Analysts predict rough year in stocks while investors rush to ‘neutral’

A leading Morgan Stanley analyst warned investors of perhaps the worst year in stocks since the 2008 crash, echoing the sentiments of many other analysts, while a survey found that investors are running to the sidelines seeing the market in neither bullish nor bearish terms but firmly planted in neutral.

The caution comes from a Michael Wilson investor note last week saying that the S&P 500 could drop to 3000 this year, which would be a 23% drop from the index’s 3930, as of this writing. Wilson, who is usually a little bearish, said in his research note that corporate profit estimates are still too high and the equity risk premium is at its lowest since 2008, according to Bloomberg News.

Although Wilson is projecting the S&P 500 to drop to 3000, it is significantly lower than the 3500 that the market is expecting the index to hit in case of a mild recession this year, according to Bloomberg.

A Goldman Sachs analyst also recommended that investors take risk off the table in a note last week. Alexandra Wilson-Elizondo, Goldman’s head of Multi-Asset Retail Investing, pointed to the relatively strong jobs market despite the Federal Reserve’s efforts to slow growth.

Wilson-Elizondo said that riskier investments cannot compete with stronger money market rates, along with other safe money yields.

Continued rate increases expected

That safe money imbalance will only grow this year as the Fed continues to raise rates. Forbes reported that markets expect two more rate increases this year, although less than the three-quarter or even half point that the bank has been using.

But others are reporting that the minutes from the December Fed meeting show that the central bank is still sticking with its 2% inflation target and is likely to raise rates for quite a while. A CNBC report showed that the central bank is bullish on rates.

“Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time,” according to the Fed’s meeting summary.

“In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy,” the summary stated.

Fed Chair Jerome Powell in remarks after the meeting suggested that the Fed will not be cutting rates later this year, even if indicators improve.

1970s errors cited

In the meeting minutes, the bank’s governors said they were wary of repeating the errors of the 1970s when the rates were not kept high for long enough. But they are also concerned about keeping the rates too high and trigger greater economic pain, especially on the most vulnerable populations.

The interest rate increases are just getting started, according to a former head of the White House Council of Economic Advisors. Christina Romer, a Berkeley professor, said "we are just now entering the window where the effects might start to be noticed," according to a Reuters report from the American Economic Association's annual meeting in New Orleans this past weekend.

Romer, who was the economics advisors chair from 2009 to 2010, said the Fed is at a disadvantage because indicators lag so much that the central bank cannot be sure when it should let up.

"Policymakers are going to need to dial back before the problem is completely solved if they want to get inflation down without causing more pain than necessary," Romer said.

In her research, Romer found that in 10 prior rate-increase episodes that it took two years for the full effect of the rate shock on unemployment rates, according to Reuters. Her research also showed that the rate-tightening cycles lowered the GDP by about 4.5% two years after the rate shock.

Overall GDP output usually begins to slow six months after the start of the rate increase cycle. The unemployment rate started to increase in five months, but it took five years for the effects to fade.

The next Fed meeting concludes on Feb. 1.

Investors rush to the sidelines

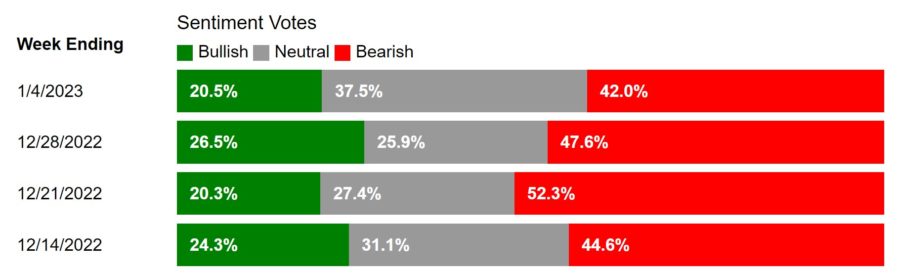

The American Association of Individual Investors survey last week showed a rush to the middle for investor sentiment.

The good news is that investors were a lot less bearish in the AAII survey, but they were also less bullish, with a large neutral sentiment growing to a 40-week high in the middle. The bullish sentiment is among the 60 lowest recorded since the survey started in 1987.

“Bearish sentiment is above its historical average of 31.0% for the 56th time out of the past 59 weeks and is at an unusually high level for the fifth consecutive week,” according to AAII. “Concerns about the economy, inflation, corporate earnings and volatility in the stock market continue to cause many individual investors to maintain a cautious short-term outlook.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

The era of remote work demands a different corporate wellness program

Half of Americans paused retirement savings in 2022

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

- Roeland Tobin Bell

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

More Life Insurance News