Capped And Uncapped Annuity Strategies: Weighing The Options

With the widespread availability of COVID-19 vaccines in the U.S., many investors are hopeful.

But even as savers nationwide continue to gain confidence amid the continuously fluctuating market, how are they addressing fast-moving market volatility? Some strategies have weathered these volatile markets and eased client anxieties of sudden or unsuspected losses.

In particular, fixed indexed annuities have offered many retirement savers stable tax-deferred opportunities with the potential for solid accumulation.

Many FIAs offer savers the ability to choose between capped and uncapped index strategies, with each providing accumulation potential while usually allowing for flexibility and reallocation opportunities on an annual or every other year basis.

Explain Capped Vs. Uncapped

With contracts flooring at zero percent, FIAs give clients solid protection from market loss, along with the potential for accumulation. But can clients be sure FIAs are a viable option for building their savings while maintaining a comfortable level of risk? Advisors must educate clients on the range of FIA options available and ways in which they can take advantage of them.

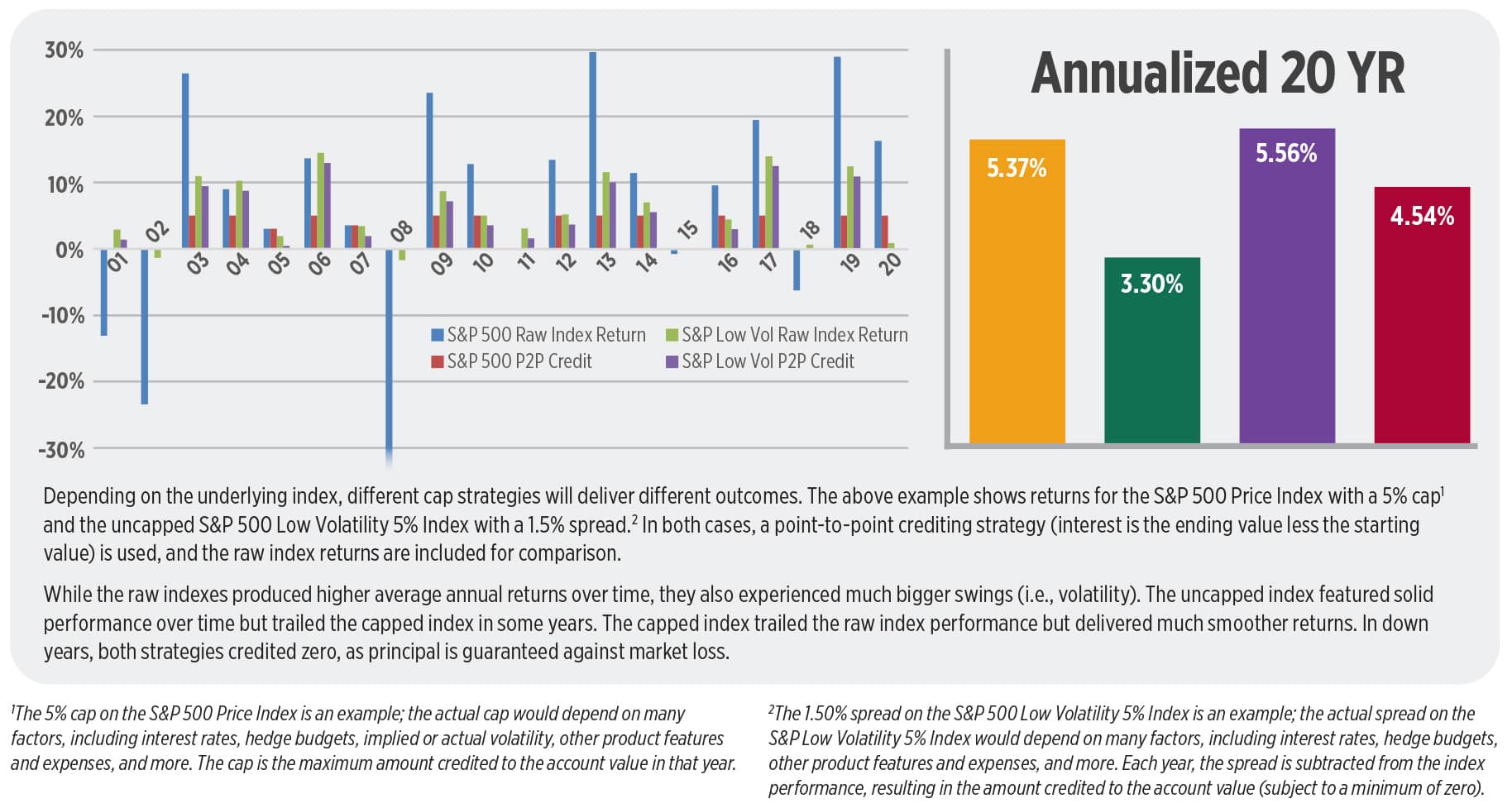

To guarantee principal in contracts, issuers design options on interest credits through a combination of a variety of account parameters including caps, participation rates and spreads. These parameters include uncapped and capped options. Allocating funds between both options is often a preferred strategy among many advisors and their clients.

A cap is essentially the maximum interest rate your client can earn during the particular index term, regardless of the change in the underlying index. For example, if the cap is 5% and the value of the chosen underlying index rises by 10% during the index term, the cap amount of 5% will be credited to your client’s contract. However, if the index rises only 2%, the contract would only be credited 2%, as that is lower than the cap.

Index crediting methodologies are established using what is commonly called a hedge budget. The hedge budget is set based on the amount the insurance company can earn on its investments less a net interest margin to cover expenses and profit. In this historically low interest rate environment, hedge budgets have been squeezed.

Uncapped strategies typically involve a volatility control mechanism with the target volatility set at a relatively low level (as compared with the volatility of a typical equity index). This lowers the cost of the derivative used to back the index credits and allows the insurance company to offer higher interest potential versus having a cap on the interest rate. It also tends to stabilize the cost of the derivative used, and can result in more consistent renewal parameters around index crediting from period to period. A drawback to uncapped strategies is that the volatility control mechanism itself can result in some limits to the index credits.

