Ask the right questions, find the right coverage

Regardless of how well you know your clients or believe that you understand what they want, some of their comments and motivations still may surprise you. That’s why asking the right questions is critical to ensuring that you have all the information required to provide them with the best solutions.

Ultimately, information in equals information out. Many upper-level executives in many industries erroneously believe they can diagnose any problem simply sitting at their desk. The reality for insurance and financial professionals is that we all must obtain accurate information directly from the client because every person, and every set of facts, is unique.

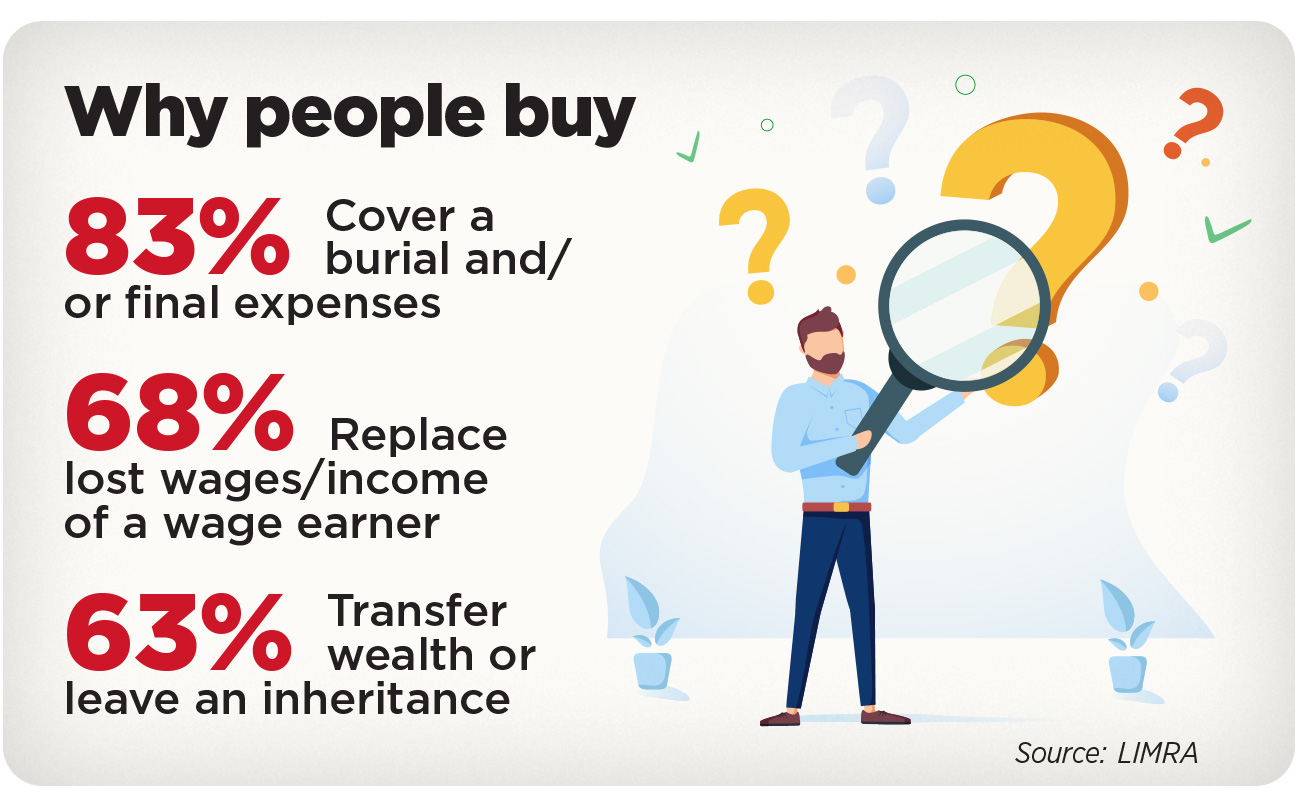

My firm recently conducted a client survey that included the question “Why did you buy life insurance?” One of the respondents, a retired doctor with no reasonable liabilities, stated that his key motivation was asset protection. I could have given you 20 reasons why I thought he should own a policy, and asset protection wouldn’t have been on the list. Yet that was his hot-button issue. The survey reinforced to me how crucial it is to ask clients what is most important to them — since those answers can be quite unexpected.

