Annuities Help Boost AIG To 2Q Surprise

The American International Group reported a strong second quarter for its life and retirement group as it plans to spin off that division into its own entity with Blackstone as a minority owner in an initial public offering in the first quarter of 2022.

AIG’s life and retirement unit saw pretax income of $1.1 billion, up 26% over the second quarter of 2020, which had slammed the company with early COVID-19 effects.

Besides improving pandemic conditions, also helping boost performance were private equity investment returns, higher fee income and improved variable and indexed annuity sales. Fixed index annuities led the increase, accounting for $700 million of the gain, and variable annuities with $365 million.

AIG said in July that it would sell 9.9% of the life and retirement business to Blackstone. Peter Zaffino, who became president and CEO in March, said Blackstone will help that new company to grow.

“The strategic partnership with Blackstone further positions life or retirement to expand its distribution relationships, enhance its product offerings, and the business will benefit from Blackstone significant capabilities,” Zaffino said during a call with analysts.

In addition to the $2.2 billion deal, Blackstone will enter into “a long-term strategic asset management relationship to manage specified Life and Retirement general account assets in the future and agreed to acquire Life and Retirement’s interests in a U.S. affordable housing portfolio for approximately $5.1 billion.”

Blackstone will manage $50 billion of specific asset classes, with that amount growing to $92.5 billion over six years. Jonathan Gray, Blackstone president and COO, will join the board of directors of the IPO entity at the closing of the equity investment, which AIG expects to occur in September.

In its performance overall, the after-tax income was $1.3 billion, or $1.52 per diluted common share, more than doubling the $561 million, or $0.64 per diluted common share, the company showed in the second quarter of 2020.

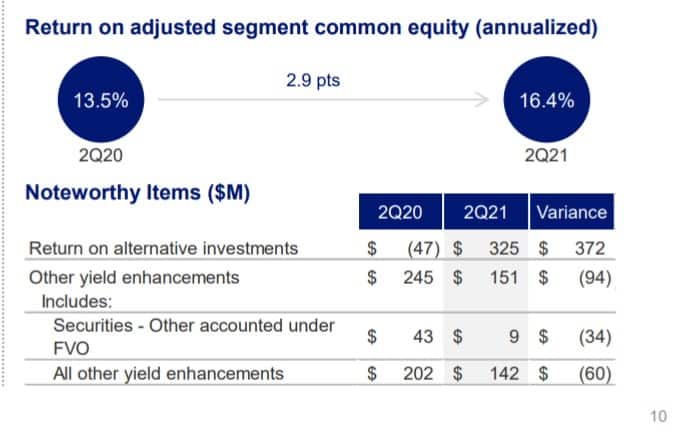

Besides the annuity income, AIG attributes the growth to favorable equity market impact resulting in higher alternative investment returns, mainly driven by strong private equity performance. In addition, the company cited higher fee income, partially offset by higher variable annuity reserves as market returns in prior year quarter were stronger than market returns in current year quarter.

The alternative investment returns saved what otherwise would have been a down investing quarter.

The life insurance business reported an adjusted pretax profit of $20 million, compared with $2 million a year earlier, largely reflecting the decrease in COVID-19 deaths.

On the individual and group retirement side, net flows were negative $306 million. Excluding retail mutual funds, individual retirement recorded net inflows of $556 million compared to net outflows of $684 million in the prior year quarter, largely due to recovery from COVID-19 disruptions.

The sale of 12 AIG Life and Retirement retail mutual funds business to Touchstone Investments, a wholly owned subsidiary of Western & Southern Financial Group, was completed on July 16. In the group retirement business, net flows were negative $229 million, slightly better than the negative $243 million in the prior year quarter, reflecting higher group acquisition deposits, partially offset by higher surrenders and withdrawals.

On the general insurance side, pretax income of $1.2 billion reflects improved underwriting results and higher net investment income. The combined ratio was 92.5, a 13.5 point improvement from the prior year quarter, primarily due to lower catastrophe losses. The general insurance accident year adjusted combined ratio, was 91.1, a 3.8 point improvement from the prior year quarter due to improved North America and international commercial lines underwriting results.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Idaho Suspends Radio Host’s Producer License For String Of Violations

Brookfield Acquires American National Group In $5.1B Deal

Advisor News

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Letter: Bentz does nothing to protect SSA, other programs

- Letter: Bentz does nothing to protect SSA, other programs

- Idaho Senate approves Medicaid budget

- Providence Health Plan to contract with California insurance administrator

- Oregon State Hospital failed to respond immediately to unconscious patient who later died

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Insurance leaders say AI a top imperative but struggle to deploy it

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- 5 steps to overcome mistrust in life insurance sales

More Life Insurance News