Broker Comp Disclosure ‘Will Change The Game’

Compensation transparency will have a bigger impact on health insurance brokers over the next few years than did the Affordable Care Act, an insurance industry veteran told members of the National Association of Health Underwriters.

Dan Meylan built four insurance firms from scratch and has five decades of business experience. He spoke to NAHU members during their 2022 Capitol Conference.

“It’s not medicine that’s broken in America, it’s the business of medicine that’s broken,” Meylan said. He predicted transparency “will change the game dramatically over the next 10 years.”

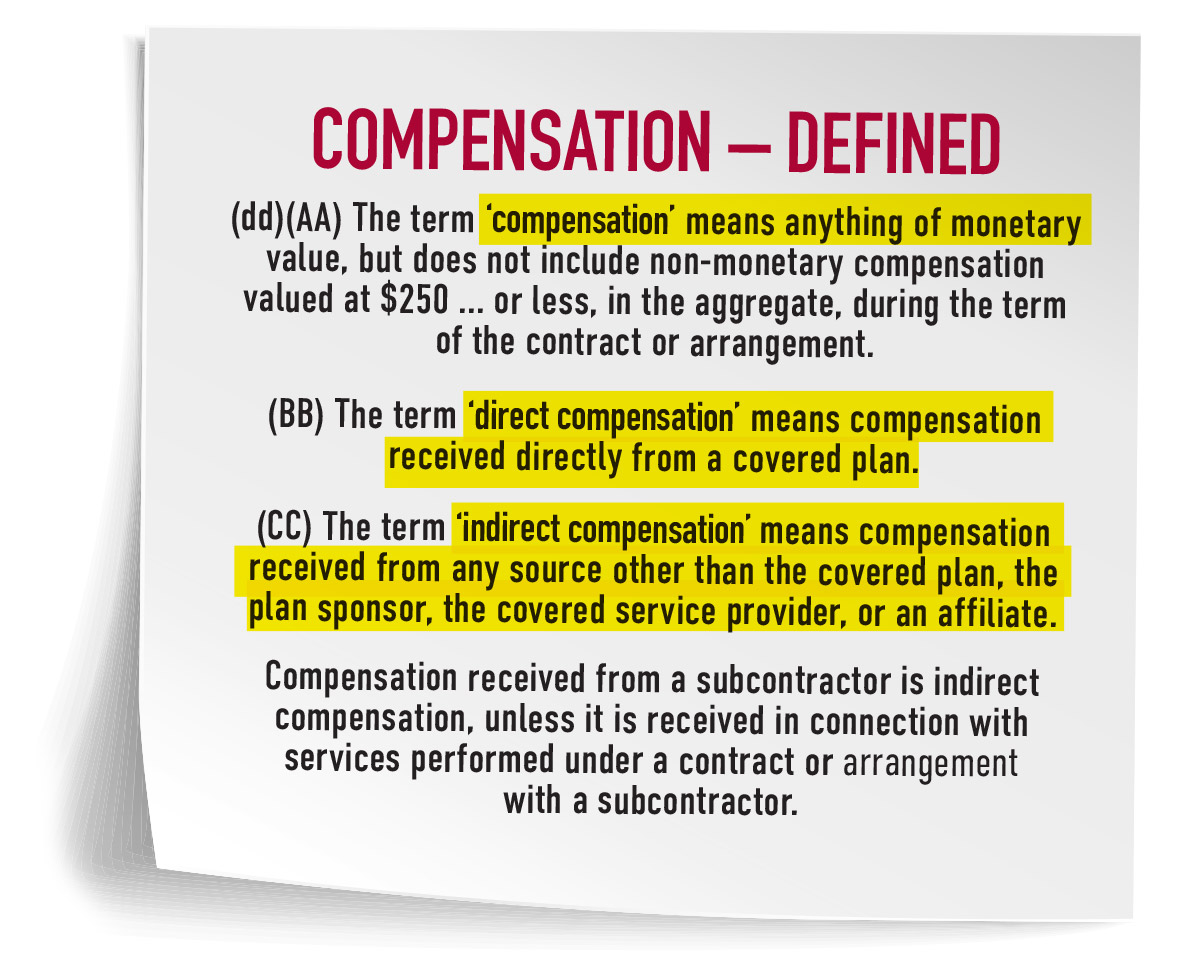

The Consolidated Appropriations Act of 2021 requires brokers and consultants who work in the health benefits field to disclose compensation from sources such as insurance carriers, including commissions, fees and noncash compensation. The new regulations require disclosure of direct and indirect payments to brokers that equal $1,000 or more, and disclosure of noncash compensation that equals $250 or more.