Another client who ran a large private equity fund once said to me, “If my father had cared enough to get life insurance, life wouldn’t have been so hard for my mother, sisters and me after he passed away. But he didn’t, and I would never leave my family in that situation.”

Although this client is wealthy enough that his family will be well provided for even without an insurance policy, he feels that having a policy serves as an important symbol of how much he cares. Priorities and wishes such as these are often only discovered by asking the right questions.

Key questions

One key question that I ask clients is “What should we know about your health or anything that might affect your mortality?” The responses could reveal health issues you’d never know about otherwise, particularly if the client appears perfectly healthy. You also might learn whether a client had a health scare earlier in life or was once involved in an accident that has strongly influenced their perspective. Factors such as these can potentially drive client decision-making and are important to understand.

I also make sure to ask clients about who is counting on them in life. Beyond the nuclear family, there might be friends or in-laws who rely on them for financial support. I recently met with one client who had about 20 people listed as beneficiaries of their trust. Wanting to help that many people is great, but it was important for us to know about those people so that we could address the gift-tax ramifications. Without asking the client specifically about this topic, I might not have been able to ensure everything was handled in the most tax-efficient way.

Additionally, toward the end of client conversations, I’ll often say, “What didn’t I ask that I should have?” This type of catch-all question can help reveal details that might otherwise slip through the cracks.

Finally, I always ask the client, “How long would you like this process to take?” This will allow me to manage the client to their desired outcome and keep the project on track.

Why information is important

I tell clients that although these conversations may not always be fun, they are necessary for adults who have responsibilities and resources. If we don’t have such discussions, then the government is free to substitute its judgment — and most likely not in the manner a client would prefer. The government implemented its own plan for every citizen and their money the day they were born. If a new plan isn’t created, the government’s plan prevails.

In addition, insurance and financial professionals too often make bad decisions for clients simply because these advisors haven’t obtained enough information from clients. For example, it might seem logical to assume that because a client is 85 years old, they’ll have a short life expectancy. However, compared with a 65-year-old client with significant health issues, the 85-year-old person could be more likely to live another 10 years.

These are all important details to know to represent clients properly. Therefore, if someone would rather not answer health-related questions, you must decide whether to continue working with them. It’s OK to say, “If you don’t feel comfortable about providing me with this information, then I advise you to find someone you are comfortable with. I simply cannot do the best job for you without being fully informed, and you deserve me at my best.”

Letting clients lead

I find that letting clients take the lead during conversations is often an effective way to acquire needed insight. People usually enjoy talking about themselves. When I come to a meeting with a list of questions and then allow the client to respond to them at length, they’ll probably feel as though we’re having a great conversation, and I’ll be able to gather relevant information.

I think too many professionals feel a need to justify why they’re sitting at the table, so they end up talking too much. It’s important to recognize that the client has already decided the merit of their being there. At that point, the focus should really be on the client and their needs.

When I’m meeting with clients, my job is to listen and put their wishes into action, even if I don’t necessarily agree with everything they want to do. In those cases, maybe I’ll say, “I might do it a different way if I were in your position, but that doesn’t mean I’m right.”

Clear communication

I have a friend who is a well-known golf instructor, and he once shared with me an intriguing aspect of his approach — there are only about 10 different things that he’ll say to the golfers he instructs, but he has 10 different ways of saying each of them because people learn differently.

Similarly, I think insurance and financial professionals should be able to say the same thing in multiple ways to ensure that we successfully communicate with our clients. Some people might grasp concepts better in graph form, while others prefer numbers, pictures or stories.

Whichever is the case, professionals who aren’t asking the right questions during these conversations will likely miss out on significant details — not only about money itself but what that money means to each client. Furthermore, we should pride ourselves on providing the best solutions.

For anyone who isn’t asking the right questions because they feel they’re too busy or don’t have the time to prepare, I don’t believe those reasons are good enough. We must dedicate the time. If you don’t feel you personally can spare that time for a client, then at least ensure an associate at your company does so for you, because the time it takes to ask those questions and gain important insight could turn out to be far more valuable to a client than how many decades of experience you can offer.

Howard Sharfman is senior managing director, NFP Insurance Solutions. He may be contacted at [email protected].

Does pessimism really suppress annuity sales?

Pro bono financial planning benefits society and advisors

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

More Health/Employee Benefits NewsLife Insurance News