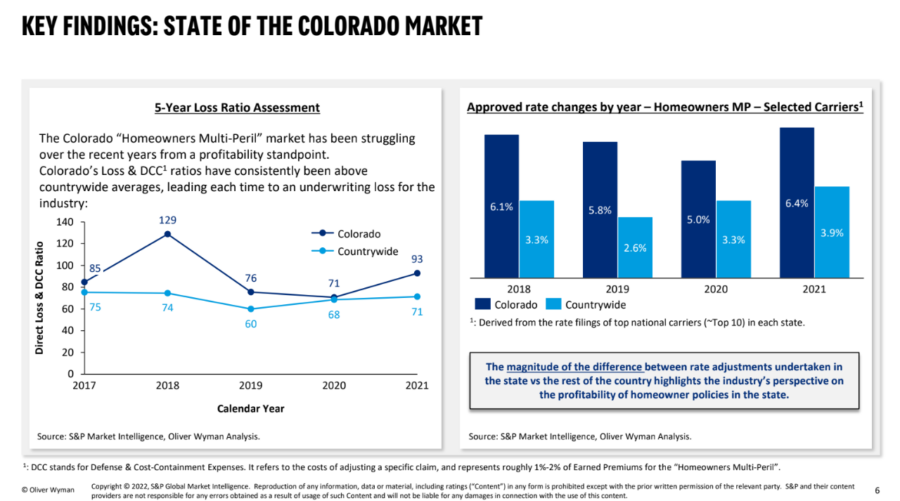

The state of the Colorado property insurance market is deteriorating fast due to ever-costly wildfires and hailstorms, a new report found.

As a result, premium is increasing fast and coverage is being left to only the biggest carriers.

