Apollo riding big annuity sales, investment fees to strong financials

Apollo Global Management continued perfecting its dual-track revenue-generating engine in the first quarter – with annuity sales and investment fees both adding hundreds of millions to company coffers.

Apollo reported total revenue of $7 billion, up from $5.3 billion in the year-ago quarter, but down from $11 billion in the fourth quarter 2022. The sequential decline was mainly driven by declines in premiums and investment-related gains.

"I like to hand we're playing," said Marc Rowan, Apollo CEO. "We are incredibly well positioned in retirement services with a decade-long lead over most of our competition. The work we have done on fixed income replacement and private investment grade, I believe is particularly well suited for the transition that is taking place as institutions and individuals migrate their historically 100% public fixed income exposure to public and private."

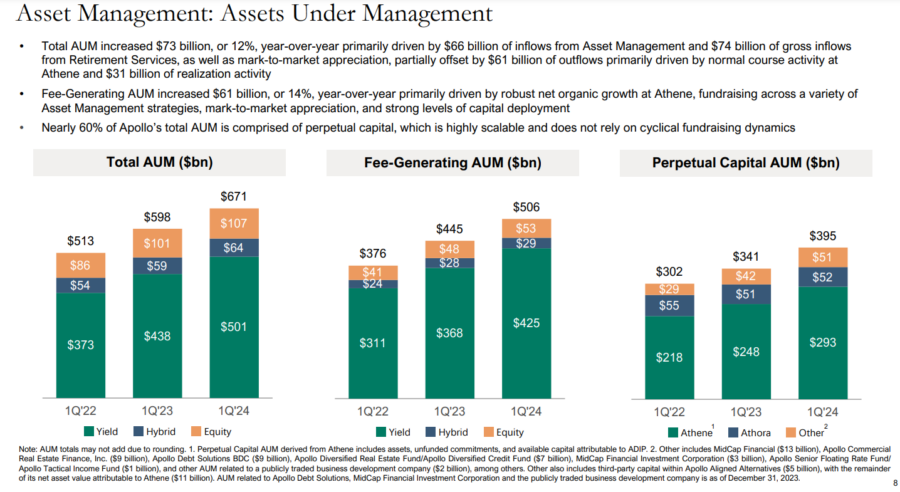

Fee-related earnings from asset management fees, as well as fees Apollo reaps for arranging financing for deals, climbed 16% to $462 million. Total assets under management increased 12% to $671 billion.

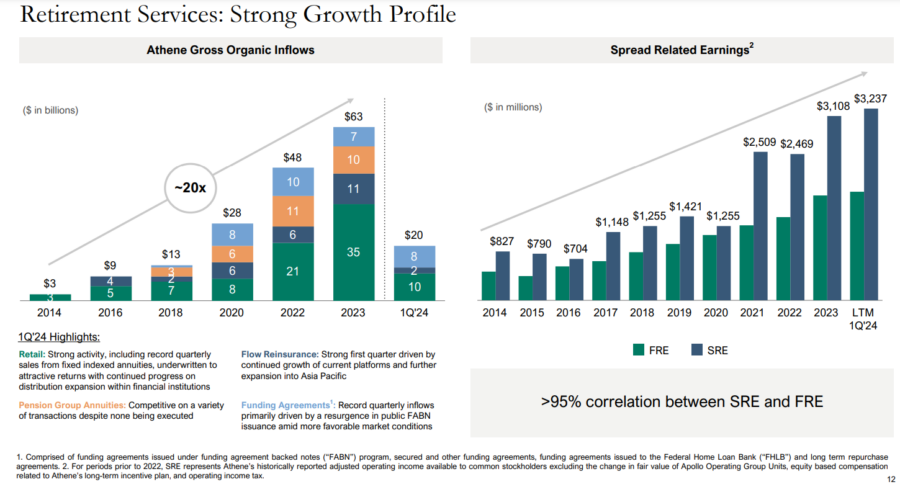

On the annuity side, Athene Life and Annuity stands atop the sales charts. Apollo's earnings from investing the capital generated by Athene jumped nearly 19% to $817 million due to strong inflows and higher interest rates.

Rowan spent several recent quarterly calls talking up the potential for annuities to be a significant answer for the American retirement crisis. He again gushed Thursday over the size of the market.

"The need for guaranteed lifetime income, guaranteed retirement income everywhere in the world exceeds what is currently provided," he said. "Whether you look at aging population. Whether you look at the decline of defined benefit plans. Whether you look at the inadequacy or lack of preparation of governments around the world. I continue to believe that retirement is going to be a massive driver of our business."

Later in the call, Rowan cited MassMutual as "our best competitor." MassMutual finished second in total annuity sales in 2023 with $24.7 billion. Athene topped the list with more than $35.5 billion.

"Record quarterly organic inflows from Retirement Services of $20 billion in the first quarter included record funding agreement issuance, the second-highest quarter of retail annuity sales to-date, and steady inflows from flow reinsurance clients," Apollo reported in a news release.

Assets under management rise

Apollo runs three main business segments: Asset Management, Retirement Services, and Principal Investing, with the Retirement Services segment being the largest revenue contributor. At the close of Q1, Apollo managed approximately $671 billion in assets.

Apollo plans to launch a new asset-backed credit company in the coming weeks, to be called ABC.

"We believe the breadth and scale of our proprietary origination ecosystem, not just for sourcing from Wall Street, will position us to be a market leader in this nascent and important growth area of the Global Wealth market," explained Jim Zelter, co-president of Apollo Asset Management. "Importantly, we structured ABC as an operating company, enabling us to access our full range of origination capabilities versus other traditional private credit structures."

Apollo reported $65 billion in unspent capital while deploying $57 billion of capital. Debt originations reached a quarterly record of $40 billion, executives noted.

"We want and we continue to deliver this message and it is resonating: We want 25% of everything and 100% of nothing," Rowan said.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Safeguard staff to safeguard the organization from hackers

Trade group files first lawsuit against the DOL fiduciary rule

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

More Annuity NewsHealth/Employee Benefits News

- Expired federal subsidies leave fewer Walla Walla residents with health insurance

- Red and blue states alike want to limit AI in insurance. Trump wants to limit the states.

- CT hospital, health insurer battle over contract, with patients caught in middle. Where it stands.

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

More Health/Employee Benefits NewsLife Insurance News