Ban Credit Scores In Insurance Nationwide, Washington State Says

Washington has banned using credit scores in setting insurance rates and its insurance commissioner is urging all states to do the same.

Insurance companies in Washington have until the end of Thursday to submit new property and casualty rates to comply with the ban on June 20, following last week’s rejection of an injunction filed on April 9 by a coalition of insurance groups led by the American Property Casualty Insurance Association.

The APCIA group argued that credit scores are only one element of the metric used to price insurance, adding that banning credit scores would adversely affect many Washington consumers.

“Insurance scores are not credit scores like the ones used by banks to offer loans or credit cards,” APCIA said in a release. “Insurers use specific information about how consumers use credit as one factor to give consumers the most affordable and accurate rate. Many other factors go into how much you pay for insurance, but not race or income. Without these tools, insurance rates could go up for more than a million Washingtonians who are already struggling to pay bills during the COVID-19 pandemic recession.”

Meanwhile, Washington Insurance Commissioner Mike Kreidler sent a letter to his colleagues at the National Association of Insurance Commissioners urging all states to abandon using credit scores for setting insurance rates.

Along with Washington, California, Hawaii, Maryland, Michigan and Massachusetts ban or limit insurance companies’ use of credit scores to rate policies, according to the Washington Department of Insurance.

Ban Followed Consumer Study

Kreidler issued the three-year ban in March, citing the state and national state of emergency declarations allowing governments to mitigate financial impact of the COVID-19 pandemic. The pandemic is affecting credit scores and that in turn adversely affects insurance rates, particularly for low-income residents and people of color.

In his letter to the NAIC, Kreidler said that consumers will be slammed by higher insurance rates when the emergency declarations expire.

“As soon as the CARES [Coronavirus Aid, Relief and Economic Security] Act and state-specific consumer protections end with the tapering of the pandemic,” according to the letter. “consumers who were financially harmed the most by the pandemic will see their insurance scores drop and face further financial punishment.”

Consumer Reports showed that even though the CARES Act allowed consumers to defer their payments, reporting agencies were wrongfully citing the deferments as missed payments, causing their credit score to drop.

The state is also considering a law banning credit scores, with Kreidler pledging to push for the bill when the legislature comes back into session next year.

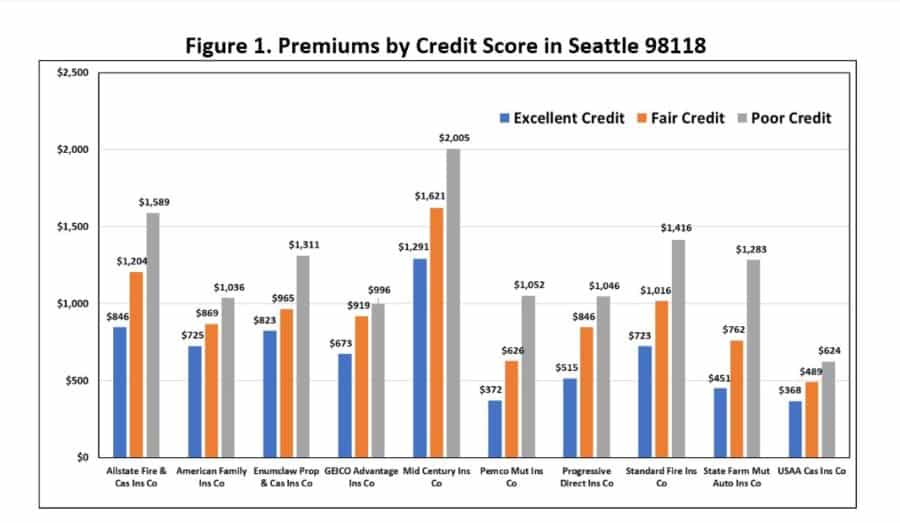

Kreidler issued the ban after the Consumer Federation of America issued findings in January showing that consumers with poor credit pay 79% more than drivers with excellent scores “all other things being equal,” according to the report.

This chart from the CFA report shows the rate for a female driver in Seattle’s 98118 zip code.

Also in the report:

• Premiums increase by 35% ($165) on average statewide for a good driver with fair credit rather than excellent credit.

• State Farm charges the highest credit score penalty of 69% for drivers with fair credit and 185% for drivers with perfect records but poor credit; PEMCO charges the next highest credit history penalty – 68% for fair credit drivers and 183% for poor credit.

• Even the smallest credit score penalty, imposed by American Family, forces safe drivers with fair credit to pay 17% higher premiums and those with poor credit to pay 36% more.

APCIA argues that the ban will not only increase rates for 1 million Washington residents, but is also fixing a nonexistent problem related to the COVID-19 pandemic.

"A new report by Lexis Nexis shows that, during the COVID-19 pandemic, credit-based insurance scores remained stable nationally and in Washington, and there is no information based on which to conclude a decline is on the way,” APCIA said, “making Commissioner Mike Kreidler's emergency rule unnecessary, and actually harmful to those paying for car, home and renters insurance.”

NAIC Moving On Proxy Discrimination

Kreidler sent his letter to the NAIC, which has put proxy discrimination at the top of its agenda. The group has been concerned about the impact of artificial intelligence on insurance rates because AI could discriminate against certain groups, depending on how it crunched the data.

The NAIC adopted principles last summer to guide states and insurance companies to guard against proxy discrimination. The principles do not have the effect of law, but they set out the regulators’ expectations and will form the basis for future regulation.

According to the National Law Journal, the principles would have insurers:

• Take proactive steps to avoid proxy discrimination against protected classes. (As NAIC President Ray Farmer (S.C.) noted, this is part of the NAIC’s broader effort to address racial equality issues.)

• Monitor the operation of its AI system and remediate harmful, unintended consequences.

• Provide responsible disclosures and give consumers an opportunity to inquire about and seek review of AI-driven decisions.

• Take a risk management approach to each phase of the AI system's life cycle.

During its spring meeting last month, the NAIC refined its direction on proxy discrimination, according to Faegre Drinker.

The NAIC expects to develop “analytical and regulatory tools to assist regulators in addressing unfair discrimination, including consideration of socioeconomic variables, proxy variables for race, correlation vs. causation, disparate impact issues, third party data and criminal history.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Insurers Win A Pair Of Business Interruption Lawsuits

Taking Charge Of Your Career With A Personal Career Construct

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Is cost of health care top election issue?

- Indiana to bid $68 billion in Medicaid contracts this summer

- NFIB NEW MEXICO CHAMPIONS SMALL BUSINESS REFORMS TO ADDRESS RISING HEALTH INSURANCE COSTS

- Restoring a Health Care System that Puts Patients First

- Findings from University of Nevada Yields New Data on Opioids (Aca Dependent Coverage Extension and Young Adults’ Substance-associated Ed Visits): Opioids

More Health/Employee Benefits NewsLife Insurance News