Changes to our publication schedule

For 25 years, InsuranceNewsNet Magazine has been a trusted resource for independent insurance agents, financial advisors and the insurance industry. We want to share an important update about how we’ll continue to serve you in the future. To better meet the evolving demands of the industry and optimize our resources, InsuranceNewsNet Magazine will transition from 12 monthly issues to 10. This decision reflects our commitment to delivering the highest-quality content while adapting to the changing realities of the publishing landscape.

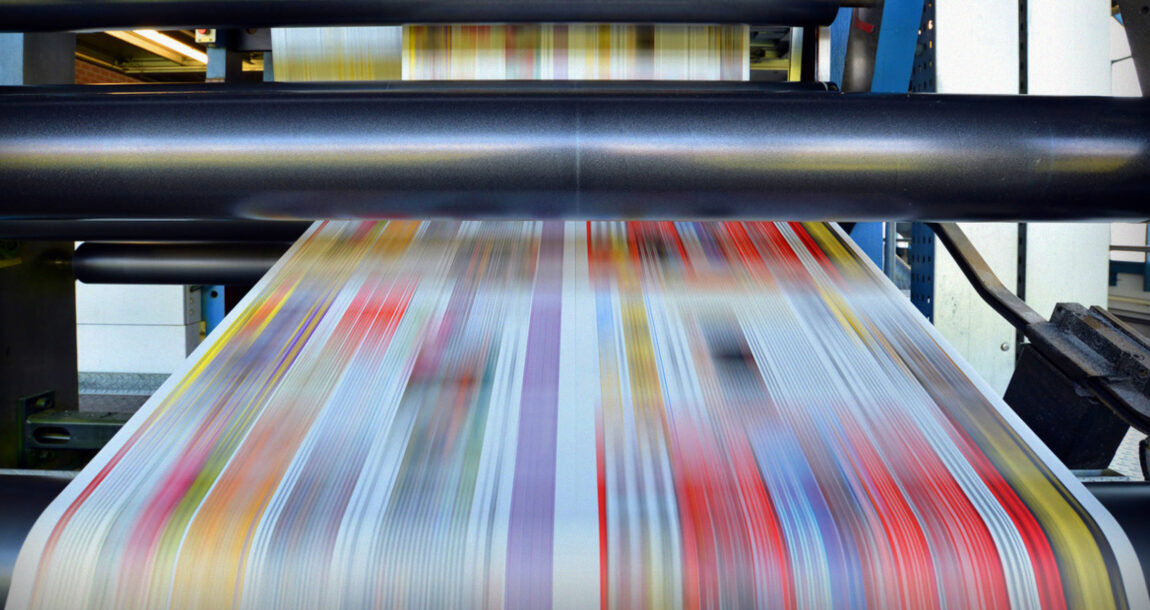

The primary reason for this adjustment is the increasingly high cost associated with printing and mailing. These expenses have risen significantly in recent years, as many of you may have experienced in your own businesses. By moving to a 10-issue schedule, we can maintain the exceptional standards you’ve come to expect while allocating resources more effectively to enhance the value of each issue.

As part of this change, we will combine two issues into special seasonal editions:

• December-January will become our “Winter” issue, offering an in-depth look at year-end reflections and trends for the year ahead.

• July-August will transition to a “Summer” issue, focusing on midyear strategies, insights and opportunities to keep your momentum strong.

These combined issues will be packed with curated insights, actionable strategies and timely updates tailored to your needs. We are confident that this revised approach will allow us to deliver rich, comprehensive content while ensuring a seamless reading experience for our loyal audience.

Our mission remains to provide you with the most relevant, engaging and insightful resources to support your success in an ever-evolving industry. By optimizing our production schedule, we can dedicate even more energy to producing impactful stories, expert analysis and innovative ideas strengthening our online content at InsuranceNewsNet.com.

We deeply value your continued support and trust. You have been the driving force behind our magazine’s success, and we are honored to be your partner in navigating the complexities of the insurance and financial industries.

Thank you for being a part of our community. We look forward to delivering exceptional content in the year ahead and beyond.

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

Should oil, gas co.’s be accountable for climate change-related disasters?

Facing the long-term care explosion — With Genworth’s Tom McInerney

Advisor News

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

- Amazon Go validates a warning to advisors

- Principal builds momentum for 2026 after a strong Q4

More Advisor NewsAnnuity News

- Corebridge Financial powers through executive shakeup with big sales

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

More Annuity NewsHealth/Employee Benefits News

- Fewer Kentuckians covered by Kynect plans

- Fewer Kentuckians covered by ACA health insurance plans as subsidies stall in US Senate

- Inside Florida's decision to cut thousands off from affordable AIDS drugs

- Support H.433 for publicly financed universal primary care

- Fewer Kentuckians covered by ACA health insurance plans as subsidies stall in U.S. Senate

More Health/Employee Benefits NewsLife Insurance News