Another Record-Setting Quarter For Index Annuities, Wink Reports

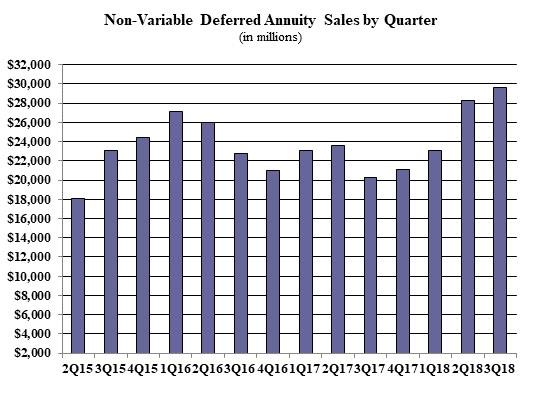

Des Moines, Iowa. November 21, 2018- Total third quarter non-variable deferred annuity sales were $29.6 billion; up nearly 5.0% when compared to the previous quarter and up more than 46.2% when compared to the same period last year, according to Wink's Sales & Market Report Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the third quarter include Allianz Life ranking as the #1 carrier overall for non-variable deferred annuity sales, with a market share of 9.2%. AIG took the second-place position, while New York Life, Athene USA, and Global Atlantic Financial Group rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the #1 selling non-variable deferred annuity, for all channels combined, in overall sales.

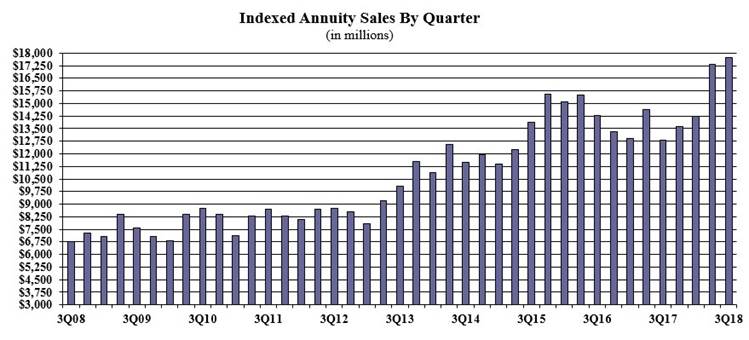

Indexed annuity sales for the third quarter were $17.7 billion; up nearly 2.2% when compared to the previous quarter, and up more than 38.4% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

“I am not surprised to see yet another record-setting quarter for indexed annuities!” exclaimed Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. She continued, “I want to prepare everyone, and just say that you can count on another go-round for fourth quarter, 2018; we are going to make it a three-peat!”

Noteworthy highlights for indexed annuities in the third quarter include Allianz Life retaining their #1 ranking in indexed annuities, with a market share of 15.4%. Athene USA held the second-ranked position while AIG, Nationwide, and Great American Insurance Group rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity was the #1 selling indexed annuity, for all channels combined, for the seventeenth consecutive quarter.

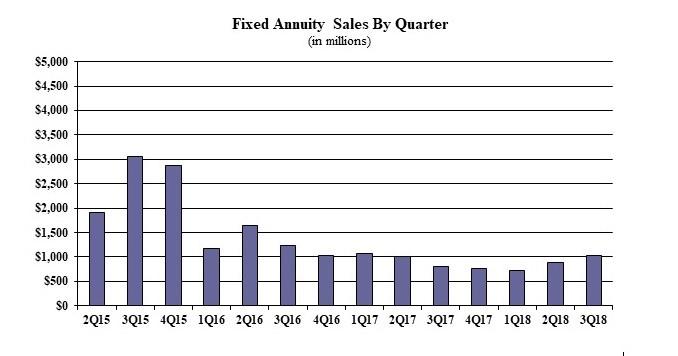

Traditional fixed annuity sales in the third quarter were $1.02 billion; up more than 16.7% when compared to the previous quarter, and up 28.7% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the third quarter include AIG ranking as the #1 carrier in fixed annuities, with a market share of over 12.3%. Jackson National Life moved into the second-ranked position and Modern Woodmen of America, Global Atlantic Financial Group, and Great American Insurance Group rounded-out the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the #1 selling fixed annuity for the quarter, for all channels combined, for the tenth consecutive quarter.

