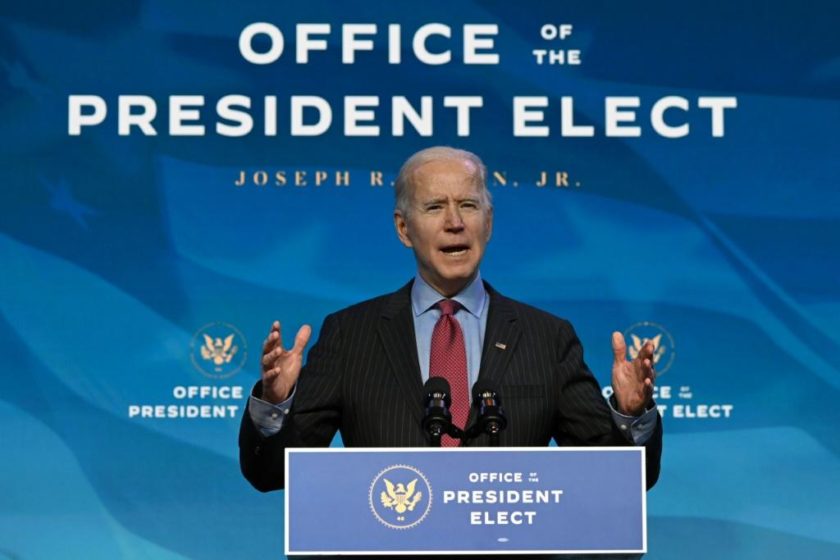

Biden To Nominate Gary Gensler To Head SEC, Reports Say

Gary Gensler will be nominated to chair the U.S. Securities and Exchange Commission (SEC) by President-elect Joe Biden, Reuters reported Tuesday.

The appointment is likely to prompt concern among Wall Street firms of tougher regulation.

Gensler was chair of the Commodity Futures Trading Commission (CFTC) from 2009 to 2014, and since November has led Biden’s transition planning for financial industry oversight.

At the CFTC, Gensler implemented dramatic new swaps trading rules mandated by Congress following the 2007-2009 financial crisis, developing a reputation as a hard-nosed operator willing to stand up to powerful Wall Street interests, Reuters noted.

Following the November election, Tom O. Gorman, partner at the Dorsey & Whitney law firm, told InsuranceNewsNet that Biden likely would shy away from an SEC chair with a hardline regulatory or prosecutorial background.

Financial firms have enjoyed the relatively light regulatory leanings of Jay Clayton, SEC chairman appointed by President Donald Trump.

Prior to joining the SEC, Clayton was a partner at Sullivan & Cromwell, where he was co-head of the firm’s corporate practice. His four years at the helm were relatively quiet, with Reg BI being perhaps the agency's most significant accomplishment.

The SEC rule took effect June 30 and, so far, with little fanfare or disruption to the brokerage industry.

Reg BI requires the following factors be considered in developing a recommendation for a retail customer: the customer’s investment profile, potential risks and rewards, and costs. It also includes a new "customer relationship summary" disclosure between broker and customer.

One reason the rule has not caused much disruption is the SEC's commitment to a soft rollout. The agency said it is merely looking for brokers and firms to make an initial "good faith effort" to comply.

A Biden-influenced SEC could also look to beef up disclosure rules on issues it considers important, Gorman said, such as climate change. In September, the CFTC released a task force report urging all financial regulators to “move urgently and decisively” to confront the “serious emerging risks to the U.S. financial system” posed by climate change.

SEC regulations on these disclosures are "having no impact," Gorman said.

Board Reports Record Growth In CFP Professionals And Diversity

What The Most Successful Advisors Know

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- ‘They won’t help me’: Sickest patients face insurance denials despite policy fixes

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News