Can employee benefits provide a solution for long-term care?

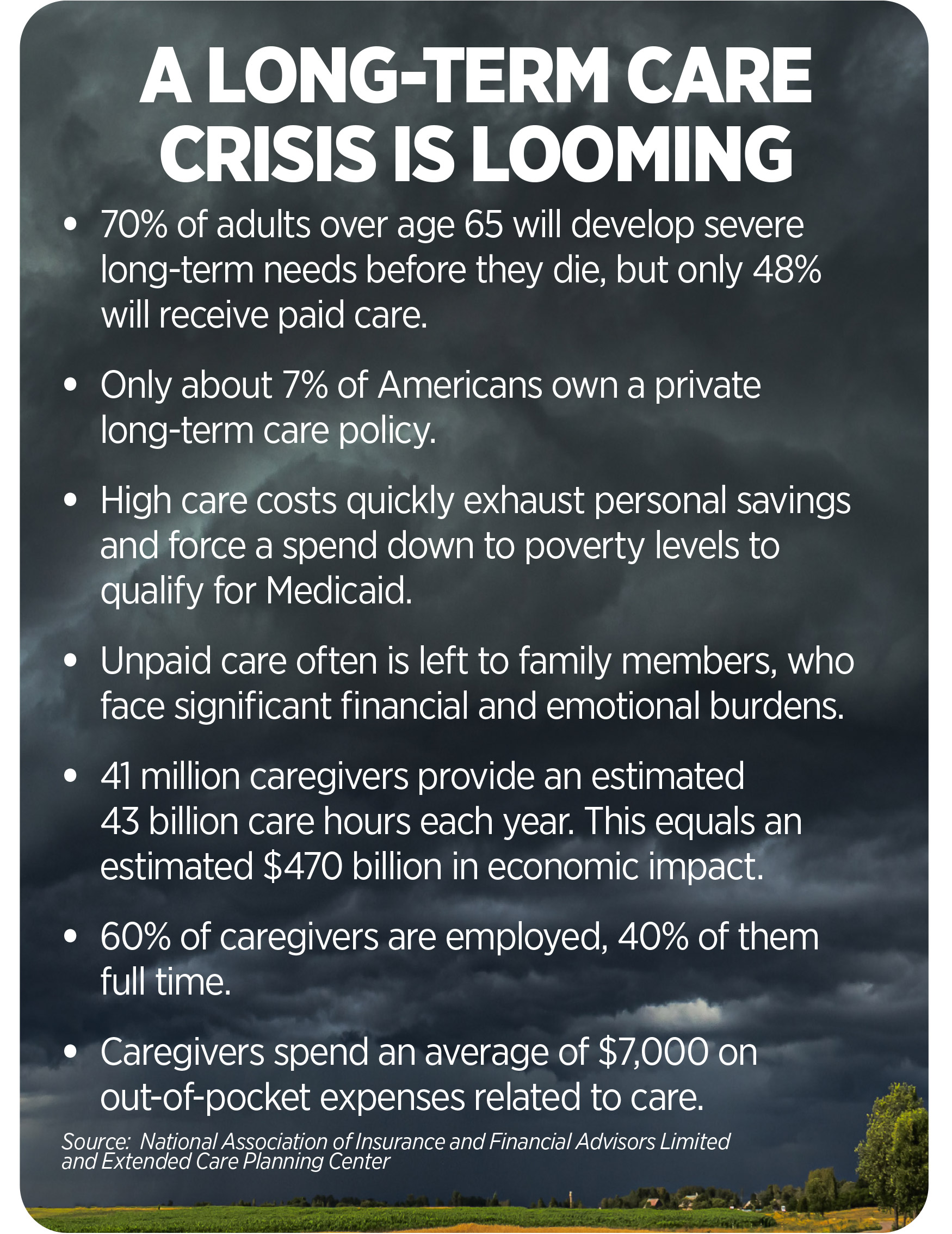

We’re living in what many are calling a “care crisis.” If you’re a benefits broker, you know exactly what I’m talking about: the discussion around long-term care. Over the past few years, demographic, legislative and economic factors have come together to force tough conversations among clients, brokers and financial consultants.

