Brighthouse ratchets up annuity sales amid tough economic quarter

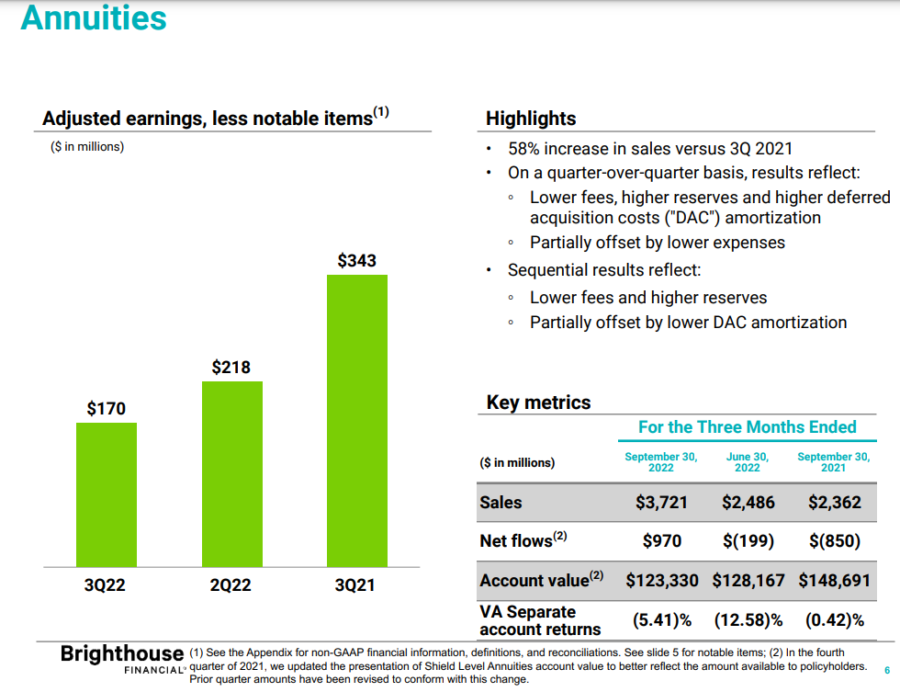

Brighthouse Financial enjoyed a very successful third quarter saleswise – a bright spot in an otherwise disappointing quarter – with annuity sales up 58% quarter-over-quarter and 50% sequentially, driven by fixed-deferred annuities.

Those results were enough to prompt a skeptical Evercore analyst to question whether the insurer offered up "a blue-light special" to move product. The question prompted a rare off-script moment from bemused Brighthouse executives during an earnings call this morning.

"This company is run by a lot of financial professionals," said CEO Eric Steigerwalt, "and we don't do blue-light specials."

The light moment, and the big sales report, could not mask a disappointing quarter in which Brighthouse missed revenue estimates and posted a net loss available to shareholders of $702 million. In the year-ago quarter, Brighthouse reported net income available to shareholders of $361 million.

The insurance company posted revenue of $1.48 billion in the period. Its adjusted revenue was $1.91 billion, falling short of Wall Street forecasts.

"The results in the third quarter were primarily driven by adverse market factors, including negative alternative investment performance as a result of second-quarter market performance and the impact of the lower equity market in the third quarter," explained Ed Spehar, chief financial officer, "which drove actuarial adjustments and amortization of deferred acquisition costs, or DAC, and reserves."

Brighthouse shares declined more than 7% as of midday trading.

Strong sales

Brighthouse was spun off as a separate company from MetLife as part of its long-term strategy to become a leaner, less complex insurer focused on segments with a higher potential for growth – such as employee benefits.

The company continues to tilt toward annuities, with its Shield Level product line delivering strong sales. The indexed-linked Shield Level products use a portion of retirement assets to participate in the market while offering downside protection.

Brighthouse will continue to "evolve with the addition of higher cash flow generating and less capital-intensive business, coupled with the runoff of older, less profitable business," Steigerwalt said.

Spehar reinforced the company commitment to its distribution network.

"We continue to manage the company under a multi-year, multi-scenario framework to protect and support our distribution franchise," he told analysts. "Distribution is critical because ultimately is growth that will drive the overall franchise value of this organization."

New life product

Life insurance segment reported an adjusted loss of $7 million in the quarter, compared with adjusted earnings of $110 million in the third quarter of 2021 and adjusted earnings of $23 million in the second quarter of 2022.

The third quarter included a $5 million unfavorable notable item and the third quarter of 2021 included a $3 million favorable notable item, both related to the annual actuarial review completed in the respective quarters. The second quarter of 2022 included a $2 million unfavorable item related to new reinsurance agreements.

Brighthouse has struggled for several years to establish a presence in the life insurance market. In 2019, the company offered SmartCare, an indexed universal life with a long-term care benefit. This was followed by the launch of the term product, SimplySelect in 2020 in collaboration with Policygenius.

Still, Brighthouse remains committed to the life insurance space, said Myles Lambert, executive vice president and chief distribution & marketing officer.

"We're focused on executing on our strategy," he said. "The SmartCare launch has been a great success for us, and we're going to continue to expand distribution. We're going to introduce a new product next year so that we're focused on continuing to grow sales."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Customer satisfaction with auto insurance industry declines, study finds

Former California insurance agent sentenced for theft from elderly consumer

Advisor News

- The financial advisor’s guide to creating an effective value proposition

- Thrivent survey finds gap between financial fear and action

- 1 in 3 say it doesn’t make financial sense to retire in their location

- Help your clients navigate tax regulations

- CFP Board announces CEO leadership transition

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Easy initial Unicam approval for 2nd Jacobson Medicaid bill

- New Texas advocacy group calls for more health insurance transparency

- GOP-led Georgia Senate votes to ban state medical coverage of transgender procedures

- Georgia Senate OKs bill to ban state workers from gender affirming care under state health plan

- Health insurance for millions could vanish as states put Medicaid expansion on chopping block

More Health/Employee Benefits NewsLife Insurance News

- Brighthouse Financial Announces Fourth Quarter and Full Year 2024 Results

- Jackson Recognized for Clear and Compelling Marketing and Communications throughout 2024

- NC yanks incentives for Charlotte-area firms that had pledged $200M investment, 900 jobs

- Symetra Adds New Consumer-Facing Cancer Care Compass (SM) Site During National Cancer Prevention Month

- Trustmark Selects Leading Caregiver Platform Cariloop To Support Customers Facing Long-Term Care Challenges

More Life Insurance News