“Is this a problem or is it an opportunity? It’s an opportunity!” Meylan said. He noted that the ACA disrupted the health insurance world, “and when disruption happens, opportunity is just around the corner.”

When change is on the horizon, Meylan said, three types of people emerge: disrupters, doubters and protectors. The disrupter knows something is broken and wants to fix it. The doubter knows something is broken but doesn’t know how to fix it. The protector knows something is broken but wants to keep everything the same.

Compensation disclosure will require several big shifts, Meylan said.

» A shift from broker to consultant.

» A shift to justifying your compensation.

» A shift to selling your professional value and not selling a plan or policy.

» A shift in the employer client’s perceptions and expectations.

» A shift in the value of your time.

» A shift in competitive strategies.

“You will have to justify your compensation to your client,” he said. The client knows how much you make, so you have to justify your value.”

Compensation disclosure also will require some shifts in the broker’s behavior, Meylan said, such as:

» Adopting a fee-for-service mindset, even if you still take commissions.

» Knowing your complete scope of services.

» Using a consulting contract.

» Knowing the value for your time on a per-hour and a per-employee per-month basis.

» Adapting your business operating model.

» Exploring performance-based

compensation.

» Making compensation disclosure an advantage over your competition.

» Transitioning from salesmanship to leadership.

Brokers must determine how they will justify their value and how they will make these shifts, he noted. By adopting a fee-for-service mindset and approach, brokers will transition to becoming health care advisors.

What You Need To Know About Disclosure

Stacy Barrow, partner in the law firm Barrow Weatherhead Lent, gave a rundown on what agents and brokers need to know about the disclosure requirements.

The requirements apply to contracts executed after Dec. 27, 2021, and apply to contracts or arrangements between plan sponsors (employers) and brokers or consultants involving group health plans. For example, he said, the requirements would apply to brokers who receive a commission on fully insured groups or consultants who receive fees from a third-party administrator for self-insured groups.

Brokers and consultants who receive at least $1,000 in fees or commissions — either directly or indirectly — for performing certain services for group health plans must disclose their compensation to their clients. Barrow said this does not apply to exclusively fee-based work subject to a fee agreement where the payment is made directly from the employer client’s general assets.

Disclosures are required to include:

1. A description of the services to be provided to the covered plan pursuant to the contract or arrangement.

2. Where applicable, a statement that the covered service provider will provide or reasonably expects to provide service directly to the covered plan as a fiduciary.

3. A description of all direct compensation the covered service provider reasonably expects to receive in connection with services provided under the contract.

4. A description of all compensation, including compensation from a vendor to a brokerage firm based on a structure of incentives not solely related to the contract with the covered plan.

5. In addition, for any indirect compensation, the disclosure also must include a description of the arrangement between the payer and the covered service provider, identification of the services for which the indirect compensation will be received, and identification of the indirect compensation payer.

Services that are covered under the broker disclosure requirements include:

Brokerage services: Help with selecting insurance products, recordkeeping services, benefits administration, wellness services, compliance services and third-party administrator services.

Consulting services: Development or implementation of plan design, insurance product selection, medical management services, TPA services and pharmacy benefit management services.

These two categories may overlap in certain circumstances. Disclosure requirements are not limited to service providers who are licensed as, or who market themselves as a “broker” or a “consultant.”

Consumers More Open To Planning Advice, Lincoln Financial Finds

A Term Alternative In Business Succession Planning

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

- IUL sales: How to overcome ‘it’s too complicated’

More Life Insurance News