AIG Execs: ‘Significant Value’ In Splitting Off Life/Retirement

American International Group has ruled out breaking up its Life & Retirement business and selling them "in pieces," incoming top executive Peter Zaffino said today.

The plan is to sell 19.9% of the life/retirement business, either through an initial public offering or a private sale. AIG “will not consider” selling more than that, said Zaffino, who will become CEO on March 1 and remain president of AIG.

"We believe that the life retirement business itself really is well integrated," said CEO Brian Duperreault, who will become executive chairman in March. "There's a synergy around them that produces greater value then separating."

AIG announced the separation plans and CEO shuffle last week, in advance of this morning's third-quarter earnings call. The AIG stock price is up about 10% to $34.29 since the separation was announced.

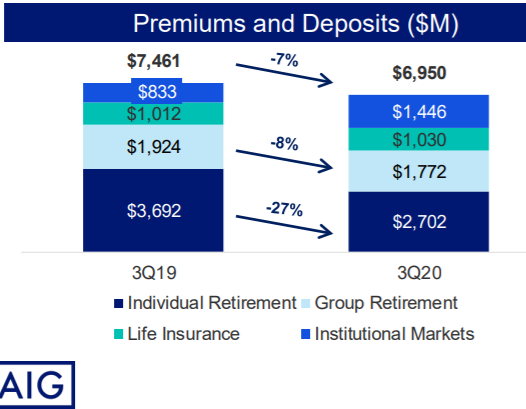

AIG reported $281 million in profit, a 57% decline from the $648 million profit in 3Q 2019. Adjusted pretax profit in its Life & Retirement unit increased 51% to $975 million compared with the prior-year quarter.

The strong numbers from Life & Retirement reflected "strong equity market performance, favorable short-term impacts from lower interest rates and tighter spreads, and lower general operating expenses," AIG said.

'In The Near Term'

Zaffino fielded several questions on the details of the separation, telling analysts that the decision details will come soon.

"Whether we pursue a minority IPO or sale, we're gonna make that decision in the near term," he said. "The ultimate closing of an IPO or sale will depend on regulatory or other required approvals. And we'd like to think we can close on the first step of separation in 2021."

Selling precisely 19.9% enables AIG to preserve its foreign tax credits, which have been used significantly in recent years, Zaffino explained.

"The separation process will require us to implement a standalone capital structure for Life & Retirement," he added. "This will involve raising new debt at Life & Retirement and restructuring debt at AIG parents. In the end, both companies will have independent capital structures in line with peers and appropriate financial leverage for their respective ratings."

AIG's General Insurance business reported an 18% decline, to $416 million from $507 million, in part due to catastrophe costs, executives said.

Net of reinsurance, losses in the company’s General Insurance segment totaled $790 million, before tax, which include $185 million of estimated catastrophe losses for claims related to COVID-19.

Those losses are principally in its travel, event cancellation, trade credit, property, agriculture and casualty books of business, AIG said. Third-quarter non-COVID-19 catastrophe losses of $605 million reflect windstorms and tropical storms in the Americas and Japan, as well as wildfires on the west coast.

“The third quarter experienced a high frequency of global catastrophe events with low to moderate severity, including the ongoing impact of COVID-19," Duperreault said. "These events have had a limited impact on AIG as a result of our underwriting discipline, reinsurance programs, revamped risk appetite and the strength of our balance sheet.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Lincoln Promises 8 New Products As Part Of Big 2021 Push

Brighthouse Racks Up Record Annuity Sales In 3Q

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Findings from Belmont University College of Pharmacy Provide New Insights into Managed Care and Specialty Pharmacy (Comparing rates of primary medication nonadherence and turnaround time among patients at a health system specialty pharmacy …): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Study Data from Ohio State University Update Knowledge of Managed Care (Preventive Care Utilization, Employer-sponsored Benefits, and Influences On Utilization By Healthcare Occupational Groups): Managed Care

- Recent Findings from Cornell University Provides New Insights into Managed Care (The Law of Large Umbrellas: Away From Risk Reduction In Health Insurance): Managed Care

- New Findings on Cancer from University of Texas Arlington Summarized (Systematic Review of Health Insurance and Survival Among Adolescent and Young Adult Cancer Patients): Cancer

- ‘Absolutely ferocious’: Idaho introduces plan to repeal Medicaid expansion

More Health/Employee Benefits NewsLife Insurance News

- Kansas City Life: Q4 Earnings Snapshot

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

More Life Insurance News