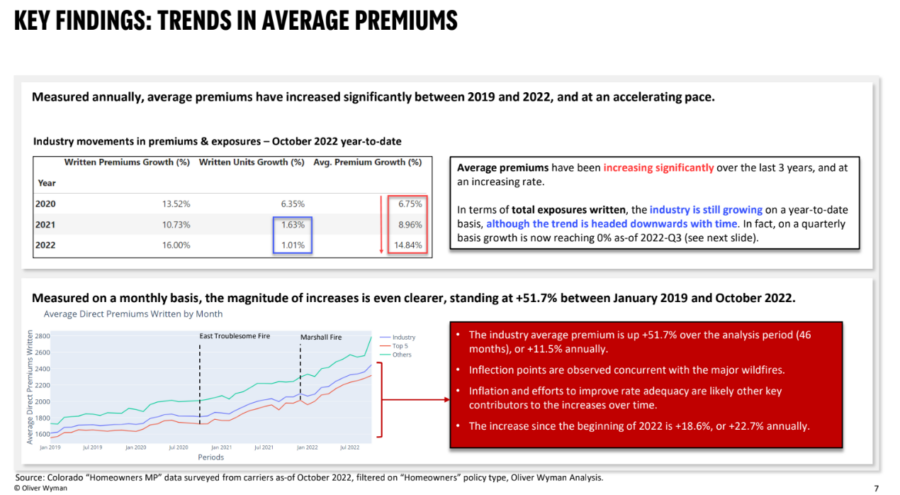

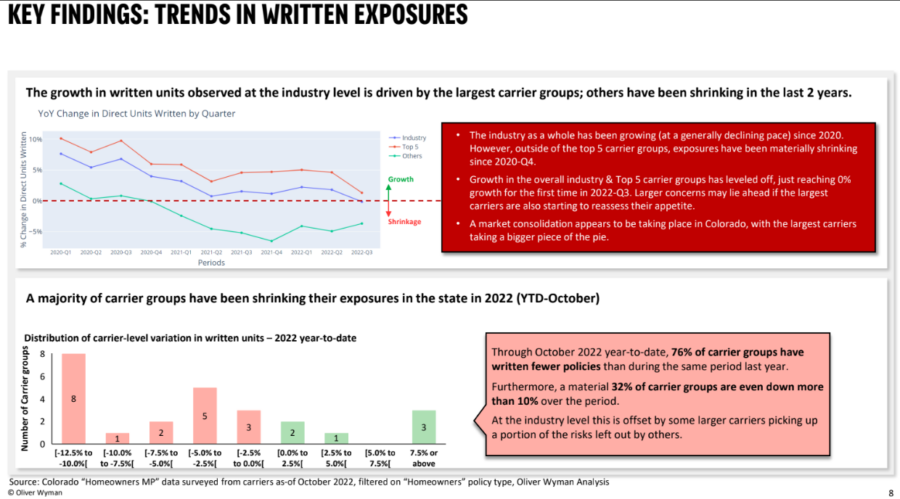

The average insurance premium jumped nearly 52% in three years, according to the study by the Colorado Division of Insurance, while outside of the top five carrier groups, 76% of insurers decreased the number of Coloradans they cover last year.

"The study confirms what insurers already knew – the market is under significant pressure, resulting in higher costs for consumers," said Lyn Elliott, assistant vice president for state government affairs for the American Property Casualty Insurance Association. "The unique challenges have resulted in some carriers needing to reduce their exposure to control costs and ensure they can fulfill promises made under the policies they offer."

With the state suffering from devastating wildfires, the Colorado Senate passed a bill tasking the insurance department with studying "the stability, availability, and affordability of homeowner insurance."

Three of the worst wildfires in Colorado history took place in 2020, burning a total of 578,000 acres. That was followed in 2021 by the Marshall Fire, which caused $513 million in damage in under six hours, destroying 1,048 residential structures.

Consultants Oliver Wyman completed the study using granular data provided by insurers, as well as feedback provided by carriers and industry associations.

One recent and consistent phenomenon in Colorado is rate hikes as insurers scramble to remain steady and solvent. Similar situations played out over the past two decades in hurricane-prone states like Florida and Louisiana.

Many property insurers either failed or decided the risks were too great and left those markets, leaving lawmakers to piece together solutions from beefing up reinsurance funds and paying property owners to reinforce roofs.

It is just a simple matter of dollars and cents, Elliott explained.

"The study confirmed that residents are facing a hard market and that insurers are emphasizing loss control through tighter underwriting and enforcement of risk reduction measures and higher prices to transfer that risk," she said. "Continued inflation and increased natural catastrophe events around the world, including in Colorado, are resulting in increased costs which is impacting the affordability of insurance."

Rising premiums

The study found that property owners are paying nearly 23% more for insurance since the beginning of 2022, and more than a third of carriers have canceled 10% of their policies in the state.

Equally concerning is the shrinking market, with smaller insurers writing fewer policies, leaving the bulk of the property coverage business to the largest carriers. Even so, growth among the top five carriers leveled off, the study reported.

Residual insurer needed?

The study also addressed the potential need for a "residual" insurer, an insurer-of-last resort created by the state to insurer properties rejected for traditional coverage. Florida and Louisiana offer state-run Citizens Insurance corporations, although officials struggle to keep policy counts manageable at both entities.

Colorado lawmakers are considering creating a similar residual insurer in the state. Stakeholders are keeping three considerations in mind, the study noted:

1. Ensuring the Plan can provide an insurance market for high-risk properties;

2. Limiting disruption in the voluntary market;

3. Making sure there is not an undue financial burden on the insurance industry or taxpayers.

Whatever solutions are offered to stabilize the Colorado property insurance market, insurers want to be at the table, Elliott said.

"Policymakers must avoid new laws and regulations that will exacerbate current market conditions, such as increasing mandatory coverage or introducing new requirements that make it harder for insurers to manage their risk," she said. "We also need to examine which parts of the market need support and work to identify solutions that help restore market stability and expand options for consumers."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Insurance industry still faces recruitment, retention challenges

Has the Federal Reserve tamed the inflation beast?

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News