Capped strategies typically involve indirect exposure to a straight equity index (such as the S&P 500). There is usually less expense built into an index, but a cap is often needed in this low interest rate environment as the cost of the derivative to back the index credits would be too expensive without introducing the cap. This is because the volatility of straight equity indexes is usually higher than the volatility of those that have a built-in volatility-controlled mechanism (like the uncapped strategies).

How And When To Reallocate?

Having uncapped and capped contracts built into a client’s investment strategy gives both the financial professional and the client more options, and flexibility, when reallocating at the end of each FIA’s term.

Advisors often examine the capped amount of a crediting option versus the reduction of return from a participation rate or spread when working with clients to reallocate their contracts. Another consideration is the level of volatility being targeted in an uncapped, volatility-controlled index. Generally, the higher the volatility target, the more exposure to the equity portion of the index a policyholder can expect over time.

An analysis of what underlying indexes are available is another important factor. Advisors can explore various options that derive interest potential from indexes linked to equities, bonds and even commodities. Depending on what their economic outlook is, advisors can adjust client portfolios to match this view, providing even greater diversification potential.

Finally, your clients may also want to consider a guaranteed fixed return option for a portion of their assets. In this case, the interest earned is “capped” at the stated rate but is also guaranteed, usually for one contract year at a time. And in this low interest market, as noted earlier, the fixed return of an insurance contract will likely be considerably higher than what you may be able to find for your clients in other instruments, such as certificates of deposit.

Balancing a well-diversified portfolio that addresses client concerns, while distributing funds across varied allocations in uncapped and capped FIA strategies, can help them accumulate assets across a variety of market conditions.

It’s important to have multiple strategies as options that allow for flexibility in redistribution over time. In addition, it is important to help make sure your clients have a portion of their money in a position where they can still sleep soundly if a drop in the equity markets should occur.

Premium Financing: Helping Heirs With Estate Taxes

Six Tips For Building Trust With Clients

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News