What’s contributing to this care crisis? The increasing costs of long-term care, for one thing. But also, the increased likelihood that people will need long-term care. Some states (notably the state of Washington) already have considered legislative action to address this issue. That’s how serious it is right now.

This crisis also is driven by population trends. If you looked at the U.S. population by age, it would probably look like a pyramid. Young people at the bottom, fewer older people at the top.

However, things are shifting. Now the older generation is much larger — and that phenomenon will continue in the years ahead.

Why?

For starters, baby boomers (those born between 1946 and 1964) are entering their senior years.

And younger people aren’t having as many kids. In 1965, families on average had 2.44 children. In 2020, that number had fallen to only 1.93.

On top of that, medical advances have helped extend life expectancies. In 1960, the average life expectancy was just under 70 years. In 2022, it’s 77 years.

Each one of those shifts is significant. Combined, they play a huge role in this emerging care crisis.

The challenges of standalone long-term care plans

Those population shifts I just mentioned highlight an issue that already was surging. For years, insurance companies sold individual long-term care policies that relied on a number of assumptions that never happened. For example, cancelation rates were much lower than expected, medical costs escalated, mortality decreased, and people have been able to live longer with more severe disease and illness than was the case a couple of decades ago.

As a result, insurance companies:

» Underestimated how many policyholders would make claims.

» Underestimated how long those policyholders would need care.

» Overestimated investment returns — they have typically been as little as half of what was projected.

So, insurance companies are now asking state regulators for support. In some instances, they’re winning large premium increases.

Other states are considering legislation as a way to address the issue of care for citizens who end up on Medicaid to receive long-term care. This is a significant and growing cost for state budgets. Washington state’s WA Cares Act, which established a long-term care insurance benefit for all eligible workers to address the future long-term care crisis, provides a blueprint. But looking ahead, pending legislation in other states could be different, leaving employers and their workers to solve the challenge.

Hybrid solutions present a viable alternative

We’re all starting to see that standalone long-term care coverage may not be the best solution for many people. It’s often positioned as a “use it or lose it” proposition, which can incentivize lower voluntary lapse rates and higher usage. On the flip side, hybrid products can have lower long-term care incidence.

Hybrid products, on the other hand, combine life insurance and long-term care benefits. Employees would purchase life insurance coverage that includes the ability to advance part of the death benefit for care needs. Based on what we’re hearing so far, this seems to be much more helpful and practical for employees for a few big reasons.

First: it ensures the use of the benefits. The employee will either end up using the benefits for long-term care, for a terminal illness or for a death benefit.

Second, it’s attractive for younger employees too. In this model, the younger you are when you purchase coverage, the lower your premiums and the greater amount of life and long-term care coverage you can afford.

Third, hybrid products can include benefits for family caregivers as well as for professional care — a huge perk for many employees who may need or want care at home.

The design of these hybrid policies is also quite different from current standalone products. In some cases, the benefits can be structured as a fixed indemnity and pay out a specific amount, regardless of the expenses incurred by the policyholder. Translation: Employers don’t have to worry about the trend of increasing costs of long-term care services.

No easy answers, but conversations worth having

Your employer clients are hearing and seeing pressure from both sides of this issue. On one hand, employees and loved ones receiving care face increased financial stress due to the increased costs of care, lingering health issues if they can’t afford proper care, and increased distractions due to managing bills and changes at home.

On the other hand, employees who are providing care face significant emotional stress in addition to the time and energy that providing care requires. As a result, these employees frequently miss time at work and, in some cases, are leaving the workforce entirely.

But employers have tools to help. Retirement savings/401(k)s, health savings accounts and standalone long-term care insurance all can help employees finance their own care. Employee assistance programs can help too. Your employer clients can direct their workers to care planning tools and strategies or provide them with access to tools that can help them manage complex aspects of care.

There are no easy answers and there is no one-size-fits-all solution. But the time is right to have these conversations and explore new hybrid plans that combine life insurance with long-term care benefits.

This care crisis we’re in right now is not going away. Employers and employees alike must be educated and presented with solutions that can help address this very real risk — one that will impact the majority of American families.

Frank Morang is a regional sales manager at Trustmark Voluntary Benefits. He may be contacted at [email protected].

New York state’s best interest regulation has lasting impact

It’s go time for financial advisors on social media

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News