Annuity sales hit record $119.5B in Q2, LIMRA reports

Total U.S. annuity sales increased 8% year over year to a record high $119.5 billion in the second quarter, according to LIMRA’s U.S. Individual Annuity Sales Survey, which represents 92% of the total U.S. annuity market. This tops the record set in the first half of 2024.

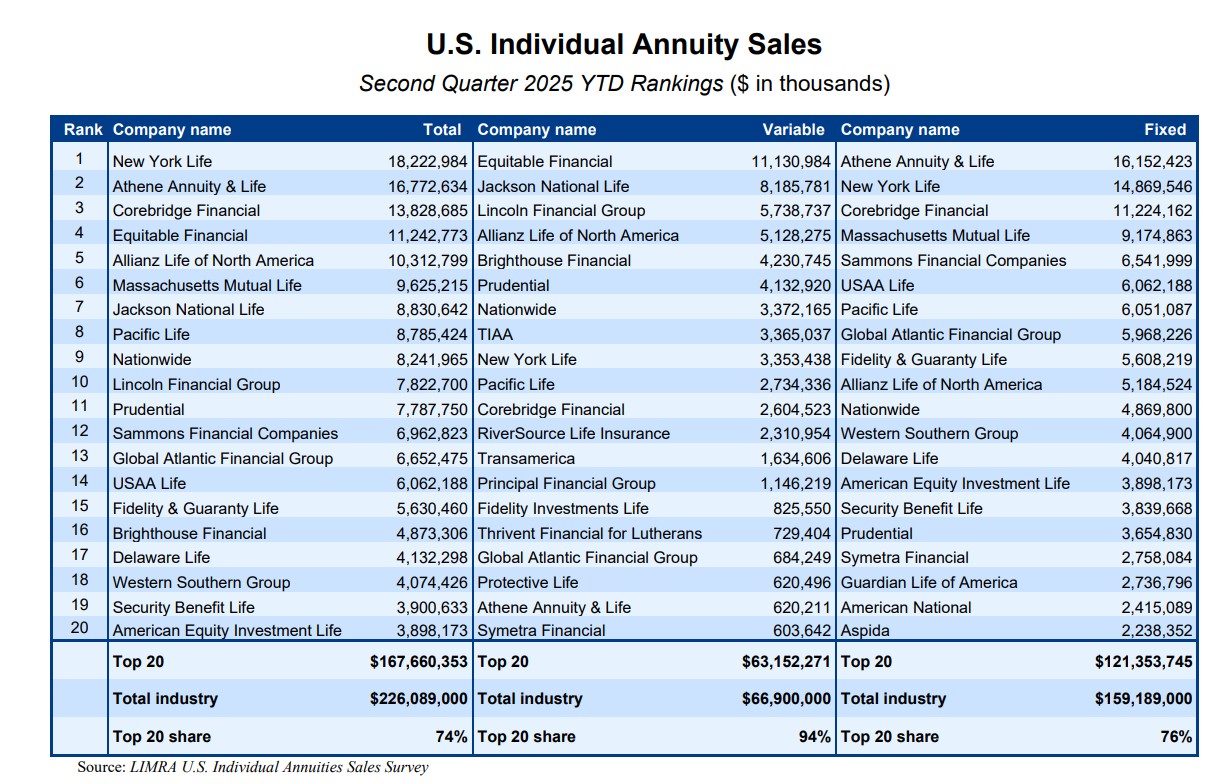

In the first half of 2025, annuity sales were $226.1 billion, up 4% from the prior year's results. This exceeds the sales record set in the first six months of 2024.

“Over the last three years, annuities have repeatedly set new sales records, which continued this quarter. While favorable economic conditions have bolstered sales, there also have been systemic market changes that have expanded the market,” said Bryan Hodgens, senior vice president and head of LIMRA research. “Product innovation, expanded capitalization and growing awareness by both investors and advisors of the need to build in guaranteed income into retirement planning have lifted the market. Based on the sales trajectory, LIMRA is expecting sales to surpass $400 billion in 2025.”

New York Life led in total annuity sales in the second quarter with $18.2 billion in sales. Equitable led the list of top variable annuity carriers with $11.1 billion in sales while Athene was the top seller of fixed annuities at $16.1 billion.

Fixed-rate deferred

Total fixed-rate deferred annuity (FRD) sales were $45.2 billion in the second quarter, 11% higher than second quarter 2024 sales. This is the second-highest quarterly sales recorded for FRD products. Year-to-date (YTD), FRD annuity sales totaled $84.9 billion, up 1% year over year.

“Second quarter FRD sales were strong, in part due to policies coming out of contract as the market anticipates interest rate cuts,” said Keith Golembiewski, assistant vice president and director of LIMRA Annuity Research. “Equity market volatility remains a concern for conservative investors and FRD crediting rates, on average, continue to outperform CD rates. LIMRA expects these products will continue to be an attractive, short-term solution for risk-adverse investors.”

Fixed indexed

Fixed indexed annuity (FIA) sales totaled $32.8 billion in the second quarter, 5% higher than the prior year’s results. FIA sales set a new record in the first half of 2025. FIA sales were $60.6 billion, up 1% from the first half of 2024.

“FIA sales remain a steady growth engine for the overall annuity market. Since 2020, FIA sales have doubled as interest in protected investment growth opportunities increased,” said Golembiewski.

Registered index-linked

Registered index-linked annuity (RILA) set new quarterly and mid-year sales records. In the second quarter of 2025, RILA sales were $19.1 billion, 15% higher than the prior year. In the first half of 2025, RILA sales jumped 18% year over year to $36.7 billion.

“RILA’s value proposition — protected growth with attractive caps and participation rates — is very appealing in the current economic environment,” noted Golembiewski, “With three new RILA market entrants and several new products introduced in 2025 to date, LIMRA expects the growth trajectory for RILA to continue for the foreseeable future, especially as more broker dealers add RILAs into their product mix.”

Traditional variable annuities

Significant market volatility in April pulled down traditional variable annuity sales in the second quarter. VA sales fell 3% to $14.7 billion year over year. YTD, traditional VA sales were $30.2 billion, 4% over the prior year’s results.

Income annuities

Single premium immediate annuity (SPIA) sales increased 6% year over year to $3.6 billion in the second quarter. In the first six months of the year, SPIA sales fell 5% to $6.6 billion. After a soft first quarter, deferred income annuity (DIA) sales rebounded 17% to $1.5 billion in the second quarter. YTD, DIA sales were $2.4 billion, down 2% from prior year.

“Over the past five years, retirees and pre-retirees have grappled with substantial economic uncertainty — heightened market volatility, inflation, and potential public policy changes — that could meaningfully impact their financial security in retirement,” said Hodgens. “In that same timeframe, our research shows greater interest in annuities by both advisors and investors. The Alliance for Lifetime Income by LIMRA will focus its attention to drawing attention to the annuities’ unique value proposition and the peace of mind annuity ownership provides.”

For more details on the sales results, visit: Annuity Sales Estimates (Second Quarter 2025) in LIMRA’s Fact Tank.

Red teaming: An effective tool for insurer assessment of AI risks

Making connections with younger advisors

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News