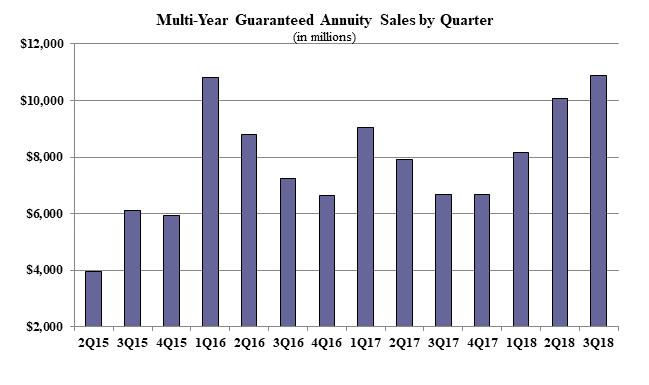

Multi-year guaranteed annuity (MYGA) sales in the third quarter were $10.8 billion; up over 8.0% when compared to the previous quarter, and up more than 63.3 % when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the third quarter include New York Life ranked as the #1 carrier, with a market share of 20.8%. Global Atlantic Financial Group continued in the second-ranked position, while AIG, Colorado Bankers Life Insurance Company, and Massachusetts Mutual Life Companies rounded-out the top five carriers in the market, respectively. Forethought’s SecureFore 5 Fixed Annuity was the #1 selling multi-year guaranteed annuity for the quarter, for all channels combined, for the third consecutive quarter.

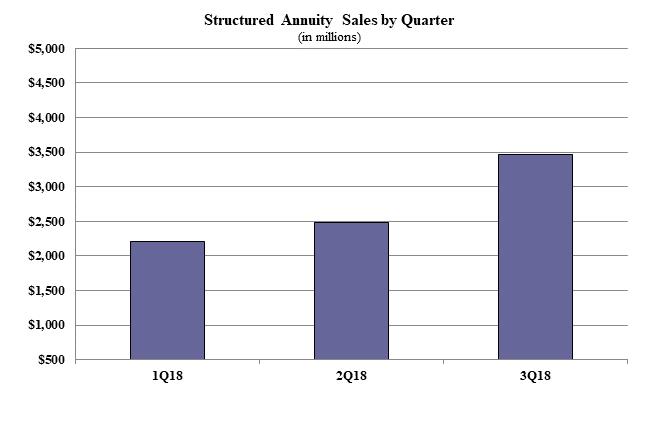

Structured annuity sales in the third quarter were $3.4 billion; up more than 39.4% as compared to the previous quarter. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

“It is amazing to see the amount of increased sales in this new market segment! Consumers definitely see value in these products.,” exclaimed Moore.

Noteworthy highlights for structured annuities in the third quarter include AXA US ranking as the #1 carrier in structured annuities, with a market share of 44.6%. Brighthouse Life Shield Level Select 6-Year was the #1 selling structured annuity for the quarter, for all channels combined.

While Wink currently reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, and multiple life insurance lines’ product sales, the firm looks forward to reporting on variable annuity sales at the beginning of the new year, and other product lines in the future.

Ohio National: No Strategy Change With Executive Shuffle

NAIFA Files Second Lawsuit Against NY Best-Interest Rule

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

- As enhanced federal subsidies expire, Covered California ends open enrollment with state subsidies keeping renewals steady — for now — and new signups down

- Supervisors tackle $3.1M budget deficit as school needs loom

More Health/Employee Benefits NewsLife Insurance News